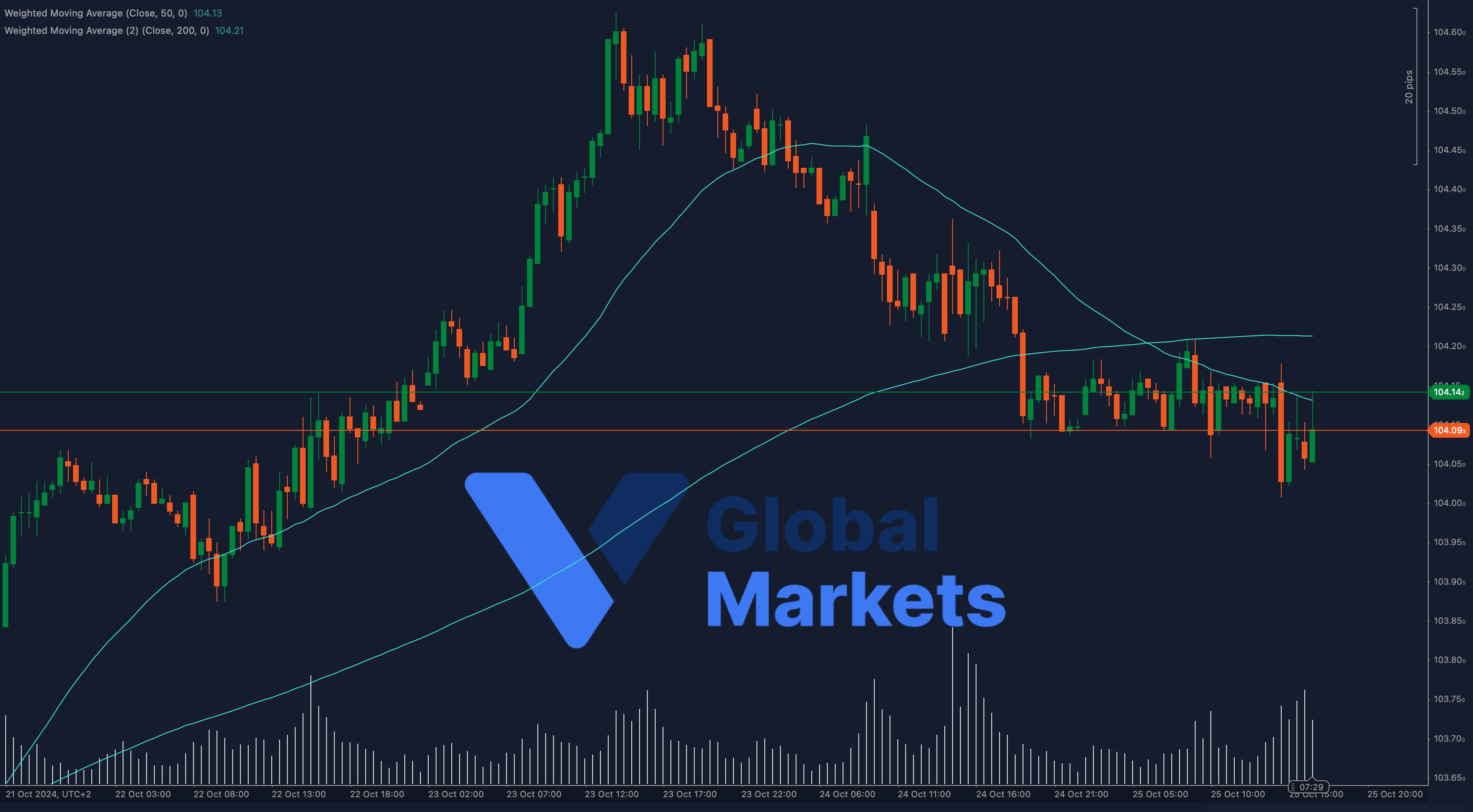

Technical Analysis:

The US Dollar Index (DXY) is trading at 104.099, just below the key 104.13 resistance level, marked by the 50-period Weighted Moving Average (WMA). The 200-period WMA sits just above at 104.21, making this a critical zone for directional cues. A clear break above these moving averages could trigger a bullish continuation toward the next resistance at 104.50.

On the downside, failure to break above these averages could see the price revisiting the 104.00 psychological support and potentially dropping toward 103.80 if bearish pressure intensifies.

- Support: Immediate support lies at 104.00, followed by 103.80.

- Resistance: Key resistance levels to watch are at 104.13 (50-WMA) and 104.21 (200-WMA).

Moving Averages:

The DXY is currently sandwiched between the 50-WMA and 200-WMA, with both levels acting as dynamic resistance. A sustained breakout above 104.21 could indicate bullish momentum, while a failure to clear these levels suggests consolidation or downside risks.

Volume:

The volume has been relatively low, which could indicate indecision among market participants. A volume spike accompanying a breakout above the moving averages could confirm the next directional move.

Key Levels to Watch:

- Support: 104.00, 103.80

- Resistance: 104.13 (50-period WMA), 104.21 (200-period WMA)

Outlook:

The DXY remains at a critical technical juncture, with key moving averages providing resistance. A breakout above 104.21 could see the dollar strengthening further, while rejection at these levels could lead to another test of the 104.00 support area.

Fundamental Analysis:

The US Dollar remains under pressure from inflation concerns and the Federal Reserve’s monetary policy outlook. Any signs of tightening or easing in future rate hikes will likely impact the dollar’s trajectory. Geopolitical factors and global risk sentiment are also driving safe-haven demand for the greenback.

#DXY #USD #TechnicalAnalysis #ForexTrading #DollarIndex #VGlobalMarkets #Trading #ForexSignals #USDIndex