The DXY (US Dollar Index) has delivered a dramatic breakout, leaving traders scrambling to reassess their strategies. The recent surge is not just a technical breakout but a signal of underlying strength in the U.S. Dollar, supported by both momentum indicators and fundamental shifts.

📈 The Fibonacci extensions perfectly frame the current move. After breaking past the 108.00 key level, the price surged toward the 108.20 zone, marking a clear reaction to the 127.2% Fibonacci extension of the prior consolidation range. If bullish momentum persists, the next Fibonacci target lies at 108.50, offering an upside potential to capitalize on the Dollar’s dominance.

💡 Momentum indicators such as the RSI are screaming overbought conditions, but this is typical during strong bullish trends. The RSI has climbed above 70, signaling the presence of a robust buying wave. As long as RSI holds these levels, buyers may continue pushing the DXY higher. However, caution is warranted if divergence begins to form.

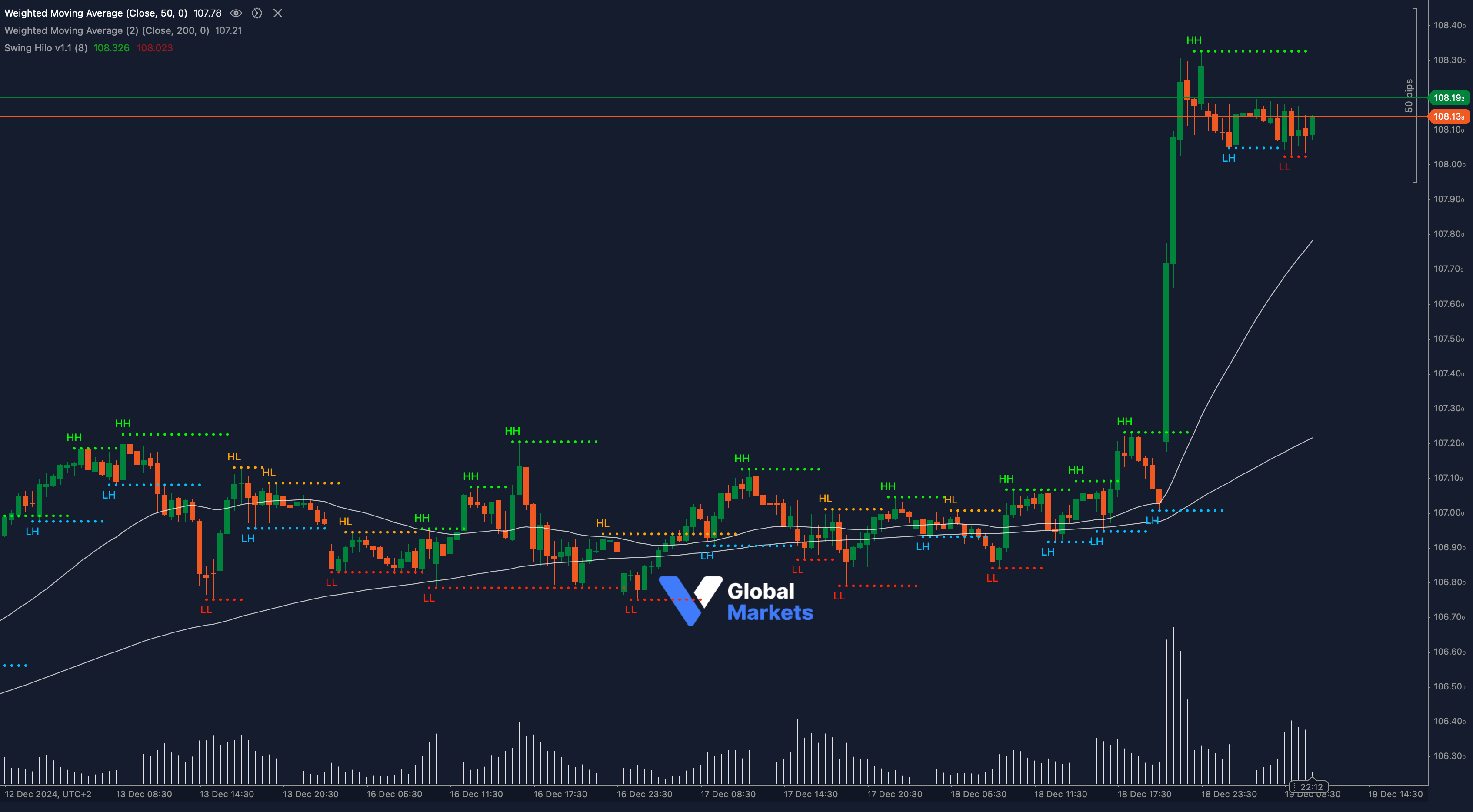

🧲 Moving Averages provide further confirmation of the bullish breakout. The 50 Weighted Moving Average (WMA) has crossed firmly above the 200 WMA, forming a golden cross, which is a powerful bullish signal. Additionally, the price is trading well above these moving averages, indicating strong upside momentum.

📍 The breakout zone at 108.00 now transforms into a critical support level. If the price retraces to this level, traders should watch for strong buying interest. On the upside, sustained momentum beyond 108.20 could accelerate moves toward the 108.50 extension and even higher.

⚠️ From a fundamental perspective, the Dollar’s strength is rooted in a combination of rising Treasury yields and market expectations of continued U.S. economic resilience. Fed officials have hinted at maintaining a hawkish bias, further fueling demand for the Dollar. In contrast, global risk sentiment remains fragile, adding to the Dollar’s appeal as a safe-haven asset.

🌍 Looking ahead, key U.S. data points, such as GDP revisions and inflation updates, will play a crucial role in determining whether this rally has legs. If data continues to support the Fed’s hawkish stance, the DXY may extend its gains. Conversely, any signs of slowing economic momentum could invite a corrective phase.

The DXY’s breakout above 108.00 is a strong statement of bullish intent, supported by Fibonacci extensions, moving averages, and RSI momentum. Traders should keep an eye on the upcoming resistance at 108.50, while using pullbacks to 108.00 as potential entry points. The Dollar’s bullish momentum shows no signs of waning just yet.