Technical Analysis:

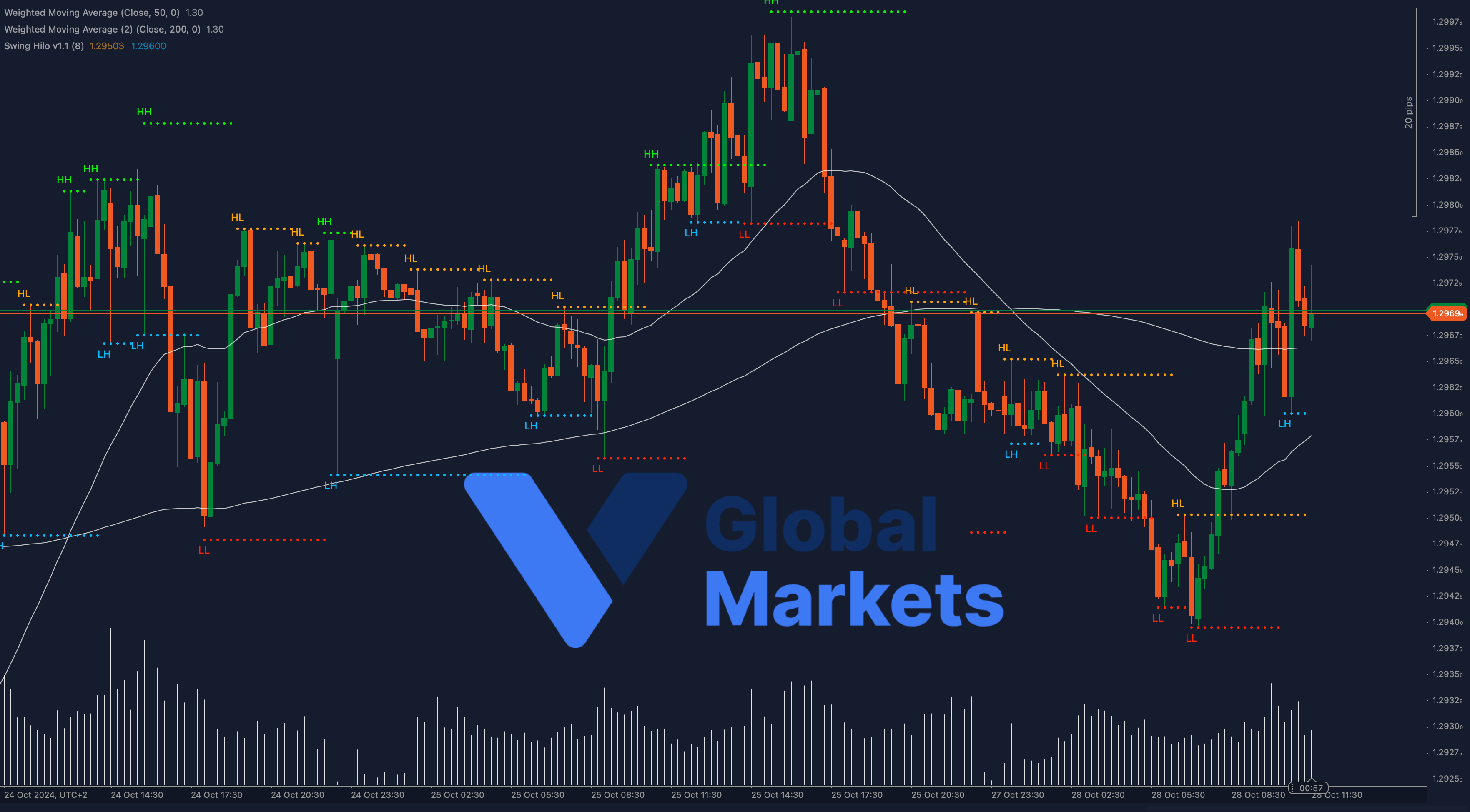

The GBP/USD pair is currently trading around 1.29696, facing resistance near the key 1.2972 level. The 50-period Weighted Moving Average (WMA) is positioned at 1.30, while the 200-period WMA aligns closely at 1.30, creating a robust zone of resistance. Recent price action indicates a bullish attempt to break above these levels, but the failure to hold suggests possible consolidation or a pullback.

A sustained move above 1.2972 could push the pair toward 1.30, while a decline below this level may target the next support at 1.2950, which aligns with recent swing lows.

Support: 1.2950, 1.2920

Resistance: 1.2972, 1.30 (50-WMA & 200-WMA)

Moving Averages:

GBP/USD is trading near its 50-period and 200-period WMAs, signaling a critical inflection point. A breakout above these averages could signal renewed bullish momentum, while failure to do so may keep the pair under pressure, targeting lower levels.

Volume:

The recent volume has been moderate, with a slight increase during attempts to break above resistance. A further increase in volume could validate a breakout or indicate strength in a potential reversal if the pair fails to sustain above key levels.

Key Levels to Watch:

Support: 1.2950, 1.2920

Resistance: 1.2972, 1.30 (50-WMA & 200-WMA)

Outlook:

The GBP/USD pair remains in a tight trading range, with the 1.2972 level acting as a pivotal resistance. A successful breach of this level could pave the way for further upside, while a failure might see the pair retesting lower support levels. Traders should monitor upcoming economic data releases from the UK, as these could provide the needed momentum for a decisive move.

Fundamental Analysis:

The British Pound remains sensitive to market sentiment around the UK economy, with ongoing discussions about inflation and potential policy shifts by the Bank of England. As the US Dollar also responds to expectations around Federal Reserve policy, the pair could experience heightened volatility. Market participants are focusing on economic indicators, such as GDP growth and inflation data, to gauge future movements.

#GBPUSD #ForexTrading #TechnicalAnalysis #VGlobalMarkets #BritishPound #USD #MarketUpdate #ForexMarket #TradingStrategy #FinancialMarkets