Technical Analysis:

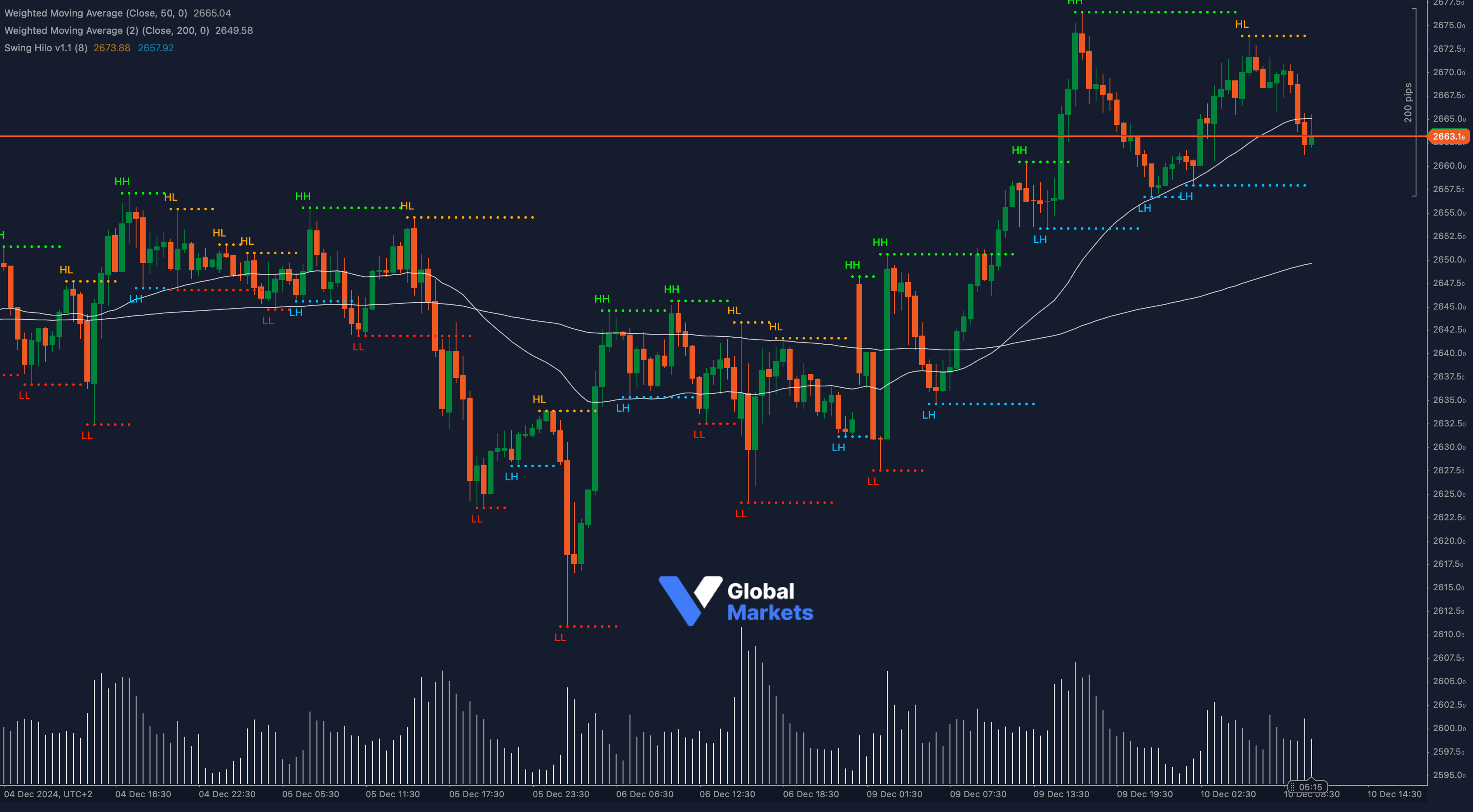

Gold (XAUUSD) is currently trading near $2,668, displaying a consolidation pattern as the market pauses following recent gains. The price hovers near the 50-period Weighted Moving Average (WMA) at $2,665, which has been acting as short-term support, while the 200-period WMA at $2,649 remains below, signaling an overall bullish trend.

Analyzing the Swing High/Low structure, gold has been forming higher highs (HH) and higher lows (HL), reflecting a steady upward trajectory. However, recent price action has shown reduced momentum, indicating the possibility of either a pullback or a breakout.

Applying a Fibonacci retracement from the previous swing low at $2,610 to the swing high at $2,677, the 38.2% retracement level at $2,653 aligns with the lower boundary of the consolidation zone, reinforcing its significance as immediate support.

The Relative Strength Index (RSI) at 54 suggests a neutral stance, with room for the price to move in either direction. Meanwhile, the Volume Profile highlights significant activity between $2,655–$2,675, indicating strong interest from both buyers and sellers.

Key Indicators Applied:

- Fibonacci Retracement: Identifies immediate support and resistance zones.

- Volume Profile: Highlights the most traded levels within the range.

- RSI Analysis: Indicates the market is neither overbought nor oversold.

Key Levels to Watch:

- Support: $2,665, $2,653

- Resistance: $2,675, $2,690

Volume and Sentiment:

📊 The volume has been declining during this consolidation phase, hinting at the potential for a sharp move once volatility resumes. Watch for increased activity near the breakout or breakdown levels to confirm directional bias.

Outlook:

Gold’s price action suggests that the market is gearing up for a decisive move. A break above $2,675 could reignite bullish momentum, targeting $2,690 and beyond. Conversely, failure to hold the $2,653 support may lead to a retracement toward $2,640. Traders should remain cautious and look for confirmation before committing to directional trades.

Fundamental Analysis:

Gold continues to benefit from a safe-haven bid amidst global economic uncertainties and fluctuating inflation data. The market is also closely watching central bank decisions on interest rates, which could impact gold’s appeal as a non-yielding asset. Any dovish signals could support further gains, while hawkish commentary might pressure prices.

#Gold #XAUUSD #ForexTrading #MarketAnalysis #ctrader