Technical Analysis:

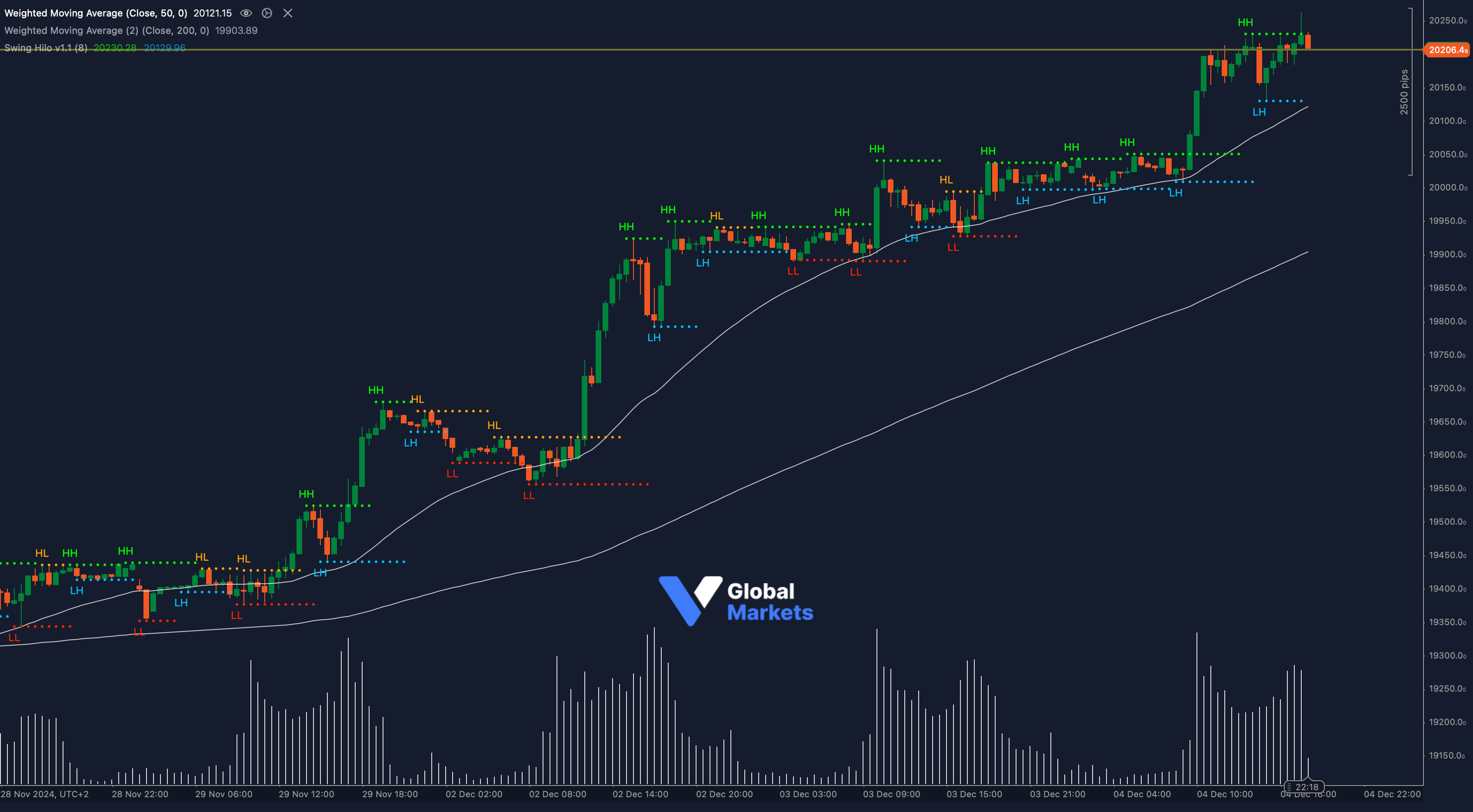

The DAX 40 index has surged to a new intraday high at 20,250, continuing its strong upward momentum. The index is trading well above the 50-period Weighted Moving Average (WMA) at 20,121, indicating robust short-term bullish sentiment. The 200-period WMA, positioned at 19,903, reinforces long-term support.

Using a Fibonacci Expansion, the price is approaching the 161.8% extension level, suggesting that further upside may be capped near 20,300 unless strong volume supports the breakout. The Relative Strength Index (RSI) remains in the neutral zone, avoiding overbought conditions and leaving room for potential upside continuation.

The Bollinger Bands are widening, reflecting increased volatility as the DAX edges closer to uncharted territory. Furthermore, the recent swing low at 20,121 serves as immediate support, while the trend’s higher lows emphasize bullish control.

Key Technical Tools Applied:

- Fibonacci Expansion: Highlights the 161.8% level as a potential target.

- Bollinger Bands: Indicate increased volatility supporting higher prices.

- RSI: Neutral levels support continued upward momentum.

- Moving Averages: Confirm strong bullish structure.

Key Levels to Watch:

- Support: 20,121, 19,903

- Resistance: 20,300, 20,500

Volume and Sentiment:

📊 Volume remains robust, particularly during intraday rallies, suggesting active participation by institutional buyers. A sustained breach above 20,250 with strong volume could open the door for further gains toward 20,500.

Outlook:

The DAX 40 is poised for continued growth as long as the 20,121 support holds. A decisive close above 20,250 would confirm the bullish breakout, targeting 20,300 and potentially 20,500. However, failure to maintain current levels could result in a pullback toward 19,903 for consolidation.

Fundamental Analysis:

The German stock index has benefited from positive sentiment driven by stronger-than-expected industrial production data and a weakening euro, enhancing export competitiveness. Investors are also optimistic about easing inflationary pressures, which could influence the European Central Bank’s monetary policy stance.

#DAX40 #GermanMarkets #TechnicalAnalysis #MarketTrends #ctrader #TradingSignals