Technical Analysis:

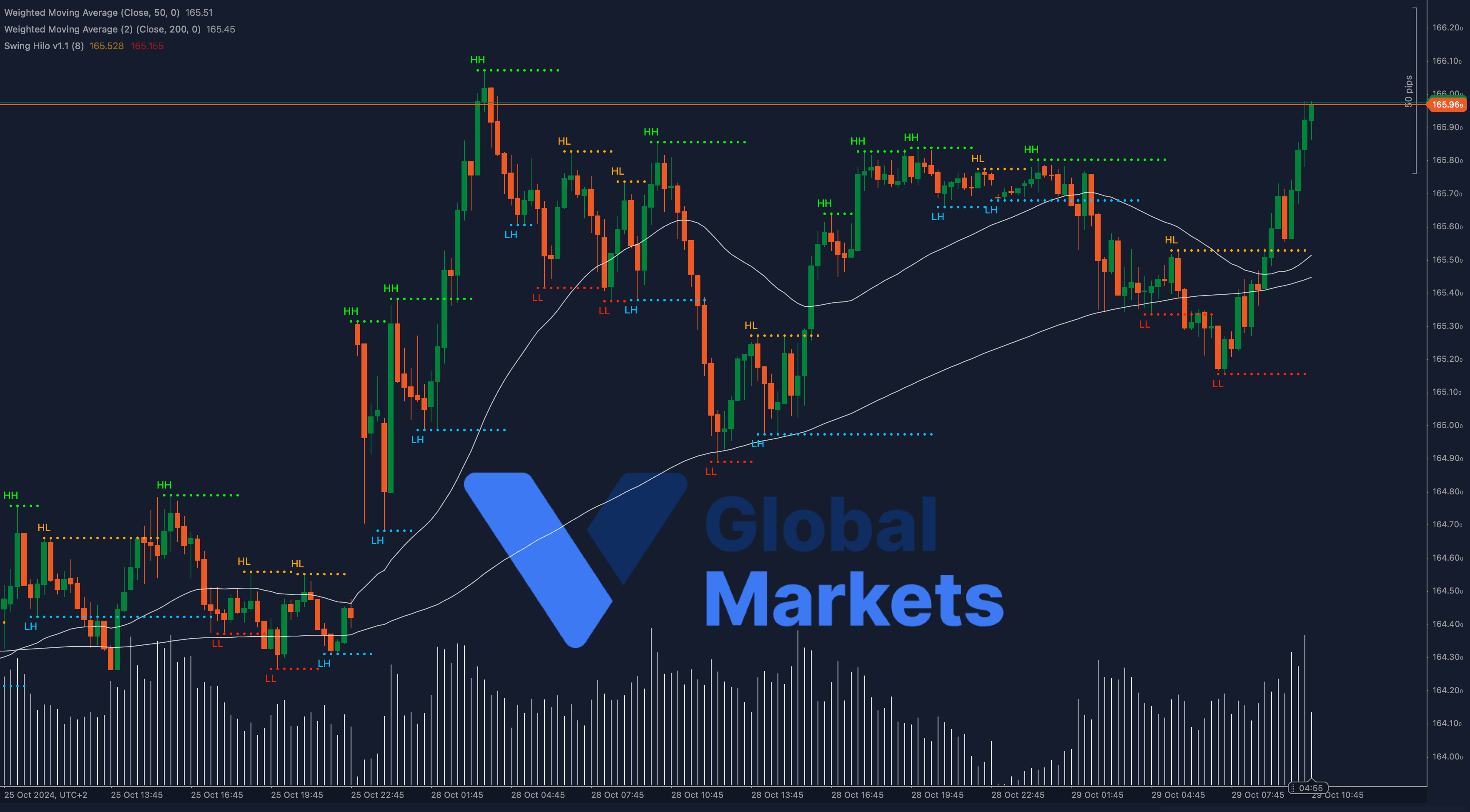

EUR/JPY is currently trading at 165.96, testing the significant resistance level near 166.00. The 50-period Weighted Moving Average (WMA) is positioned at 165.51, with the 200-period WMA close by at 165.45, providing robust support. The pair has shown upward momentum, breaking above the moving averages, which signals a potential continuation of the bullish trend.

If the price can sustain above 166.00, it could pave the way for further gains towards 166.50. Conversely, a pullback might test the support levels around the 50 and 200 WMAs, with further downside limited by support near 165.00.

Support: 165.51 (50-WMA), 165.45 (200-WMA)

Resistance: 166.00, 166.50

Moving Averages:

The EUR/JPY pair is trading above both the 50 and 200 WMAs, suggesting bullish momentum. A confirmed close above the 166.00 resistance may solidify this upward trend, while a failure to hold above this level could indicate a potential reversal.

Volume:

Volume has seen an uptick as the pair approached the resistance zone, indicating strong buyer interest. A continued volume increase could support a bullish breakout above 166.00, while diminishing volume might signal caution among traders.

Key Levels to Watch:

Support: 165.51 (50-WMA), 165.45 (200-WMA)

Resistance: 166.00, 166.50

Outlook:

EUR/JPY appears poised for a bullish breakout, with critical support from the 50 and 200 WMAs. A sustained move above 166.00 could lead to further gains, though caution is advised if the pair fails to maintain this level, as it may result in a pullback towards the support areas.

Fundamental Analysis:

The Euro remains supported by economic resilience in the Eurozone, while the Japanese Yen faces pressure from dovish monetary policy in Japan. The divergence in economic outlook and central bank policies continues to favor EUR/JPY strength, though global risk sentiment may play a crucial role in near-term movements.

#EURJPY #Forex #TechnicalAnalysis #Trading #ForexSignals #VGlobalMarkets #Euro #JapaneseYen #MarketTrends #FinancialMarkets