Technical Analysis:

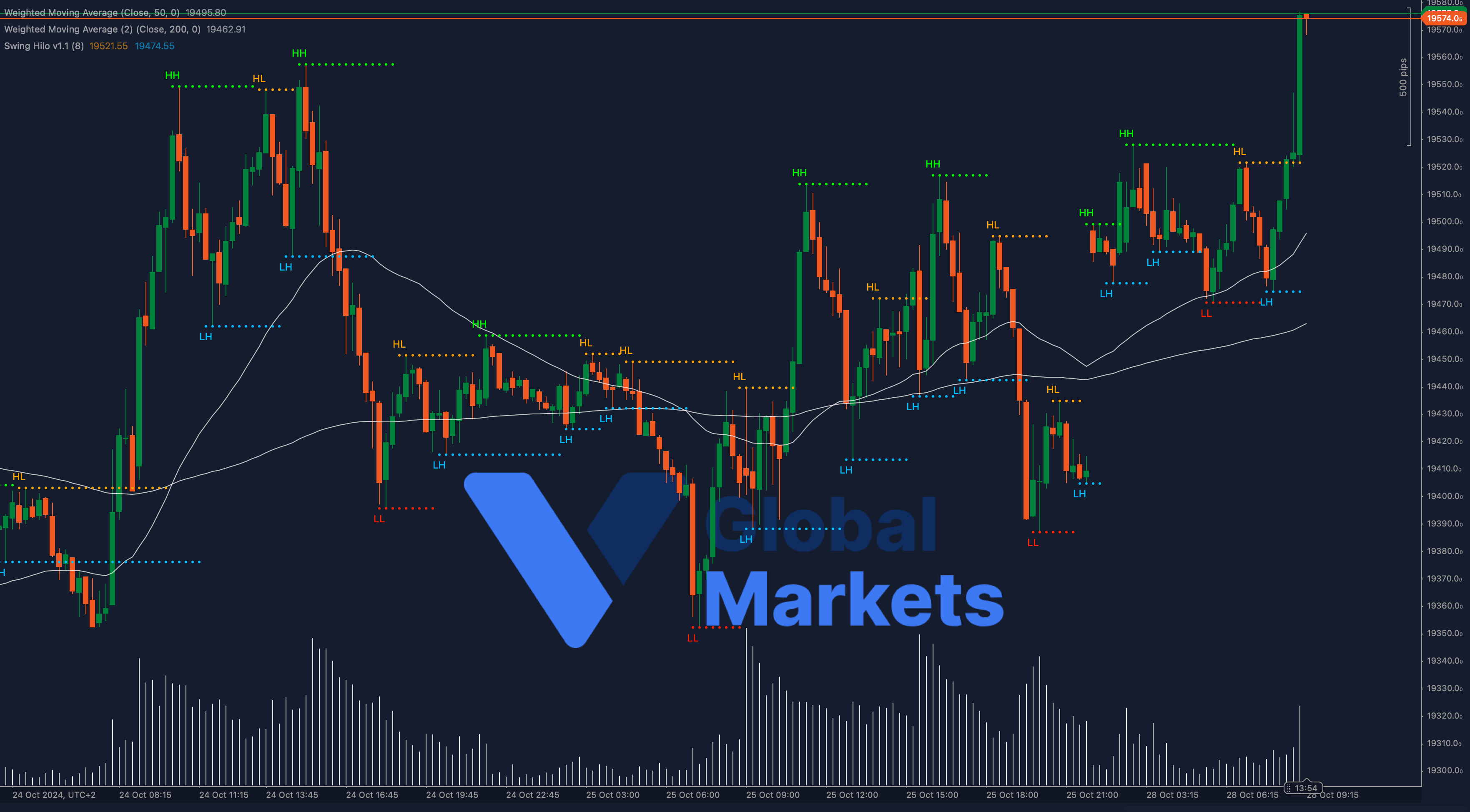

The DAX 40 is trading near 19,570, with the recent upward momentum pushing it above the key resistance of 19,495.80. The 50-period Weighted Moving Average (WMA) is positioned at 19,495.80, while the 200-period WMA lies at 19,462.91, indicating the index’s short-term bullish trend. The breakout above the moving averages is supported by increased buying pressure, suggesting the potential for further gains.

A sustained move above 19,570 could open the door for a test of the next resistance at 19,600. However, if the index fails to maintain its current levels, a retracement towards 19,495.80 and the 200-WMA at 19,462.91 could be seen.

Support: 19,495.80 (50-WMA), 19,462.91 (200-WMA)

Resistance: 19,570, 19,600

Moving Averages:

The DAX 40 has recently crossed above its 50-period and 200-period WMAs, indicating a bullish shift in momentum. A continued close above these levels would reinforce the bullish bias, while a move back below the 50-WMA might signal a short-term reversal.

Volume:

The recent increase in volume during the breakout above 19,495.80 suggests strong buying interest. A continuation of this trend could confirm the upward movement, while a drop in volume might indicate weakening momentum.

Key Levels to Watch:

Support: 19,495.80 (50-WMA), 19,462.91 (200-WMA)

Resistance: 19,570, 19,600

Outlook:

The DAX 40 is at a pivotal point with the breakout above key resistance levels. If it can maintain this momentum, the index could continue its upward trajectory toward the 19,600 mark. However, traders should be aware of potential pullbacks, especially if the index fails to sustain its current levels, as this could signal a short-term correction.

Fundamental Analysis:

The DAX 40’s recent gains are buoyed by a positive sentiment in the European markets, supported by easing inflation concerns and improving economic data from Germany. However, uncertainties around global trade and geopolitical tensions continue to pose risks. Investors will closely monitor upcoming Eurozone GDP and CPI data for further market direction.

#DAX40 #GermanStockMarket #TechnicalAnalysis #VGlobalMarkets #StockIndices #MarketTrends #BullishBreakout #TradingStrategy #FinancialMarkets #Investing