Technical Analysis:

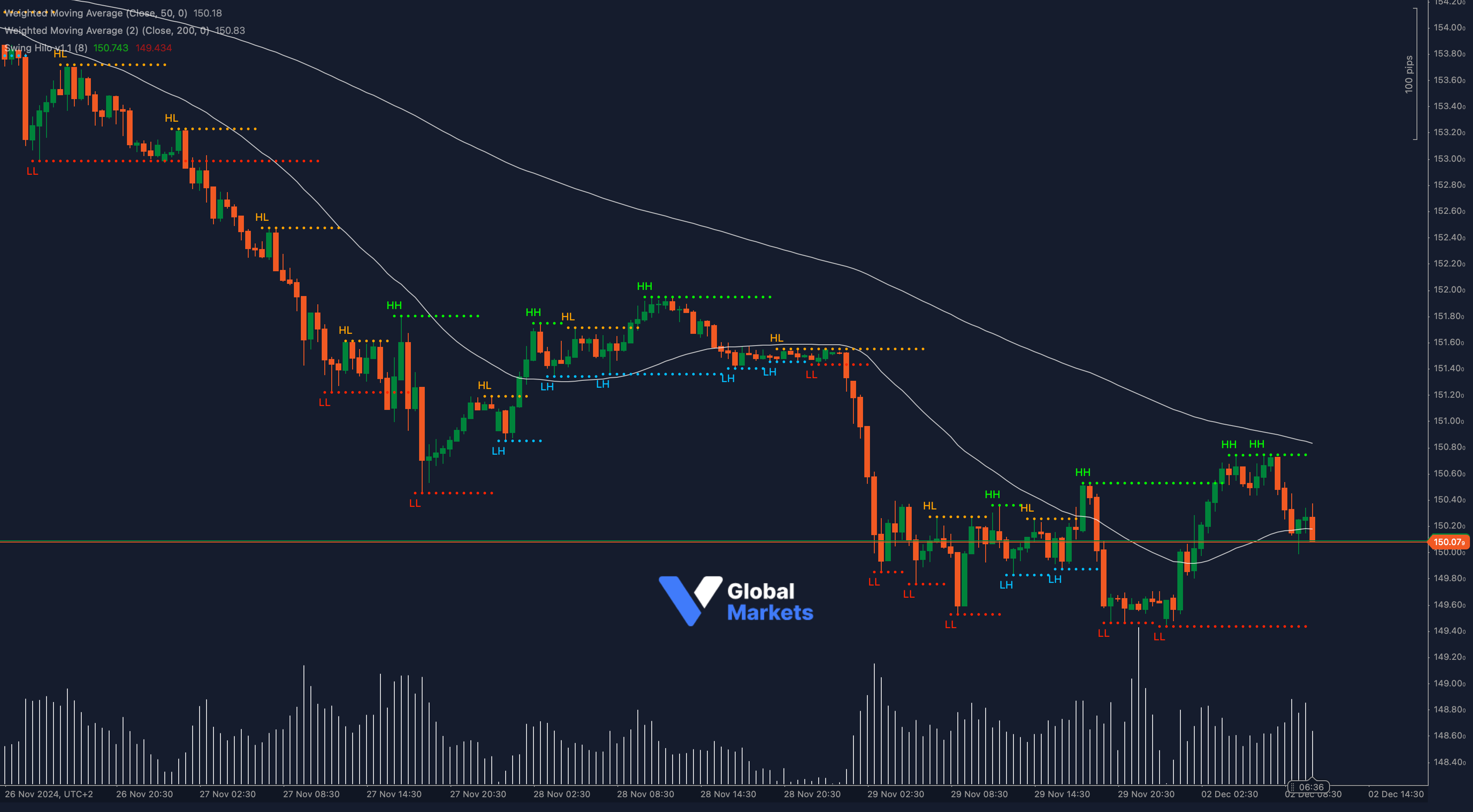

USD/JPY is trading near a pivotal support level of 150.07, showing signs of uncertainty after recent price swings. The pair remains below its 200-period Weighted Moving Average (WMA) at 150.83, which signals a sustained bearish bias, while the 50-period WMA at 150.18 is acting as a short-term pivot.

A closer look at the Fibonacci Retracement from the recent downswing indicates that the pair is hovering near the 38.2% retracement level, suggesting this zone could act as a temporary stabilization point. The Parabolic SAR indicator has flipped above the price, reinforcing downward pressure.

Momentum indicators, such as the Stochastic Oscillator, show oversold conditions, with %K crossing above %D, hinting at a potential near-term recovery. However, broader sentiment remains bearish unless the pair convincingly breaks above 151.00, which aligns with the 61.8% Fibonacci level.

If USD/JPY breaks below 150.07, the next critical target lies at 149.50, followed by 148.80, a level that coincides with previous swing lows. Conversely, a rebound could see resistance at 150.50, with further gains capped near 151.00.

Key Technical Tools Applied:

- Fibonacci Retracement: Identifies critical levels like 38.2% and 61.8% for potential reactions.

- Parabolic SAR: Confirms bearish momentum.

- Stochastic Oscillator: Suggests oversold conditions, hinting at a short-term bounce.

- Weighted Moving Averages: Highlights bearish alignment in the longer term.

Key Levels to Watch:

- Support: 150.07, 149.50, 148.80

- Resistance: 150.50, 151.00, 151.50

Volume and Sentiment:

📊 Trading volume has been increasing near the support level of 150.07, which reflects heightened interest among participants. A break on high volume could drive strong directional movement.

Outlook:

USD/JPY is at a decision point near its support at 150.07. While oversold signals may lead to a short-term bounce, the overall bearish structure suggests further downside risk unless the price breaks above 151.00.

Fundamental Analysis:

The dollar faces headwinds as market participants weigh the Federal Reserve’s policy outlook amidst softening inflation data. Meanwhile, the yen has found support from recent comments by Bank of Japan officials, indicating possible shifts in ultra-loose monetary policy. Upcoming US jobs data could significantly influence USD/JPY’s trajectory.

#USDJPY #ForexMarket #TechnicalAnalysis #Trading #ctrader #MarketUpdate