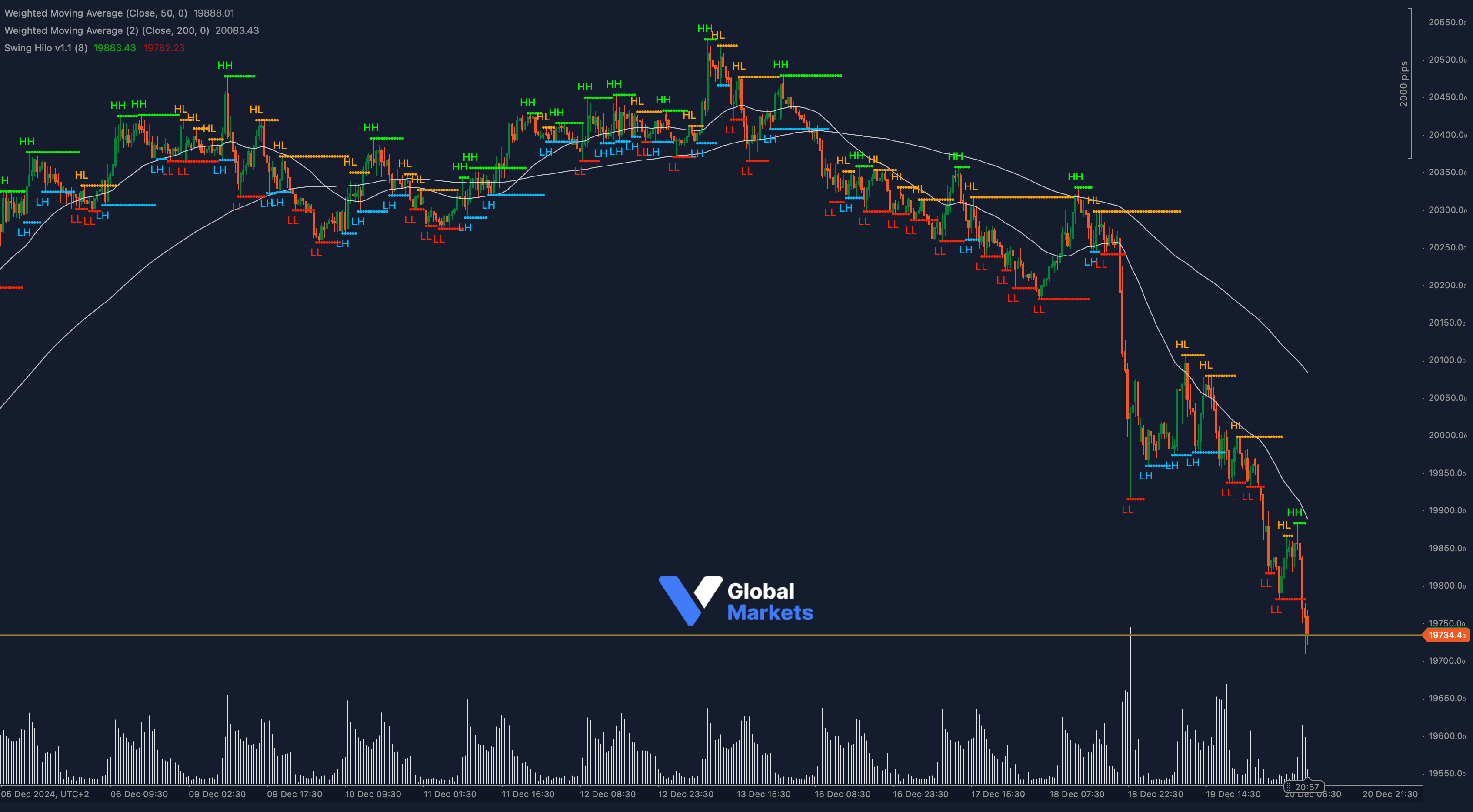

The DAX40 index has plunged sharply, breaking below critical support levels in a move fueled by a combination of bearish momentum and weak market sentiment. The steep decline marks a significant shift, with traders now focusing on whether further downside is imminent or if a recovery attempt will unfold from oversold levels.

📉 The breach below 19,800 is a crucial technical event. This level served as a major pivot in prior consolidations, and its loss opens the door for a continuation toward the next psychological and Fibonacci support at 19,600, which coincides with the 161.8% Fibonacci extension of the recent correction leg.

💡 Fibonacci projections highlight immediate downside targets. The 100% extension at 19,700 aligns with a minor support zone, while the 161.8% level at 19,600 is a key area to monitor for potential relief. If the sell-off deepens, the next projection lies at 19,450, a level that aligns with historical demand zones.

📊 Moving averages emphasize the prevailing bearish trend. The 50 WMA has crossed decisively below the 200 WMA, forming a death cross, which is a long-term bearish signal. Additionally, price action remains firmly below both moving averages, signaling strong selling pressure.

🧲 Momentum indicators such as the RSI reveal deeply oversold conditions, now hovering below 30. While this suggests a potential bounce in the near term, traders should remain cautious of a weak recovery rally that fails to reclaim critical resistance levels around 19,800.

📍 On the volume front, the spike in activity during the latest sell-off confirms strong participation from sellers, further reinforcing the bearish case.

⚠️ Fundamentals and broader sentiment: The sell-off aligns with growing concerns about slowing global economic growth and monetary tightening fears in major economies. Weak macroeconomic data from the Eurozone, coupled with risk-off sentiment, has intensified pressure on equities, making the DAX40 particularly vulnerable.

🌍 With the European Central Bank maintaining a cautious stance and global risk appetite diminishing, the DAX faces headwinds. Any improvement in risk sentiment or dovish commentary could lead to a recovery attempt, but for now, the bias remains bearish.

The DAX40’s break below 19,800 is a critical event, and the index now targets Fibonacci extensions and psychological levels. Traders should remain alert for potential bounces, but the dominant trend is unmistakably bearish.