Technical Analysis:

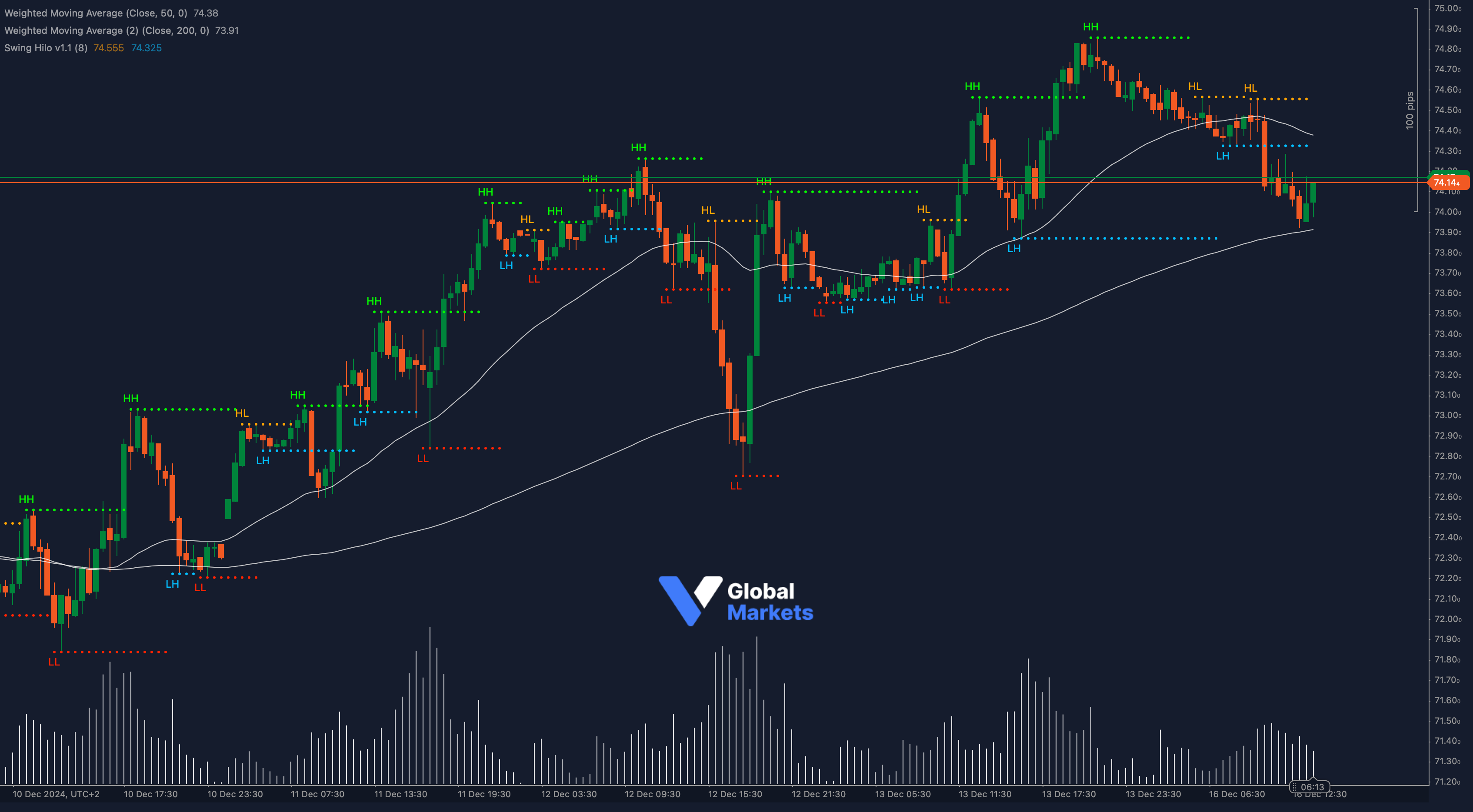

Brent Crude Oil (UKOIL) is trading around the critical support level of $74.14, with a mild rebound following a steep decline from the swing high of $74.90. The 50-period WMA (Weighted Moving Average) at $74.38 and the 200-period WMA at $73.91 are providing dynamic resistance and support, respectively, hinting at a consolidating trend.

Key Technical Insights:

- Fibonacci Retracement:

- The pullback from the recent high of $74.90 to the swing low of $73.50 identifies the 50% retracement at $74.20, currently acting as a short-term resistance. If breached, bulls may test the 61.8% level at $74.45.

- Bollinger Bands:

- Prices are consolidating near the lower band at $74.00, signaling reduced volatility. A breakout above the middle band at $74.20 could confirm bullish momentum, while a failure may lead to another test of the lower band.

- RSI (Relative Strength Index):

- The RSI sits at 48, reflecting neutral sentiment. A push above 50 could support a bullish scenario, while a drop below 45 may confirm weakness.

Volume Analysis:

📊 Volume has been declining, indicating trader hesitation near key support. A surge in volume at $74.14 could determine the next directional move.

Key Indicators Applied:

- Fibonacci Retracement: Resistance at $74.20 and $74.45, support at $73.50.

- Bollinger Bands: Prices near the lower band, signaling reduced volatility.

- RSI: Neutral at 48, awaiting momentum confirmation.

Key Levels to Watch:

- Support: $74.14, $73.50

- Resistance: $74.20, $74.45, $74.90

Outlook:

Brent Crude Oil holds a key level at $74.14. Bulls need to overcome resistance at $74.20 and target the 61.8% Fibonacci retracement near $74.45 to confirm upward momentum. However, failure to sustain above $74.14 may expose oil to further declines toward $73.50. Traders should monitor price action alongside volume and key technical indicators for confirmation.

Fundamental Analysis:

Brent Crude remains sensitive to global supply-demand factors. OPEC+ production decisions, geopolitical tensions in key oil-producing regions, and demand trends from major economies like China and the U.S. will be critical. Additionally, any significant updates on U.S. inventory levels or global growth forecasts could impact sentiment.

#BrentCrude #UKOIL #OilMarket #TechnicalAnalysis #TradingInsights #ctrader