Technical Analysis:

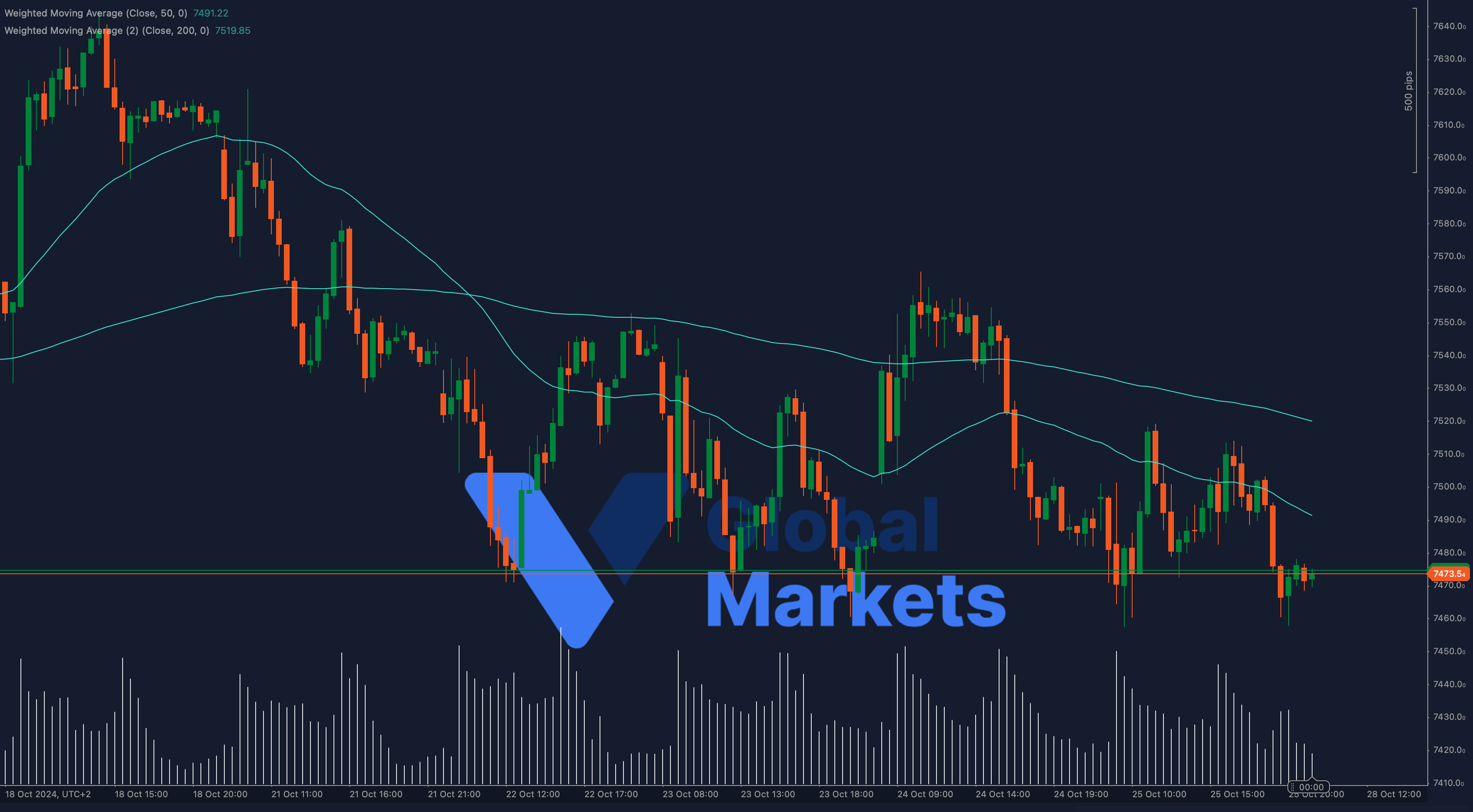

The CAC 40 is currently trading around 7479.5, facing pressure near the critical support level of 7479. The 50-period Weighted Moving Average (WMA) is positioned at 7491.22, while the 200-period WMA stands at 7519.85, creating significant resistance zones. Recent price action suggests bearish momentum as the index remains below both moving averages, pointing to further downside potential.

A sustained break below 7479 could pave the way toward the next support at 7420, while a rebound might push the index to retest the resistance at 7519.85. If the index manages to hold above 7491.22, it could indicate a potential short-term recovery.

Support: 7479, 7420

Resistance: 7491.22 (50-WMA), 7519.85 (200-WMA)

Moving Averages:

The CAC 40 remains below both the 50-period and 200-period WMAs, indicating sustained downward pressure. A close above the 50-WMA could trigger renewed buying interest, but failure to do so may see further declines.

Volume:

Recent volume remains moderate, suggesting caution among market participants. A volume surge with a move above 7491.22 could confirm a bullish breakout, while increased volume on a drop below 7479 may confirm further bearish sentiment.

Key Levels to Watch:

Support: 7479, 7420

Resistance: 7491.22 (50-WMA), 7519.85 (200-WMA)

Outlook:

The index is at a critical juncture, with further bearish continuation likely if support levels fail. A move above the 50-WMA could signal a potential reversal, but traders should remain cautious as the market remains sensitive to economic data releases.

Fundamental Analysis:

The CAC 40 continues to face challenges due to concerns surrounding Eurozone growth and broader global market uncertainty, which have kept the index under pressure. Key economic data releases from the Eurozone, such as inflation figures and industrial production data, will play a crucial role in shaping the market’s next moves. Investors are also closely monitoring any shifts in global risk sentiment, especially in light of ongoing geopolitical developments.

#CAC40 #StockMarket #TechnicalAnalysis #VGlobalMarkets #TradingStrategy #BearishOutlook #Eurozone #MarketAnalysis #FinancialMarkets #ParisStockExchange