Technical Analysis:

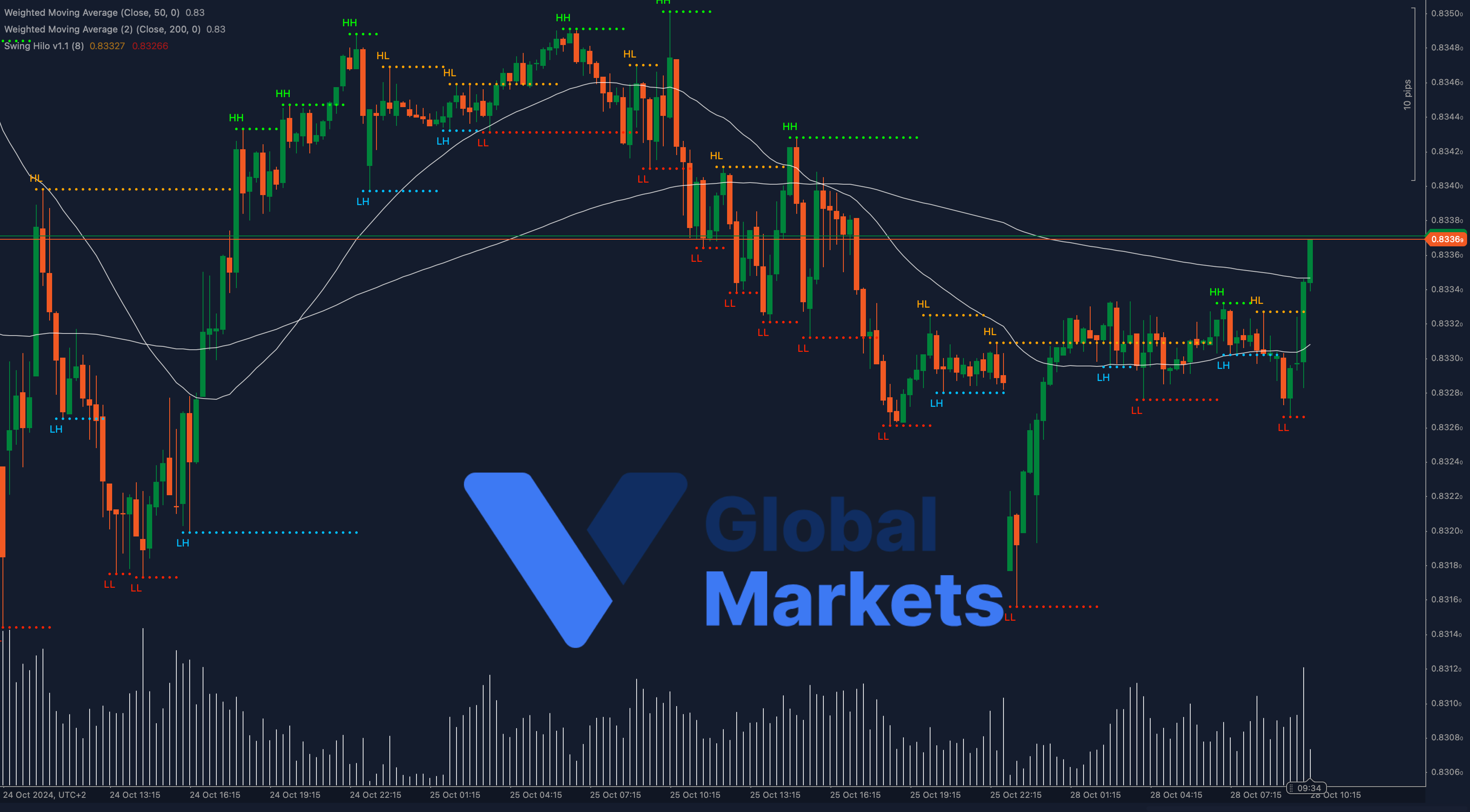

The EUR/GBP is currently trading near 0.8336, experiencing a bullish breakout above the key level of 0.83327. The 50-period Weighted Moving Average (WMA) is positioned at 0.83, while the 200-period WMA sits at 0.83 as well, marking a crucial area for support. The recent price action has shown strength, with the pair pushing higher, indicating a potential continuation of the bullish trend if momentum persists.

A sustained move above 0.8336 could open the path towards 0.8350, while failure to hold above the current levels may result in a pullback towards 0.83266.

Support: 0.83327 (200-WMA), 0.83266

Resistance: 0.8350, 0.8360

Moving Averages:

The EUR/GBP has managed to break above both the 50-period and 200-period WMAs, indicating a shift towards a bullish trend. A continued hold above these levels would reinforce the positive outlook, while a move back below could signal potential consolidation or a reversal.

Volume:

The recent volume has picked up alongside the breakout above 0.83327, indicating renewed buying interest. A further rise in volume could confirm the strength of this breakout, while any dip in volume might suggest caution among traders.

Key Levels to Watch:

Support: 0.83327 (200-WMA), 0.83266

Resistance: 0.8350, 0.8360

Outlook:

EUR/GBP is at a critical juncture, with the recent bullish breakout providing a positive outlook. If the pair maintains its position above 0.8336, further gains towards 0.8350 seem likely. However, caution is advised if the pair fails to sustain these levels, as it may lead to a short-term correction.

Fundamental Analysis:

The EUR/GBP’s recent strength comes amidst a slight recovery in the Eurozone sentiment and ongoing uncertainties surrounding the UK’s economic outlook. Traders are keeping a close eye on upcoming Eurozone inflation data and the Bank of England’s stance on monetary policy, which could influence the pair’s direction in the coming days.

#EURGBP #ForexAnalysis #TechnicalAnalysis #VGlobalMarkets #Euro #BritishPound #TradingStrategy #ForexTrader #FinancialMarkets #ForexSignals