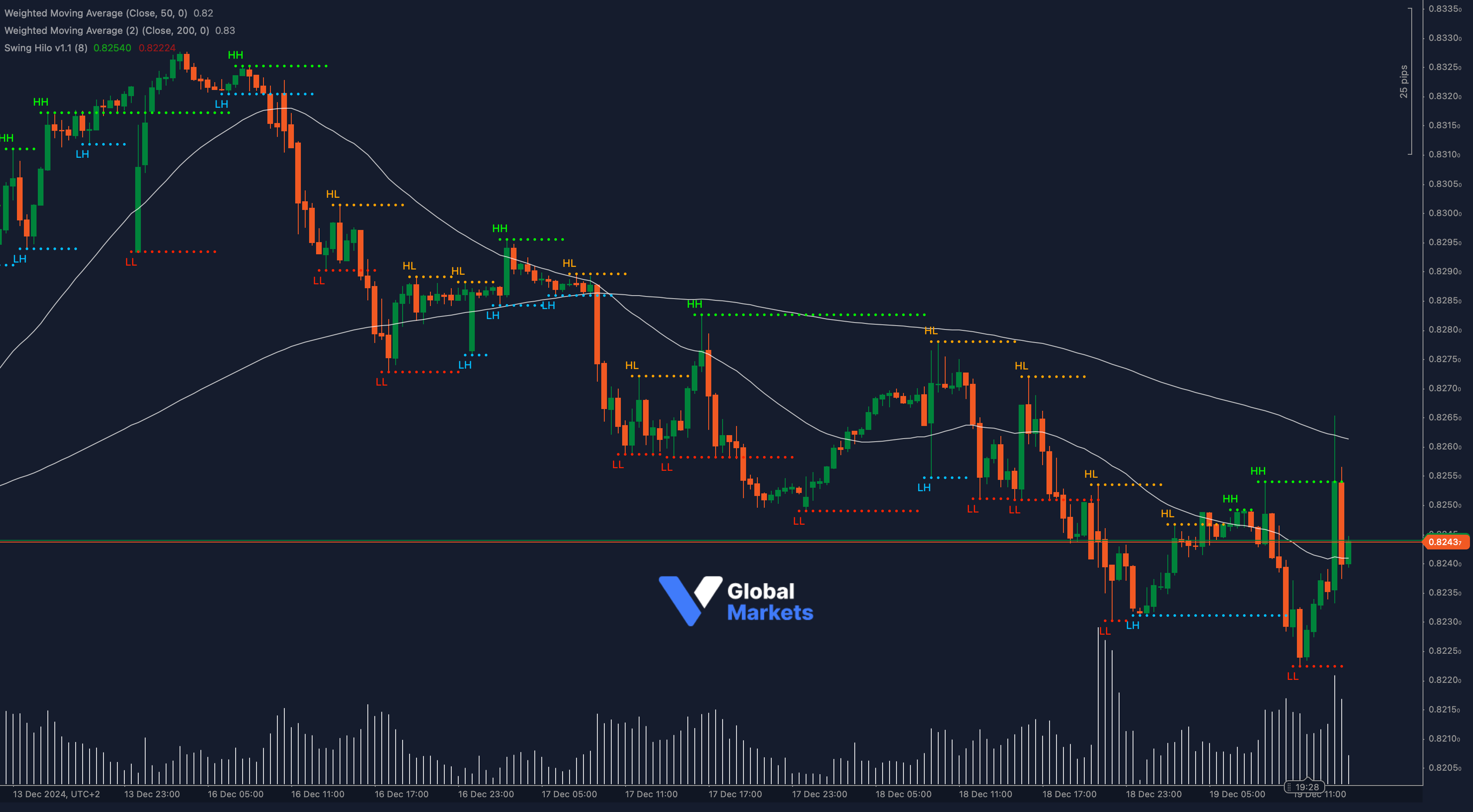

The EUR/GBP pair has displayed a sharp recovery, testing critical technical levels while leaving traders debating whether this is the start of a larger reversal or a mere corrective bounce. The interplay between price action and key indicators is creating a compelling setup for the next move.

📈 A sharp reversal candle near the recent low at 0.8230 signals strong buyer interest at this key support zone. This bounce aligns with the S1 pivot level, a historically significant area for price reactions. If the pair sustains this recovery, the next resistance at 0.8270 comes into focus, marking a critical Fibonacci confluence zone.

💡 Fibonacci levels highlight a potential retracement target at 38.2%, sitting near 0.8265, followed by the 50% retracement at 0.8280. The ability of the pair to clear these levels will determine whether this is a reversal or a continuation of the broader downtrend.

🧲 The RSI momentum is recovering from oversold conditions, with the indicator climbing back above 30 and pushing toward the midline. A decisive break above 50 on the RSI would suggest increasing bullish momentum, supporting a potential rally toward the pivot resistance zone at 0.8270.

📍 Moving averages add another layer of insight. The 50 Weighted Moving Average (WMA) is sloping downward, but the price is attempting to regain this level. A close above the 50 WMA would strengthen the bullish case and signal a potential short-term trend shift. However, the 200 WMA remains a key overhead resistance near 0.8275, which aligns with the upper pivot levels and Fibonacci retracements.

⚠️ From a fundamental perspective, the EUR/GBP pair remains influenced by diverging monetary policy expectations. The European Central Bank’s recent cautious tone contrasts with the Bank of England’s ongoing hawkish outlook, keeping the pair under pressure. Additionally, Brexit-related uncertainties and Eurozone economic growth concerns continue to weigh on the Euro. Traders should watch for any surprises in upcoming central bank commentary or economic data releases.

🌐 Broader market sentiment will also play a crucial role. A shift in risk appetite could drive demand for the Pound as a regional safe haven, while a deteriorating Eurozone outlook may further pressure the Euro.

The EUR/GBP’s bounce from 0.8230 marks a significant recovery point, but traders should remain cautious until the pair clears 0.8270. Momentum indicators and pivot levels will provide critical clues for the pair’s next move, offering potential trading opportunities on both sides.