Technical Analysis:

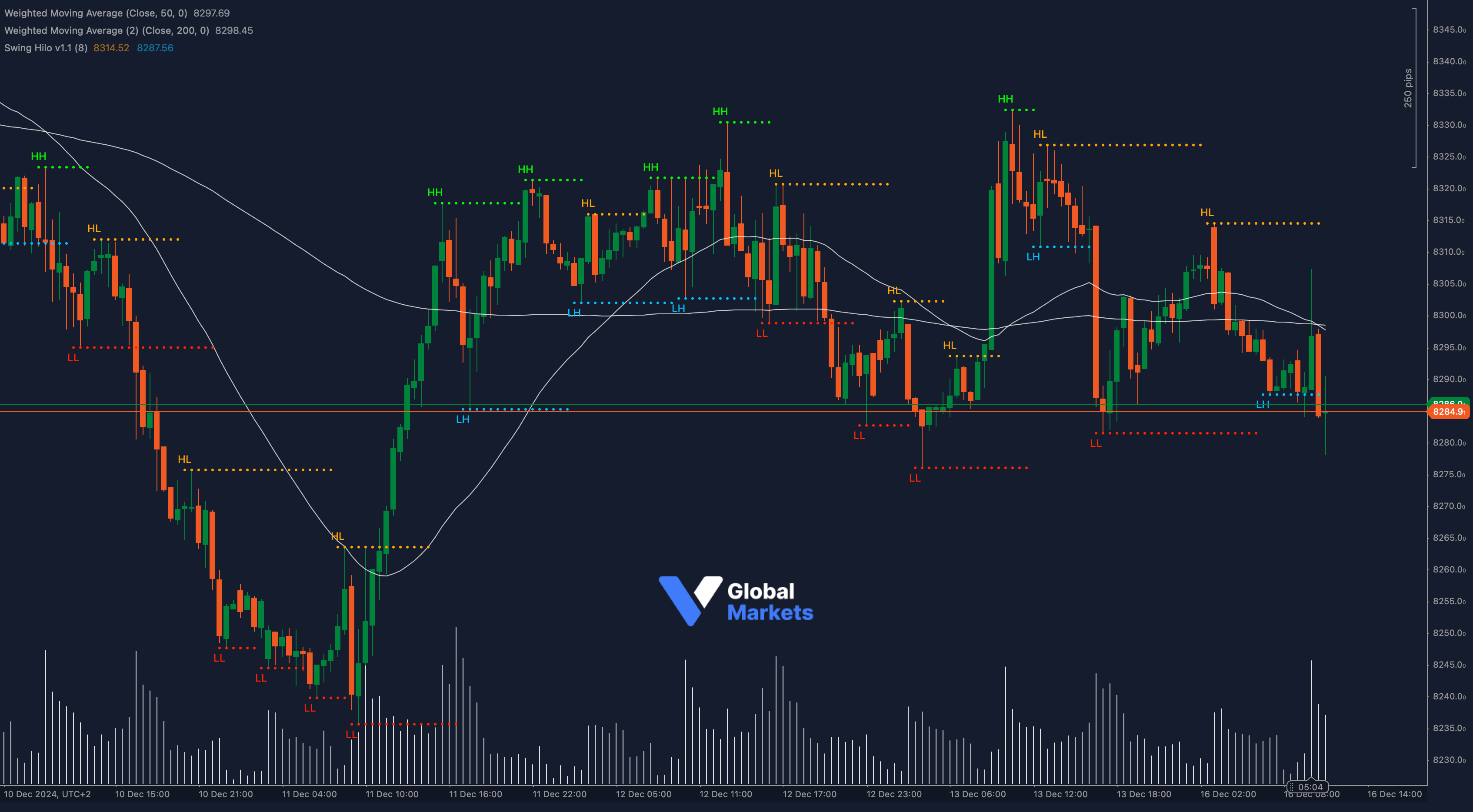

The FTSE 100 Index (UK100) is consolidating around 8,284, a critical support level, after retracing from its recent high of 8,335. The 50-period WMA (8,297) and the 200-period WMA (8,298) are converging, reflecting indecision in the market and hinting at a potential breakout or breakdown.

Key technical insights:

- Fibonacci Retracement:

- The pullback from the swing high 8,335 to the swing low 8,270 highlights the 38.2% retracement at 8,288, acting as minor resistance. The 61.8% level near 8,312 will be a key target for bulls if momentum picks up.

- Bollinger Bands:

- Prices are tightening around the middle band, suggesting a breakout could be imminent. The lower band at 8,275 acts as immediate support, while the upper band at 8,312 offers a resistance target.

- RSI (Relative Strength Index):

- Currently at 46, RSI indicates a mildly bearish tone. A move above 50 would signal strength, while a drop below 45 could confirm further downside.

Volume analysis shows light participation, signaling caution. A surge in volume at 8,288 or 8,270 will likely determine the next trend.

Key Indicators Applied:

- Fibonacci Retracement: Support at 8,270, resistance at 8,288 and 8,312.

- Bollinger Bands: Prices consolidating with reduced volatility.

- RSI: Neutral at 46, watching for directional confirmation.

Key Levels to Watch:

- Support: 8,284, 8,270

- Resistance: 8,288, 8,312, 8,335

Volume and Sentiment:

📊 Market volume remains muted, suggesting hesitation among traders. A breakout above 8,288 on strong volume could open the door for further upside, while a drop below 8,270 may indicate renewed selling pressure.

Outlook:

The FTSE 100 remains at a pivotal point. Bulls will need to reclaim resistance at 8,288 and target the 8,312 level to sustain upward momentum. However, failure to hold above 8,284 may expose the index to a slide toward 8,270 and lower.

Fundamental Analysis:

UK market sentiment hinges on macroeconomic updates, particularly UK GDP growth and inflation data. A hawkish stance from the Bank of England could pressure the index, while dovish signals may fuel a rebound. Geopolitical events and global equity trends will also play a key role in driving investor sentiment.

#FTSE100 #UK100 #TechnicalAnalysis #StockMarketNews #TradingStrategy #ctrader