Technical Analysis:

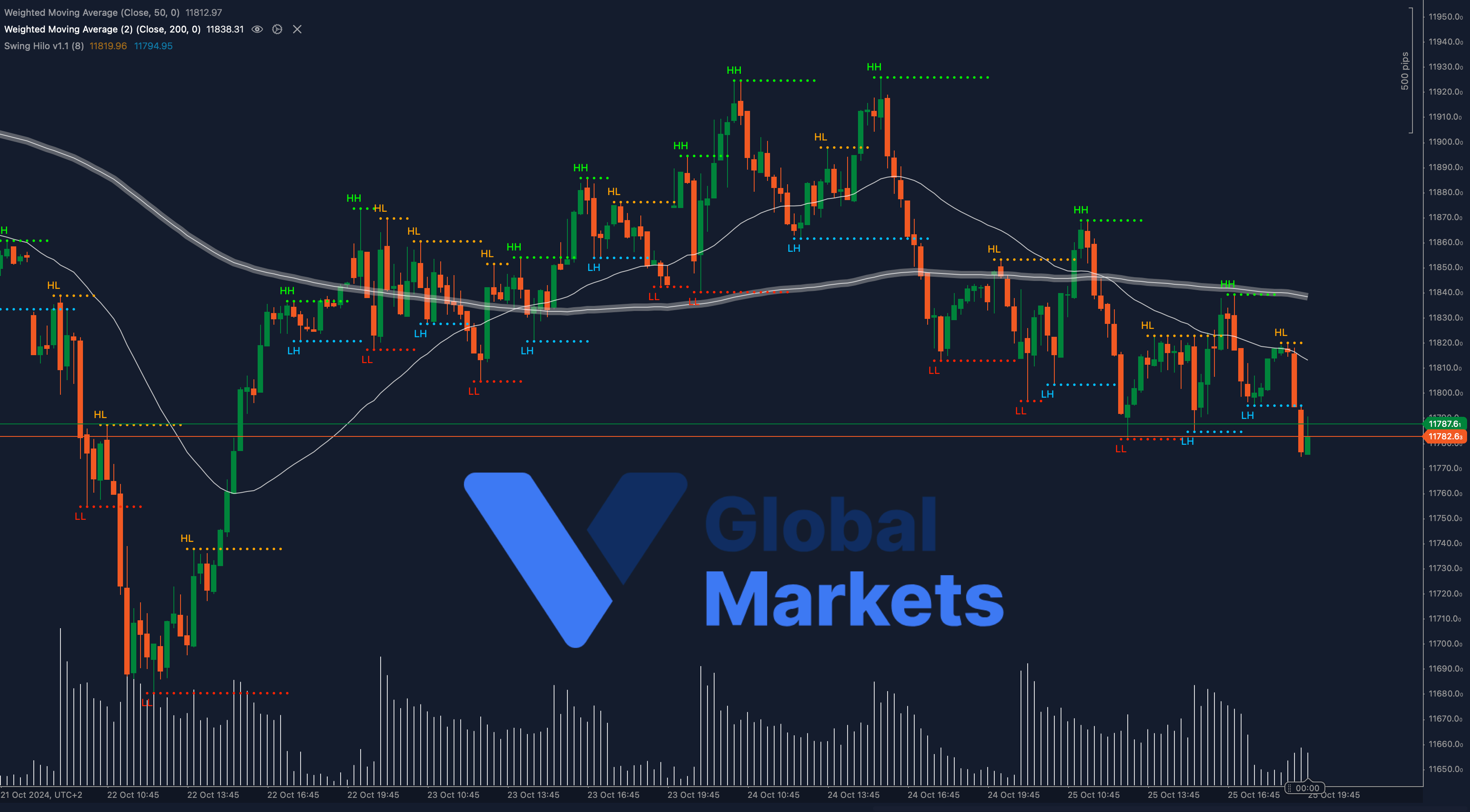

The ESP 35 Index is currently trading around 11,728.6, facing pressure near the critical support level of 11,728. The 50-period Weighted Moving Average (WMA) is positioned at 11,812.97, while the 200-period WMA stands at 11,838.31, creating significant resistance zones. Recent price action suggests bearish momentum as the index remains below both moving averages, pointing to further downside potential.

A sustained break below 11,728 could pave the way toward the next support at 11,700, while a rebound might push the index to retest the resistance at 11,838.31. If the index manages to hold above 11,812.97, it could indicate a potential short-term recovery.

Support: 11,728, 11,700

Resistance: 11,812.97 (50-WMA), 11,838.31 (200-WMA)

Moving Averages:

The ESP 35 remains below both the 50-period and 200-period WMAs, indicating sustained downward pressure. A close above the 50-WMA could trigger renewed buying interest, but failure to do so may see further declines.

Volume:

Recent volume remains moderate, suggesting caution among market participants. A volume surge with a move above 11,812.97 could confirm a bullish breakout, while increased volume on a drop below 11,728 may confirm further bearish sentiment.

Key Levels to Watch:

Support: 11,728, 11,700

Resistance: 11,812.97 (50-WMA), 11,838.31 (200-WMA)

Outlook:

The ESP 35 Index is at a critical juncture, where further bearish continuation seems likely if the current support levels fail to hold. However, should the index manage to hold above the 11,728 level, there may be room for a short-term bounce towards the 11,812.97 and potentially 11,838.31. Traders should remain vigilant for any breakout above the 50-WMA, which could spark a recovery phase. Market sentiment remains sensitive to economic indicators and external factors, suggesting that swift movements in either direction are possible.

Fundamental Analysis:

The ESP 35 Index faces pressure from ongoing concerns over Eurozone economic performance and global uncertainties. Key upcoming economic reports from the Eurozone, including inflation data and ECB policy outlook, will be critical for shaping market direction. Geopolitical tensions and shifts in global risk sentiment also continue to weigh on investor decisions.

#ESP35 #StockMarket #TechnicalAnalysis #VGlobalMarkets #TradingStrategy #BearishOutlook #Eurozone #MarketAnalysis #FinancialMarkets #SpainStockMarket