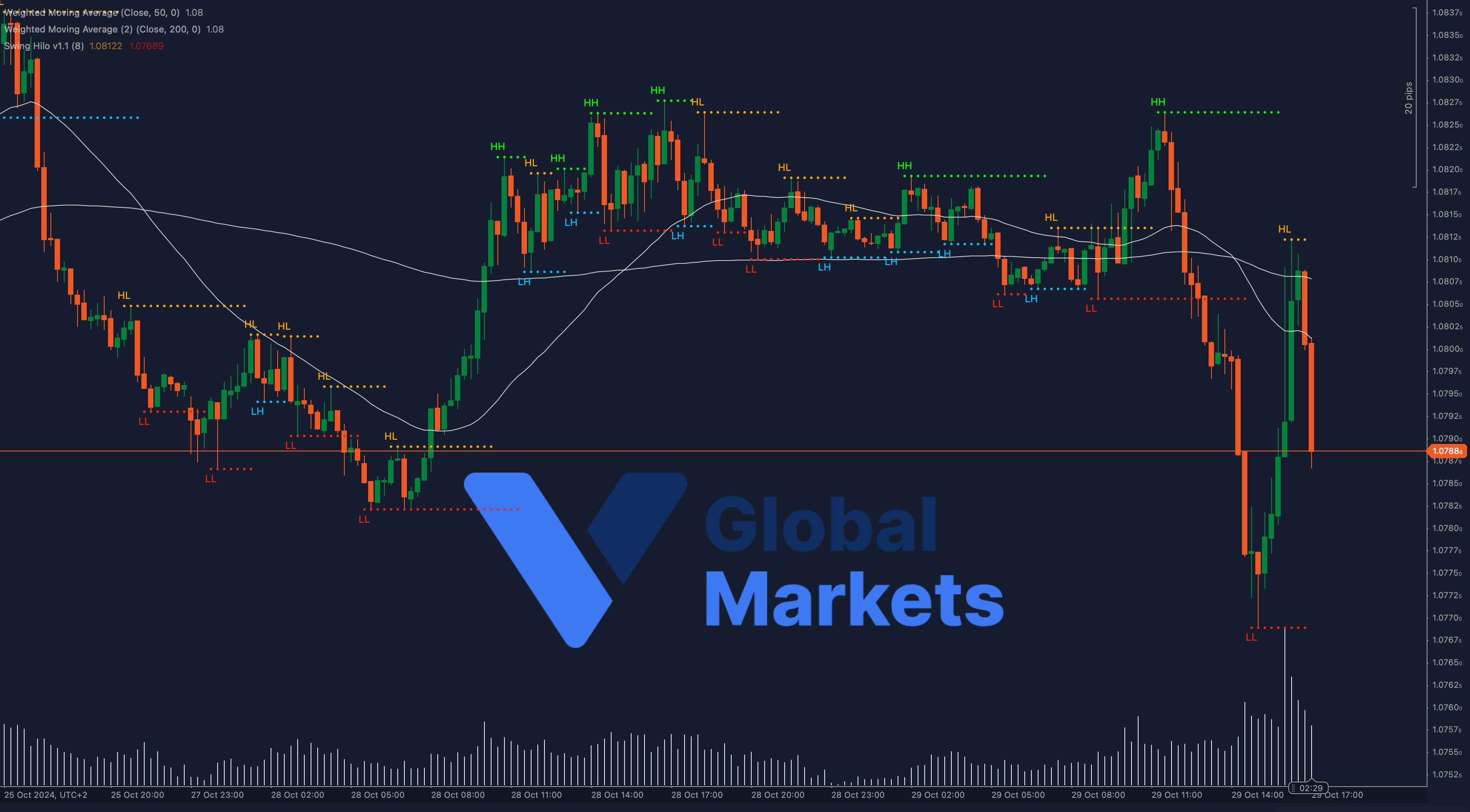

Technical Analysis:

EUR/USD is trading around 1.0788, experiencing pressure below the significant level of 1.0800. The 50-period Weighted Moving Average (WMA) is positioned at 1.0812, while the 200-period WMA is slightly lower at 1.0789, forming key resistance levels. Recent price action suggests bearish momentum as the pair trades below the 50-WMA, potentially paving the way for further downside if the 1.0780 support level fails.

Should EUR/USD maintain levels below 1.0780, a move towards 1.0750 is likely. Conversely, a break above 1.0812 could trigger a recovery towards the 1.0830 resistance area.

Support: 1.0780, 1.0750

Resistance: 1.0812 (50-WMA), 1.0830

Moving Averages:

The EUR/USD pair is currently positioned between the 50-WMA and 200-WMA, showing a bearish inclination. A close below the 200-WMA might solidify downward pressure, while a recovery above the 50-WMA could bring in bullish momentum.

Volume:

Recent volume shows a spike during the latest sell-off, indicating strong bearish sentiment. If volume remains high with a drop below 1.0780, it could confirm additional downside pressure. Lower volume during an upward move may signal caution among buyers.

Key Levels to Watch:

Support: 1.0780, 1.0750

Resistance: 1.0812 (50-WMA), 1.0830

Outlook:

EUR/USD is at a critical juncture, testing the support at 1.0780. A sustained move below this level could extend the bearish trend, targeting 1.0750 next. However, a recovery above 1.0812 might revive bullish sentiment in the short term.

Fundamental Analysis:

EUR/USD’s recent decline is influenced by concerns over Eurozone economic growth and a stronger US Dollar amid Fed rate hike expectations. Key upcoming data from the Eurozone, including inflation figures, will be pivotal for the pair’s direction. Geopolitical factors and global risk sentiment are also impacting the Euro, adding pressure to the downside.

#EURUSD #Forex #TechnicalAnalysis #ForexTrading #VGlobalMarkets #EUR #USD #BearishTrend #Eurozone #FederalReserve