Technical Analysis:

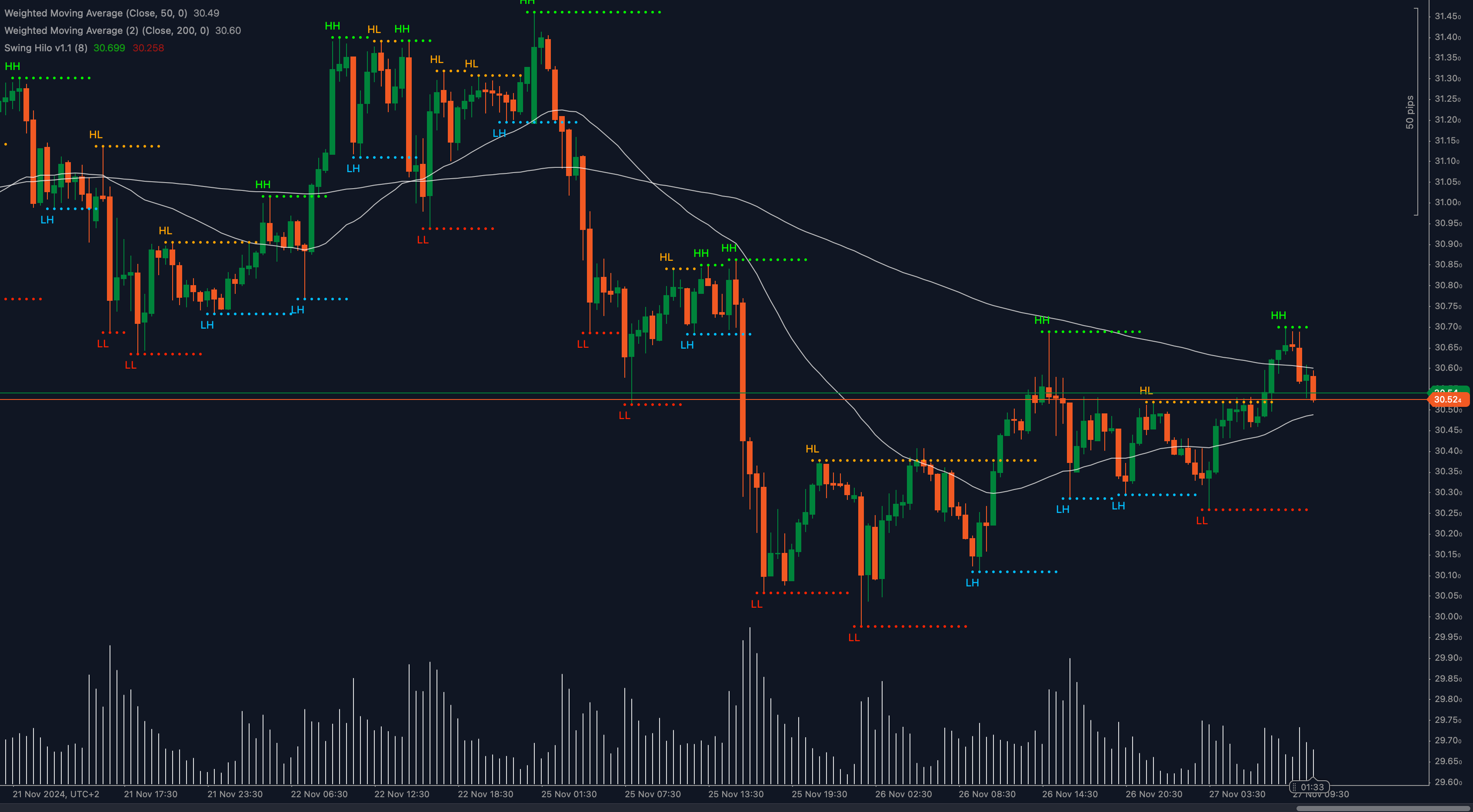

XAG/USD (Silver) is trading at $30.52, testing a crucial support level following a retracement from the recent high of $30.70. The price has struggled to hold above the 200-period moving average (30.60), indicating persistent selling pressure. Additionally, the 50-period moving average (30.49) is acting as interim support, creating a narrow range of consolidation.

The Relative Strength Index (RSI) is at 52, suggesting neutral momentum, while the Stochastic Oscillator is turning lower, hinting at potential bearish continuation. Moreover, the Fibonacci retracement levels show $30.52 aligning closely with the 61.8% retracement of the recent uptrend from $30.25 to $30.70.

If the price holds above $30.52, a recovery toward $30.70 or even $31.00 is possible. However, a breakdown below this support could see Silver retesting $30.25 and potentially dipping further toward $30.00, a psychological level.

Key Levels to Watch:

- Support: $30.52, $30.25, $30.00

- Resistance: $30.60, $30.70, $31.00

Volume and Sentiment:

📊 Volume has tapered off after the recent rally, indicating cautious sentiment among traders. An uptick in volume near $30.52 would be crucial for confirming the next directional move.

Outlook:

Silver remains range-bound, with $30.52 serving as a key decision point. A hold above this level could reignite bullish sentiment, while a break lower would open the door to further downside.

Fundamental Analysis:

XAG/USD’s direction is being shaped by global risk appetite and the US dollar’s performance. As traders monitor central bank policy signals and economic data, Silver’s safe-haven appeal could see fluctuations depending on market volatility and inflation expectations.

#XAGUSD #SilverTrading #TechnicalAnalysis #ForexMarket #TradingStrategy #PreciousMetals #ctrader #MarketUpdate