Technical Analysis:

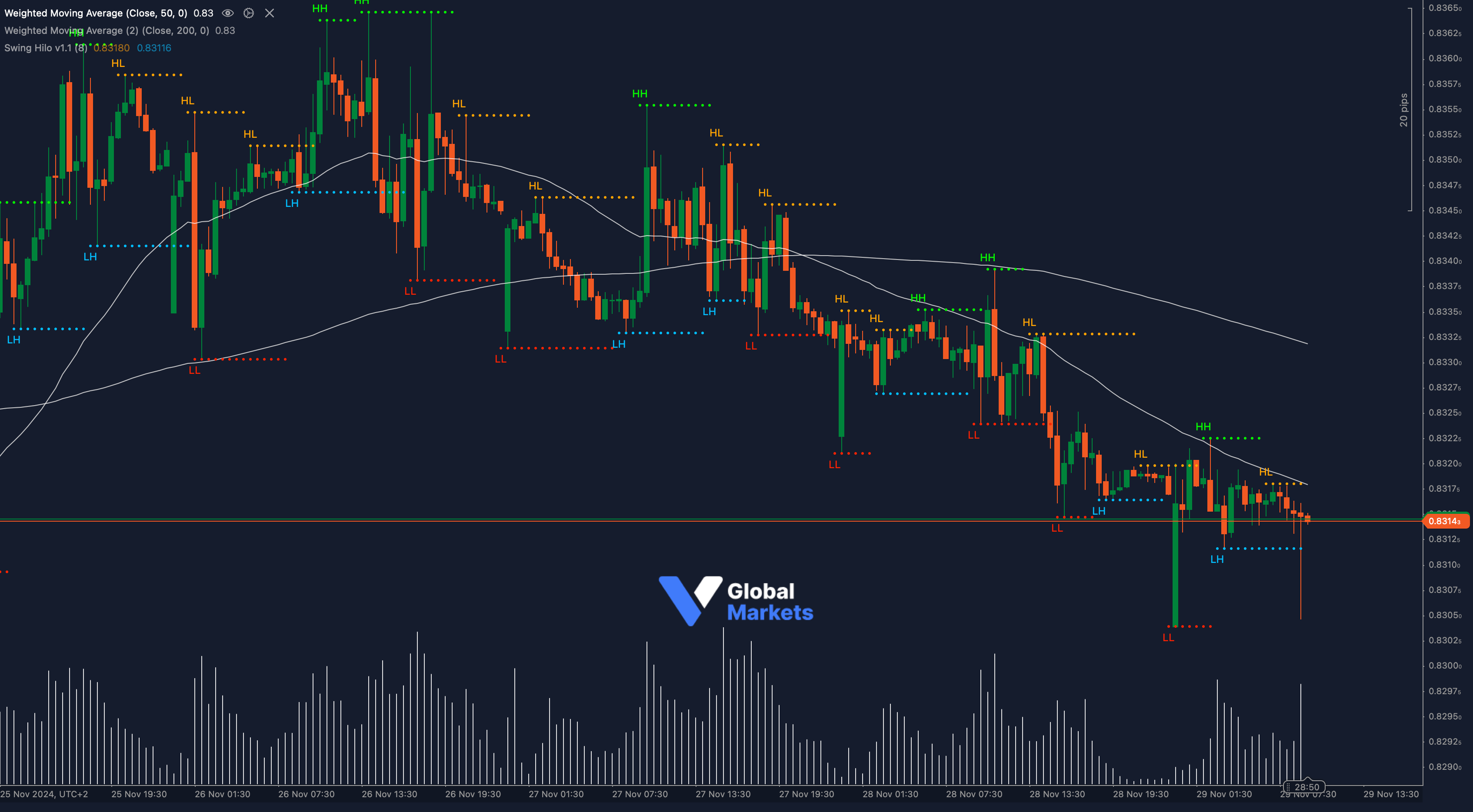

EUR/GBP is consolidating near its critical support level of 0.8310, following a prolonged downtrend. This level has historically served as a strong demand zone, as indicated by prior price rebounds. The pair has remained under pressure below the 200-period Weighted Moving Average (WMA) at 0.8316, which continues to act as a dynamic resistance, reflecting a bearish bias.

Adding another layer of insight, the Bollinger Bands reveal a tightening range, signaling that volatility is compressing and a potential breakout or breakdown is imminent. The MACD indicator displays weak momentum, with the signal line remaining below the MACD line, supporting the bearish sentiment.

The Relative Strength Index (RSI) hovers near the oversold territory at 35, suggesting a possibility for short-term correction, although the broader trend remains downward.

If the price decisively breaks below 0.8310, it could pave the way for further declines toward 0.8280, with a potential extension to 0.8250, the latter being a significant Fibonacci extension level. Conversely, a bounce from the support level could lead to a recovery targeting 0.8335 and eventually the 200-period WMA.

Key Technical Tools Applied:

- Bollinger Bands: Indicate volatility contraction, suggesting an upcoming decisive move.

- MACD Indicator: Reflects bearish momentum dominance.

- Fibonacci Extensions: Highlight potential downside targets beyond current support.

- Weighted Moving Averages (50 and 200): Confirm long-term bearish alignment.

Key Levels to Watch:

- Support: 0.8310, 0.8280, 0.8250

- Resistance: 0.8335, 0.8350, 0.8370

Volume and Sentiment:

📊 Declining volume as EUR/GBP approaches 0.8310 suggests a lack of conviction among buyers. A breakdown on increasing volume would validate further bearish moves.

Outlook:

EUR/GBP remains at a critical juncture, with the support level of 0.8310 likely to dictate the next directional bias. While short-term correction is plausible, the overall bearish trend remains intact unless a significant breakout above the 200-period WMA occurs.

Fundamental Analysis:

The euro remains weighed down by mixed economic data from the eurozone, with inflation figures failing to surprise markets. Meanwhile, the pound holds steady amid cautious optimism about the UK economy, supported by recent PMI data exceeding expectations. Market participants await further central bank commentary to gauge the near-term trajectory of EUR/GBP.

#EURGBP #ForexTrading #TechnicalAnalysis #ForexMarket #MarketUpdate #ctrader