Technical Analysis:

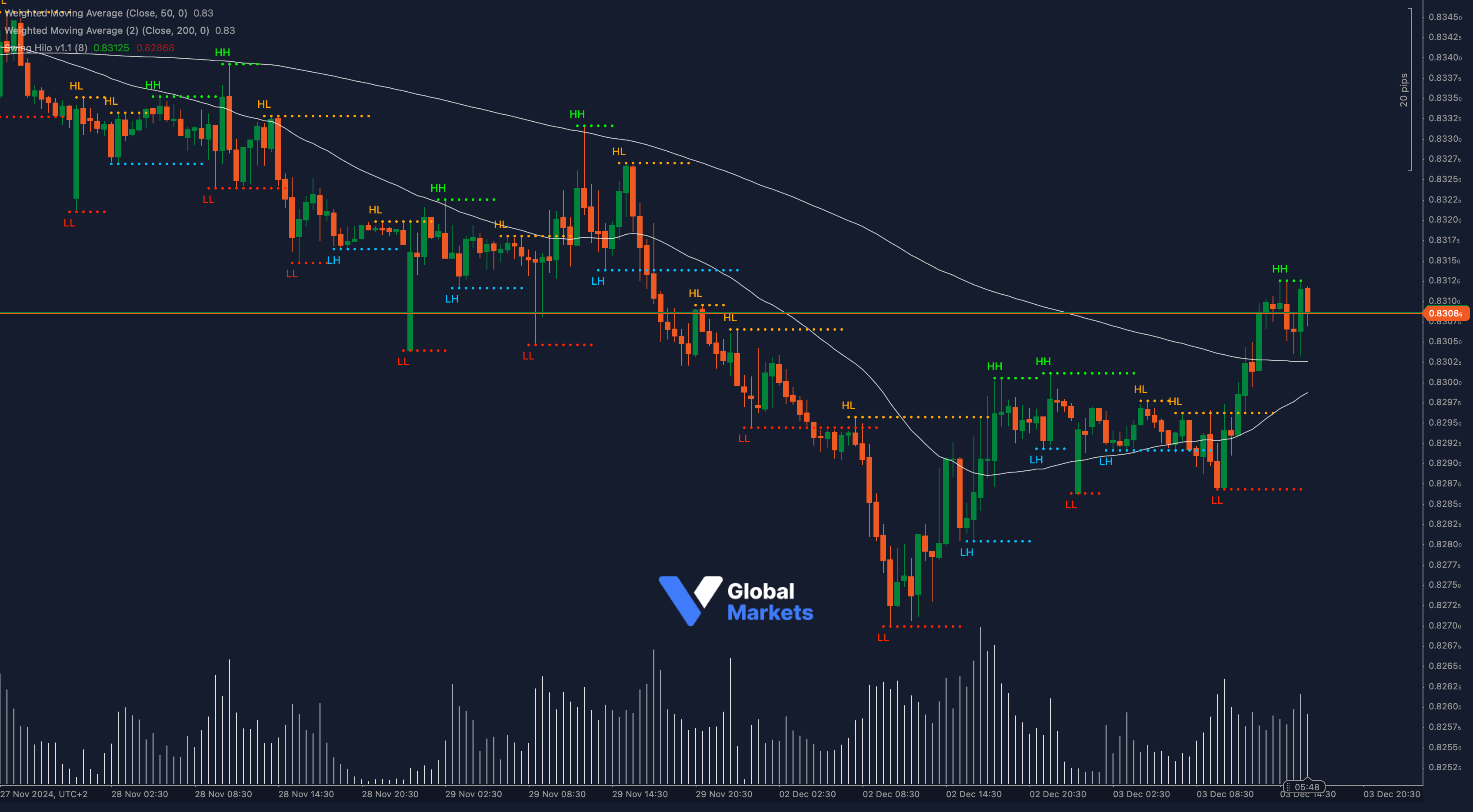

EUR/GBP is currently testing resistance near 0.8310, recovering strongly from its recent lows around 0.8270. The pair has climbed above the 50-period Weighted Moving Average (WMA) at 0.8302, signaling bullish momentum in the short term. The 200-period WMA, positioned at 0.8286, further reinforces this bullish stance as it provides a reliable support floor.

Using the Fibonacci Retracement drawn from the recent swing high at 0.8330 to the low at 0.8270, the price has retraced to the 78.6% level, indicating a potential reversal zone near the current price. Additionally, the Relative Strength Index (RSI) is hovering near the 70 level, suggesting overbought conditions, which could prompt a short-term correction.

The ADX (Average Directional Index) indicates strengthening trend momentum, supporting a potential continuation towards the next resistance at 0.8330 if the pair breaches the 0.8310 barrier. Conversely, a rejection at this level could see EUR/GBP revisiting the 0.8300 support zone or even lower, at 0.8280.

Key Technical Tools Applied:

- Fibonacci Retracement: Highlights the 78.6% retracement zone as a critical level.

- RSI: Overbought signals indicate possible consolidation or correction.

- ADX: Reinforces trend strength, favoring bullish continuation.

- Moving Averages: Align to support bullish momentum.

Key Levels to Watch:

- Support: 0.8300, 0.8280, 0.8270

- Resistance: 0.8310, 0.8330, 0.8350

Volume and Sentiment:

📊 Volume has surged as the price approached the 0.8310 resistance, suggesting heightened interest. A break above this level on increased volume could confirm the bullish bias.

Outlook:

EUR/GBP appears poised for further upside if it breaks the 0.8310 resistance. However, overbought conditions on the RSI call for caution, as a pullback could be on the horizon. The broader sentiment remains cautiously bullish, with targets set at 0.8330 and beyond.

Fundamental Analysis:

EUR/GBP’s recovery has been supported by a stronger euro, buoyed by recent robust economic data from the eurozone. Meanwhile, ongoing uncertainty around the UK’s economic outlook continues to weigh on the pound. Markets are now keenly awaiting this week’s central bank updates for further cues.

#EURGBP #ForexAnalysis #TechnicalTrading #MarketUpdate #ctrader #ForexMarket