Technical Analysis:

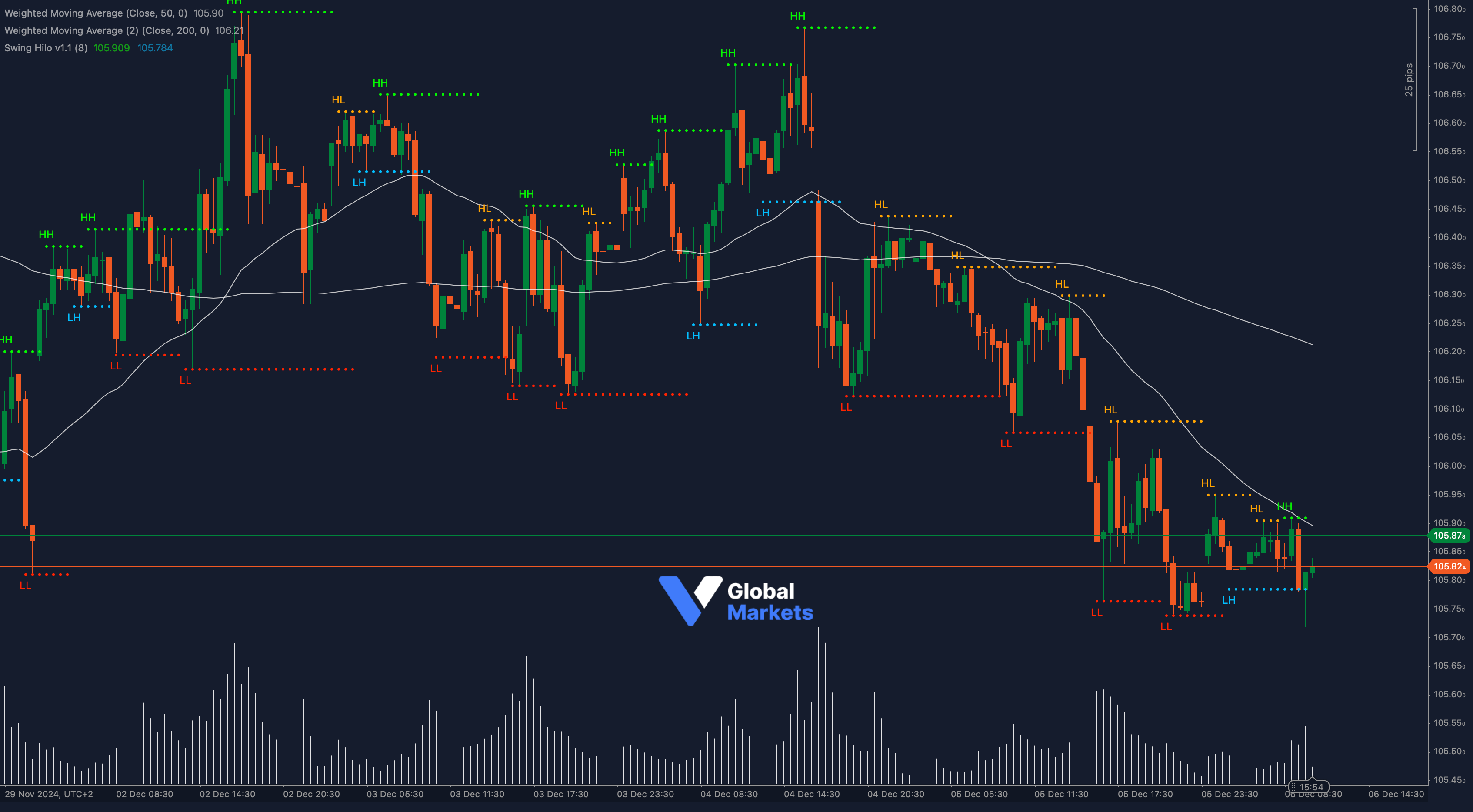

The US Dollar Index (DXY) is navigating a critical juncture as it hovers near the 105.80 support level, marking a significant area for directional cues. Recent price action shows a series of lower highs and lower lows, emphasizing a persistent bearish trend.

The 50-period Weighted Moving Average (WMA) at 105.90 and the 200-period WMA at 106.20 are reinforcing downward momentum, with the price struggling to sustain above these key averages. The Relative Strength Index (RSI) is currently at 38, inching closer to oversold territory, which could attract short-term buying interest.

A Fibonacci retracement analysis of the latest swing high at 106.80 to the swing low at 105.60 reveals resistance at the 106.10 (38.2%) retracement level, making it a key zone to watch for any recovery attempts. The Volume Profile indicates higher activity around the 106.00 zone, underscoring its significance as a potential resistance area.

A break below 105.80 could open the path for further downside toward 105.50, a level last seen in mid-November. Conversely, a move above 106.10 may set the stage for a recovery toward 106.40, aligning with the 61.8% Fibonacci retracement level.

Key Indicators Applied:

- Fibonacci Retracement Levels: Highlight critical resistance areas.

- Relative Strength Index (RSI): Indicates potential oversold conditions.

- Volume Profile: Confirms significant activity around 106.00.

Key Levels to Watch:

- Support: 105.80, 105.50

- Resistance: 106.10, 106.40

Volume and Sentiment:

📊 Volume has surged near the 105.80 support level, signaling increased market activity and interest from both buyers and sellers. However, sustained downward pressure could intensify if this level breaks.

Outlook:

The DXY faces a decisive moment at 105.80, a level that will likely determine its short-term trajectory. While a rebound is possible, bearish momentum remains dominant, with the next few sessions critical for confirming a potential reversal or continuation of the downtrend.

Fundamental Analysis:

The US dollar has shown resilience amid robust economic data and higher treasury yields. However, uncertainties around Federal Reserve policy and global risk sentiment are weighing on the greenback. This mix of factors continues to keep traders cautious as they navigate these key levels.

#DXY #USDIndex #ForexTrading #TechnicalAnalysis #ctrader