Technical Analysis:

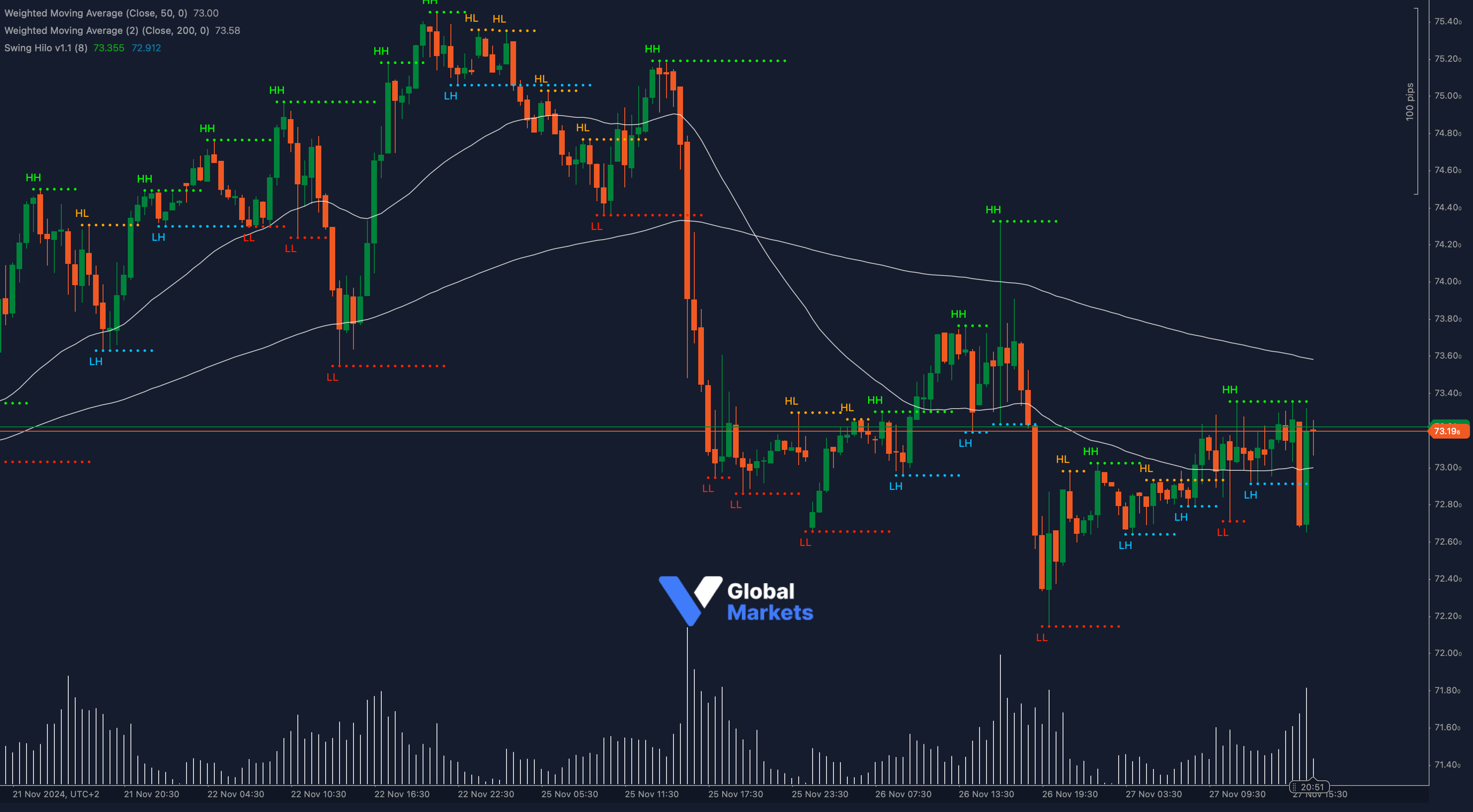

UK Oil (Brent) is showing mixed momentum around the $73.18 level, where prices are testing the 200-period moving average (73.58) as immediate resistance. The 50-period moving average (73.00), however, is providing short-term support, keeping the pair range-bound for now.

The Relative Strength Index (RSI) is at 50, reflecting neutral conditions, while the MACD indicator is beginning to show a potential bullish crossover. Notably, the recent recovery from the $72.20 low suggests the possibility of buyers regaining control. The price action also reveals a potential double bottom pattern, signaling a bullish reversal if prices sustain above $73.20.

On the upside, a break above $73.58 could see Brent targeting $74.20 and potentially $74.80, key resistance levels. Conversely, failure to clear this level might push prices back toward $72.50 and the critical support at $72.20.

Key Levels to Watch:

- Support: 73.00, 72.50, 72.20

- Resistance: 73.58, 74.20, 74.80

Volume and Sentiment:

📊 Volume has increased during the latest recovery, signaling stronger market interest. Further bullish confirmation could come from rising volume above $73.58.

Outlook:

UK Oil is at a critical juncture, with short-term indicators slightly favoring the bulls. A decisive breakout above $73.58 could signal a bullish continuation, while failure to break higher might invite renewed selling pressure.

Fundamental Analysis:

Brent prices remain sensitive to global oil demand outlooks and OPEC+ production policies. With traders awaiting updates on potential supply adjustments and economic data influencing demand, volatility is expected to persist.

#UKOil #BrentCrude #ForexAnalysis #OilMarket #TradingStrategy #ctrader #MarketUpdate