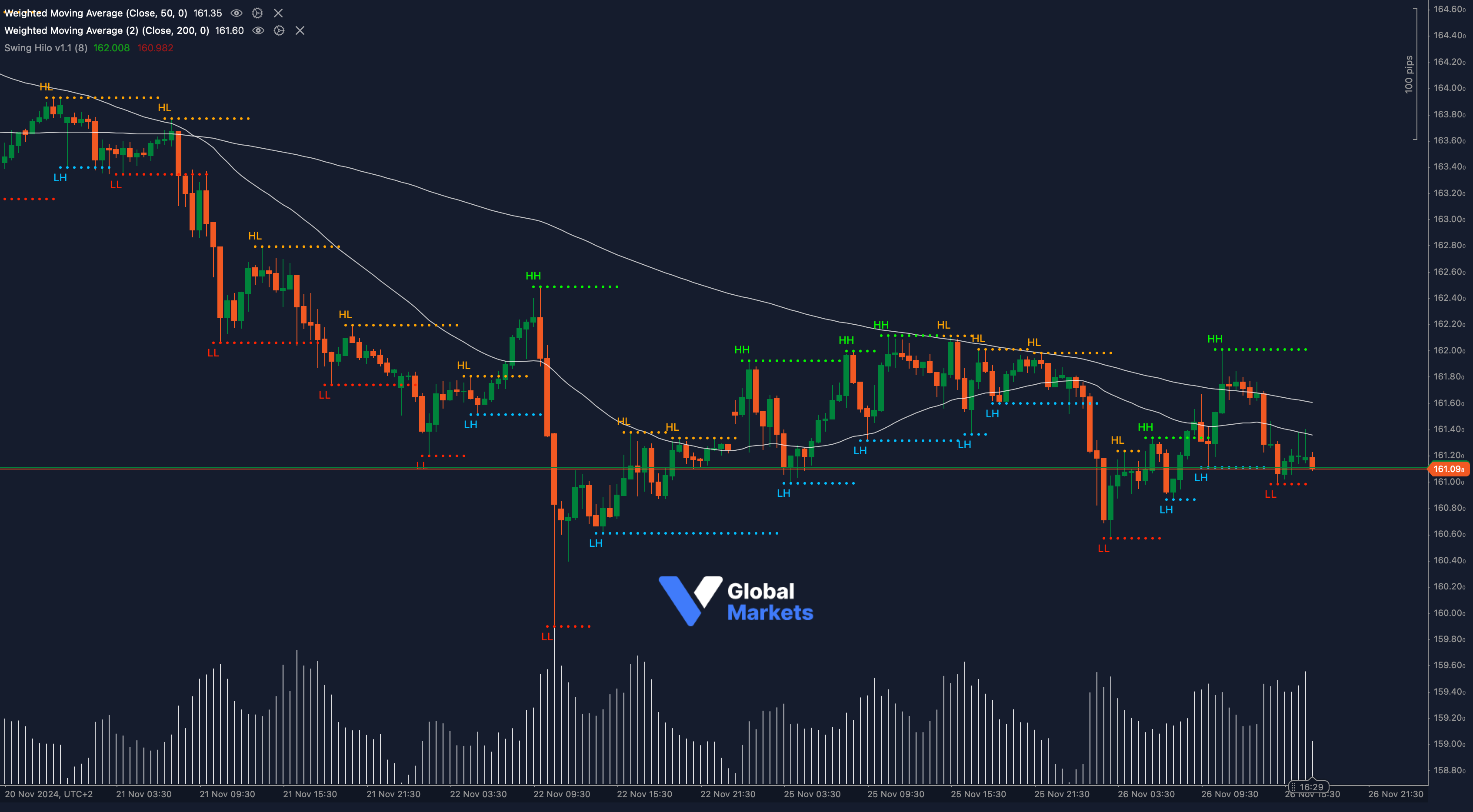

Technical Analysis:

EUR/JPY is currently testing a significant support level at 161.09, a price point aligned with the 50% Fibonacci retracement of the recent recovery from 159.80 to 162.00. The pair is trading below the 200-period moving average (161.60), suggesting a bearish bias in the short term.

The Relative Strength Index (RSI) hovers around 40, indicating growing bearish momentum without reaching oversold conditions. The Stochastic Oscillator, however, is entering oversold territory, signaling a potential bounce. Additionally, a descending triangle pattern appears to be forming, which could hint at further downside pressure if the support at 161.09 breaks.

If sellers push prices below 161.09, the next targets could be 160.50 and 159.80, key support levels from prior lows. On the flip side, a recovery above 161.60 could see EUR/JPY targeting 162.00, a key resistance level and the upper boundary of the triangle pattern.

Key Levels to Watch:

- Support: 161.09, 160.50, 159.80

- Resistance: 161.60, 162.00

Volume and Sentiment:

📊 Volume has risen during the latest decline, highlighting growing bearish sentiment. A continuation of high volume near the 161.09 level will be critical in determining the next move.

Outlook:

EUR/JPY sits at a pivotal support level at 161.09. If buyers can defend this level, a short-term bounce is possible. However, a sustained break lower could confirm bearish control, setting the stage for further declines.

Fundamental Analysis:

The EUR/JPY pair reflects ongoing divergence between European and Japanese monetary policies. While the Eurozone faces economic slowdown concerns, the Bank of Japan’s dovish stance continues to weigh on the yen. Upcoming Eurozone inflation data and BoJ commentary may drive further volatility in the pair.

#EURJPY #ForexAnalysis #TechnicalAnalysis #ForexMarket #TradingStrategy #ctrader #CurrencyPairs #MarketUpdate