Technical Analysis:

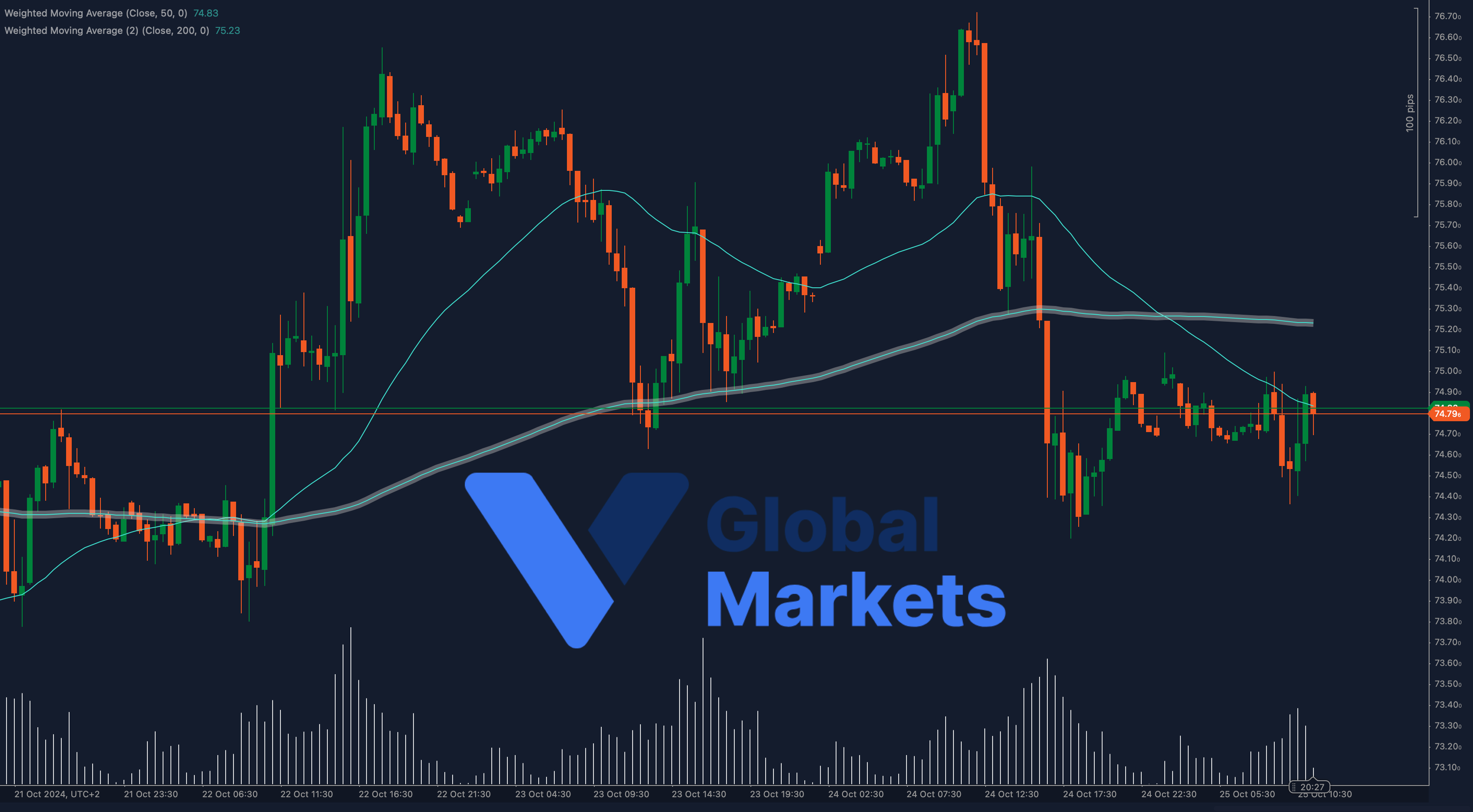

UKOIL is currently trading at 74.79, showing some recovery after bouncing off the 74.50 support level. The price remains below the 50-period and 200-period Weighted Moving Averages (WMA), positioned at 74.83 and 75.23 respectively. This confluence of resistance levels just above the current price suggests that the market remains under bearish pressure in the short term.

A break above 75.23, where the 200-WMA resides, could indicate a potential bullish breakout, leading to further upside toward 75.50 and possibly 76.00. However, if the price fails to break these resistance levels, it may result in another move back toward the 74.50 support zone.

- Support: Immediate support is at 74.50, followed by 74.00.

- Resistance: Key resistance is at 75.23, with the next target at 75.50.

Moving Averages:

UKOIL is trading just below both the 50-period WMA and the 200-period WMA, creating a significant resistance area. A decisive break above these averages would signal a shift in market sentiment toward the upside, while failure to break them would maintain the bearish outlook.

Volume:

Volume has been rising as the price approaches the key resistance at 75.23. This could be an early indication of a potential breakout, but traders should wait for confirmation through price action.

Key Levels to Watch:

- Support: 74.50 (immediate), 74.00 (next key support)

- Resistance: 75.23 (immediate resistance), 75.50 (next upside target)

Outlook:

UKOIL remains under pressure, with the 74.50 support holding for now. A break above the 75.23 resistance level would indicate a potential bullish reversal, while failure to clear this level could trigger another decline toward 74.00. Traders should closely monitor price action around the WMAs for further clues.

Fundamental Analysis:

Oil markets continue to face volatility due to global supply concerns and geopolitical tensions. The price of crude oil is heavily influenced by OPEC+ production decisions, demand forecasts, and ongoing negotiations in major oil-producing regions. The current bearish sentiment reflects the market’s cautious stance amid uncertain economic conditions.

#UKOIL #CrudeOil #BrentCrude #TechnicalAnalysis #OilMarkets #VGlobalMarkets #CommodityTrading #FXMarket