Technical Analysis:

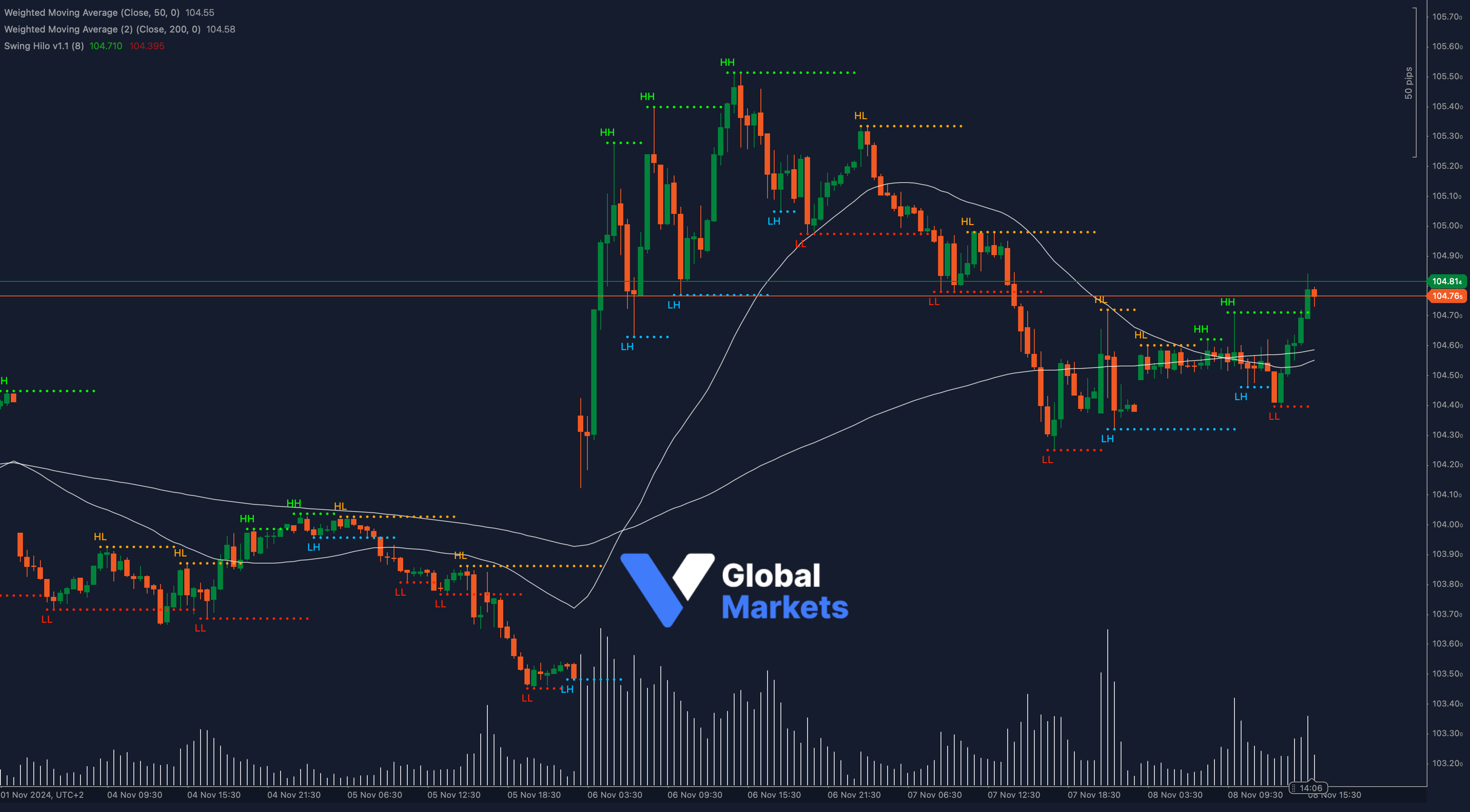

The DXY (US Dollar Index) is currently testing a significant resistance level at 104.81, near both the 50-period WMA (104.55) and the 200-period WMA (104.58). This convergence indicates a critical decision point, as breaking above this level could lead to further bullish momentum, while a rejection may signal a reversal.

A successful breakout above 104.81 could target higher levels around 105.00 and 105.20. On the downside, failure to clear this resistance might bring support around 104.30 and 104.00 into focus.

Support: 🔻 104.30, 104.00

Resistance: 🔺 104.81, 105.20

Moving Averages:

📉 DXY is positioned near the 50-WMA and 200-WMA, creating a strong resistance zone. A decisive move above these averages could shift the momentum in favor of the bulls.

Volume:

📊 Rising volume as the DXY approaches this key resistance level suggests significant market interest. High volume on a breakout could support further upside movement.

Key Levels to Watch:

Support: 104.30, 104.00

Resistance: 104.81, 105.20

Outlook:

🚩 The DXY is at a pivotal level near 104.81. A breakout could open the door for further gains, while failure to do so might indicate a pullback.

Fundamental Analysis:

The DXY remains influenced by Federal Reserve policy expectations and US economic indicators. Market participants are closely monitoring economic data for clues on the Fed’s stance, with recent data supporting the USD’s strength near resistance levels.

#DXY #USDIndex #TechnicalAnalysis #ForexMarket #Trading #VGlobalMarkets #MarketOutlook #ctrader