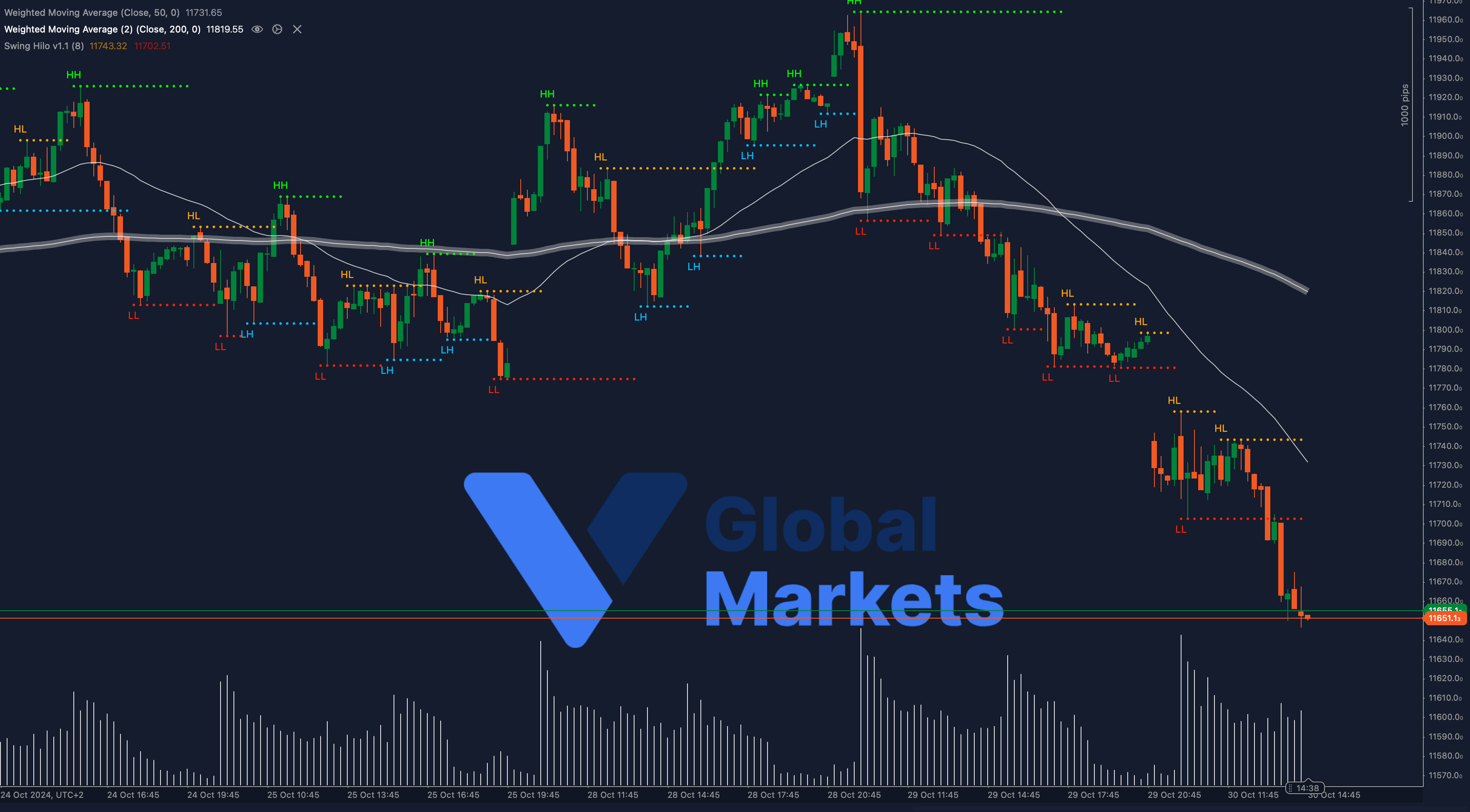

Technical Analysis: 📉 The ESP 35 is currently trading around 11,651, teetering on a key support level at 11,650. The index is under strong bearish pressure, with the 50-period WMA at 11,731.65 and the 200-period WMA at 11,819.55 providing significant overhead resistance. Recent price movements suggest that sellers are dominating, with the index firmly below both moving averages, pointing towards further downside risk.

Should the index break below 11,650, it could pave the way for a decline towards the next support level at 11,600. On the upside, a recovery above 11,732 would be needed to alter the bearish outlook and invite potential buyers back into the market.

Support: 🔻 11,650, 11,600

Resistance: 🔺 11,731.65 (50-WMA), 11,819.55 (200-WMA)

Moving Averages: 📊 The ESP 35 remains below both its 50-period and 200-period WMAs, confirming ongoing downward momentum. A sustained break above these levels would be required to reverse the bearish trend.

Volume: 🔍 Volume has surged as the index approached the 11,650 support, indicating increased selling activity. A further rise in volume on a break below this level could confirm the potential for additional losses.

Key Levels to Watch:

Support: 11,650, 11,600

Resistance: 11,731.65 (50-WMA), 11,819.55 (200-WMA)

Outlook: ⚠️ The ESP 35 is at a critical juncture, with bearish momentum intact as long as it remains below the 11,732 resistance. A break below 11,650 could reinforce the downward trend, while a recovery above 11,731.65 might signal the start of a reversal. Caution is warranted as the index navigates these pivotal levels.

Fundamental Analysis: 🌍 The Spanish market is facing headwinds due to broader European economic concerns and uncertainty in global markets. Inflationary pressures and concerns over economic slowdown continue to weigh on investor sentiment, adding to the bearish outlook for the ESP 35.

#ESP35 #SpanishStockMarket #TechnicalAnalysis #BearishTrend #VGlobalMarkets #EconomicOutlook #ForexTrading #MarketAnalysis #Spain #Indices