Technical Analysis:

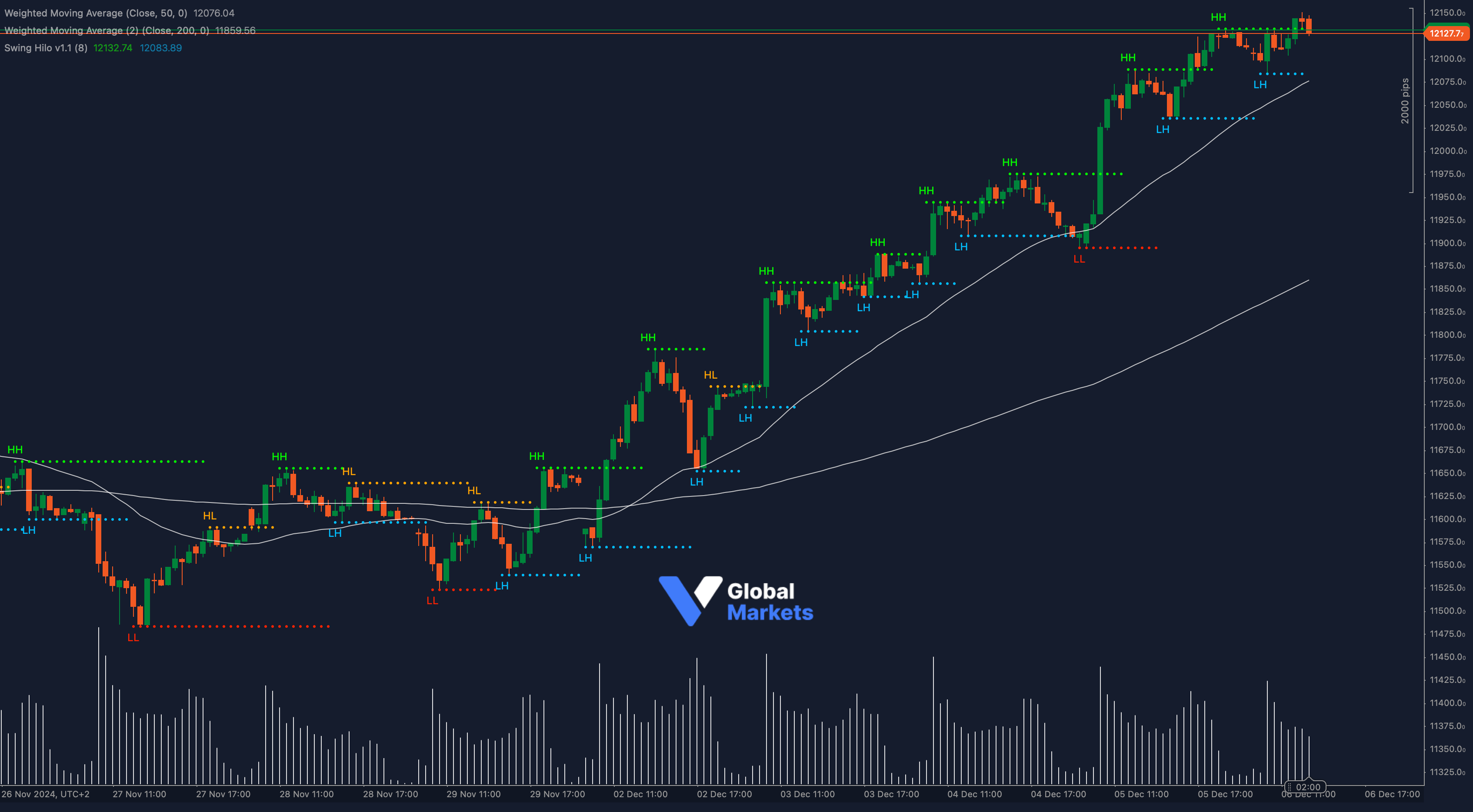

The IBEX 35 (ESP35) index has shown a consistent upward momentum over the last few sessions, now challenging the 12,127 resistance level, a price point not seen in recent months. This level aligns with the previous swing high, making it a key inflection point for the index.

The Weighted Moving Averages (50 and 200-period) at 12,076 and 11,859 are exhibiting a bullish crossover, further reinforcing the upward trend. The consistent formation of higher highs (HH) and higher lows (HL) underscores the strength of the bullish sentiment.

Applying a Fibonacci extension from the recent low of 11,706 to the swing high at 12,127, the 161.8% extension level resides near 12,300, suggesting that a breakout above 12,127 could fuel additional gains toward this target. The Volume Profile highlights increased trading activity around 11,900–12,000, marking it as a solid support area for potential pullbacks.

Additionally, the Relative Strength Index (RSI) stands at 68, signaling the index is nearing overbought conditions. Traders should watch for potential exhaustion or a minor pullback before further upward moves.

Key Indicators Applied:

- Fibonacci Extension: Identifies potential breakout targets.

- Volume Profile: Confirms strong support below the current price.

- RSI Analysis: Indicates potential overbought levels.

Key Levels to Watch:

- Support: 12,000, 11,900

- Resistance: 12,127, 12,300

Volume and Sentiment:

📊 Volume has shown a steady increase as the price approached 12,127, suggesting strong participation in this uptrend. However, a lack of follow-through above this resistance may attract short-term profit-taking.

Outlook:

The ESP35 is poised for a potential breakout above 12,127, with bullish momentum favoring further upside toward 12,300. However, traders should monitor signs of exhaustion or rejection at this critical resistance. A sustained move above 12,127 could confirm the bullish trend, while a break below 12,000 may signal a corrective phase.

Fundamental Analysis:

The IBEX 35’s rally reflects optimism around European equities, bolstered by easing inflationary pressures and resilient economic data from Spain. However, global risk factors, including monetary policy uncertainty and geopolitical tensions, could influence the broader market sentiment.

#IBEX35 #ESP35 #StockMarket #TechnicalAnalysis #ctrader