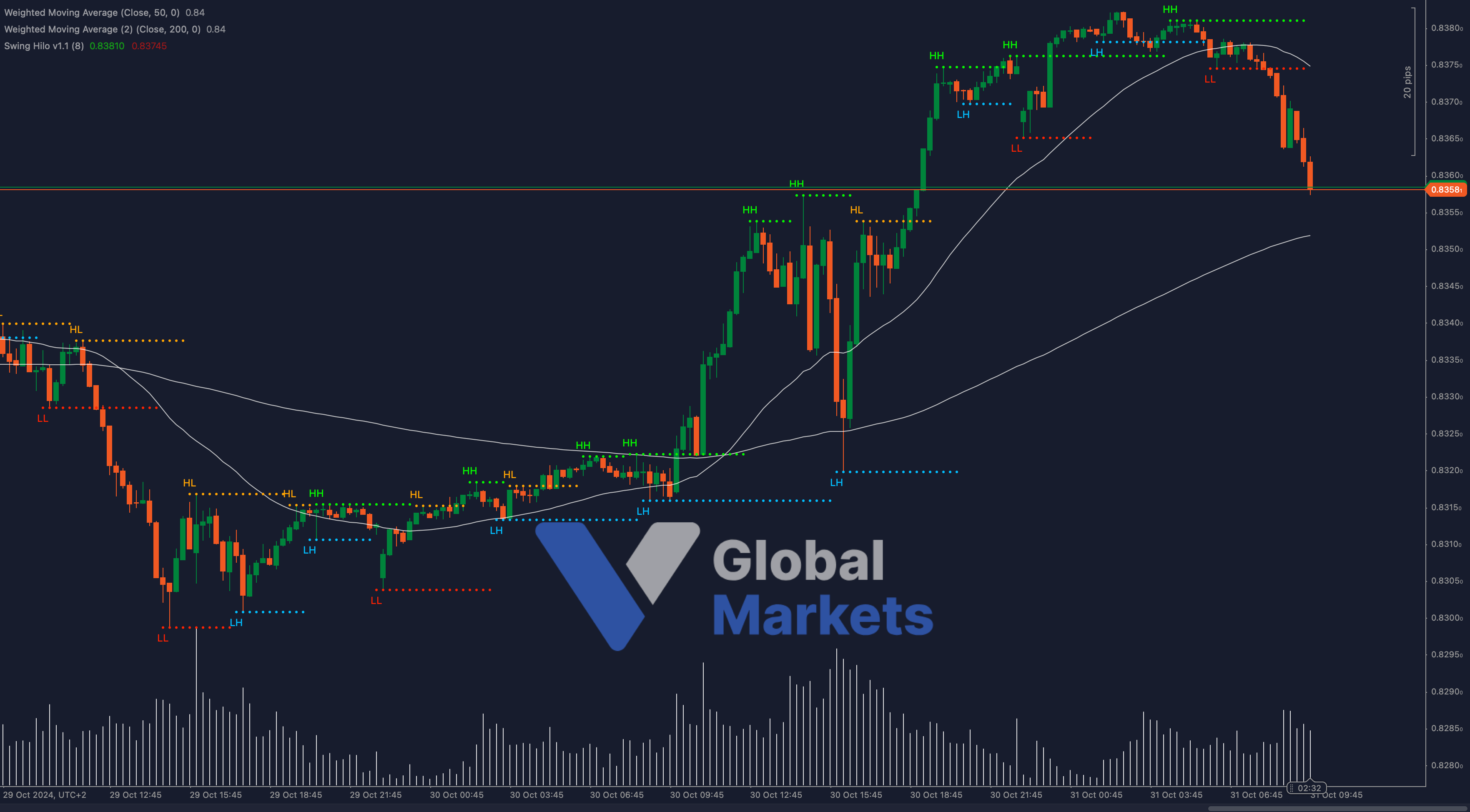

Technical Analysis:

The EUR/GBP is currently trading around 0.8358, resting on a critical support level. The recent sell-off has driven the pair below both the 50-period and 200-period Weighted Moving Averages (WMAs), located at 0.83810 and 0.83745 respectively, signaling a bearish outlook. This downtrend suggests that unless EUR/GBP can hold above this support, further declines could be expected.

A breakdown below 0.8358 could open the way for a deeper retracement toward 0.8330, while any recovery attempt might face resistance around the 0.8380 region, aligning with the 50-WMA and 200-WMA.

Support: 🔻 0.8358, 0.8330

Resistance: 🔺 0.83810 (50-WMA), 0.83745 (200-WMA)

Moving Averages: 📉 EUR/GBP is trading under both the 50-WMA and 200-WMA, reinforcing a bearish bias. A close above these averages could signal a shift in momentum, but until then, sellers seem in control.

Volume: 📊 Recent trading volume has increased as the pair nears the 0.8358 support level, indicating strong selling pressure. Higher volume on a break below this support could confirm a further downside move.

Key Levels to Watch:

Support: 0.8358, 0.8330

Resistance: 0.83810 (50-WMA), 0.83745 (200-WMA)

Outlook: 🚩 The EUR/GBP is under significant pressure, and a breakdown below 0.8358 could lead to further losses. However, if it manages to stay above this level, there might be a chance for a short-term recovery, although resistance around the WMAs could limit any upside.

Fundamental Analysis: The EUR/GBP pair faces ongoing challenges from divergent economic data between the Eurozone and the UK, along with uncertainties over inflation and central bank policies. The UK’s resilient economic indicators may continue to support the Pound, keeping EUR/GBP pressured near its support levels.

#EURGBP #ForexTrading #TechnicalAnalysis #ForexMarket #EUR #GBP #TradingStrategy #VGlobalMarkets #ctrader