Technical Analysis:

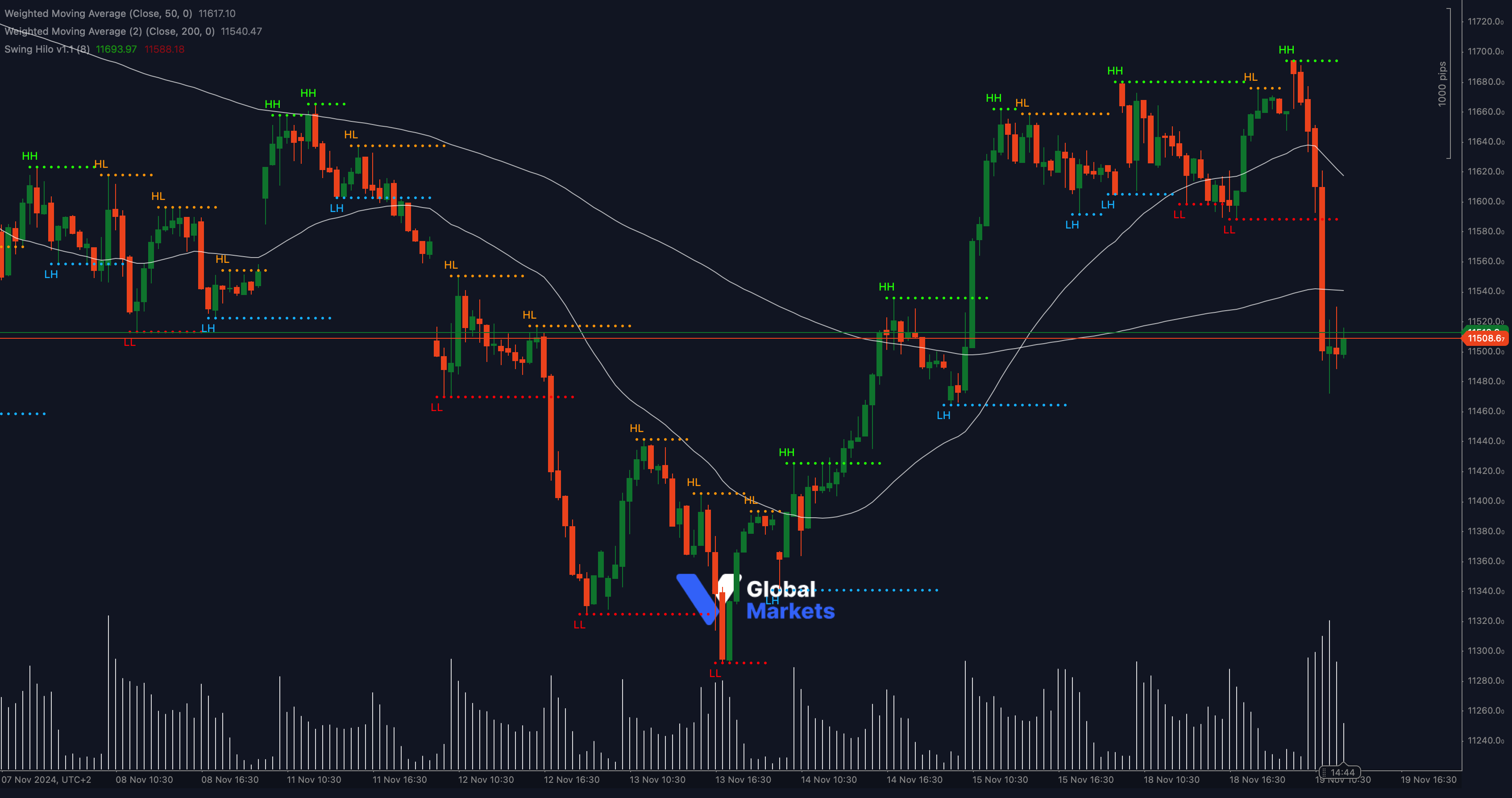

The ESP35 (Spain 35 Index) is currently testing a significant support level at 11,508, following a sharp decline from its recent high near 11,690. This level coincides with a key price cluster that has previously served as both support and resistance. The Fibonacci retracement levels suggest 11,508 aligns closely with the 61.8% retracement of the recent bullish move from 11,360 to 11,690, adding weight to its significance.

The Relative Strength Index (RSI) has dropped to 40, indicating growing bearish momentum but not yet signaling oversold conditions. Meanwhile, the Stochastic Oscillator shows the index nearing oversold territory, which could hint at a potential bounce. Volume has surged during the recent sell-off, underscoring heightened market activity.

If the index stabilizes at this level, it could attempt to recover towards 11,580 and potentially retest resistance at 11,640. However, a sustained break below 11,508 may open the door for deeper declines towards 11,450 and 11,360, the latter being a critical swing low.

Key Levels to Watch:

- Support: 11,508, 11,450

- Resistance: 11,580, 11,640

Volume and Sentiment:

📊 Recent volume spikes highlight growing bearish sentiment. A drop below 11,508 with continued high volume could solidify a bearish outlook, while reduced volume on a rebound would signal waning selling pressure.

Outlook:

The ESP35 is at a critical juncture near 11,508. Traders are eyeing this level as a key decision point that could either reaffirm the broader uptrend or mark the start of a deeper correction.

Fundamental Analysis:

The ESP35 reflects ongoing uncertainty in European equities, as markets grapple with mixed economic data and the impact of fluctuating energy prices. Investor focus is on upcoming Eurozone economic releases and central bank commentary, which could drive near-term volatility.

#ESP35 #Spain35 #TechnicalAnalysis #ForexMarket #TradingStrategy #ctrader #StockIndices #MarketOutlook