Technical Analysis:

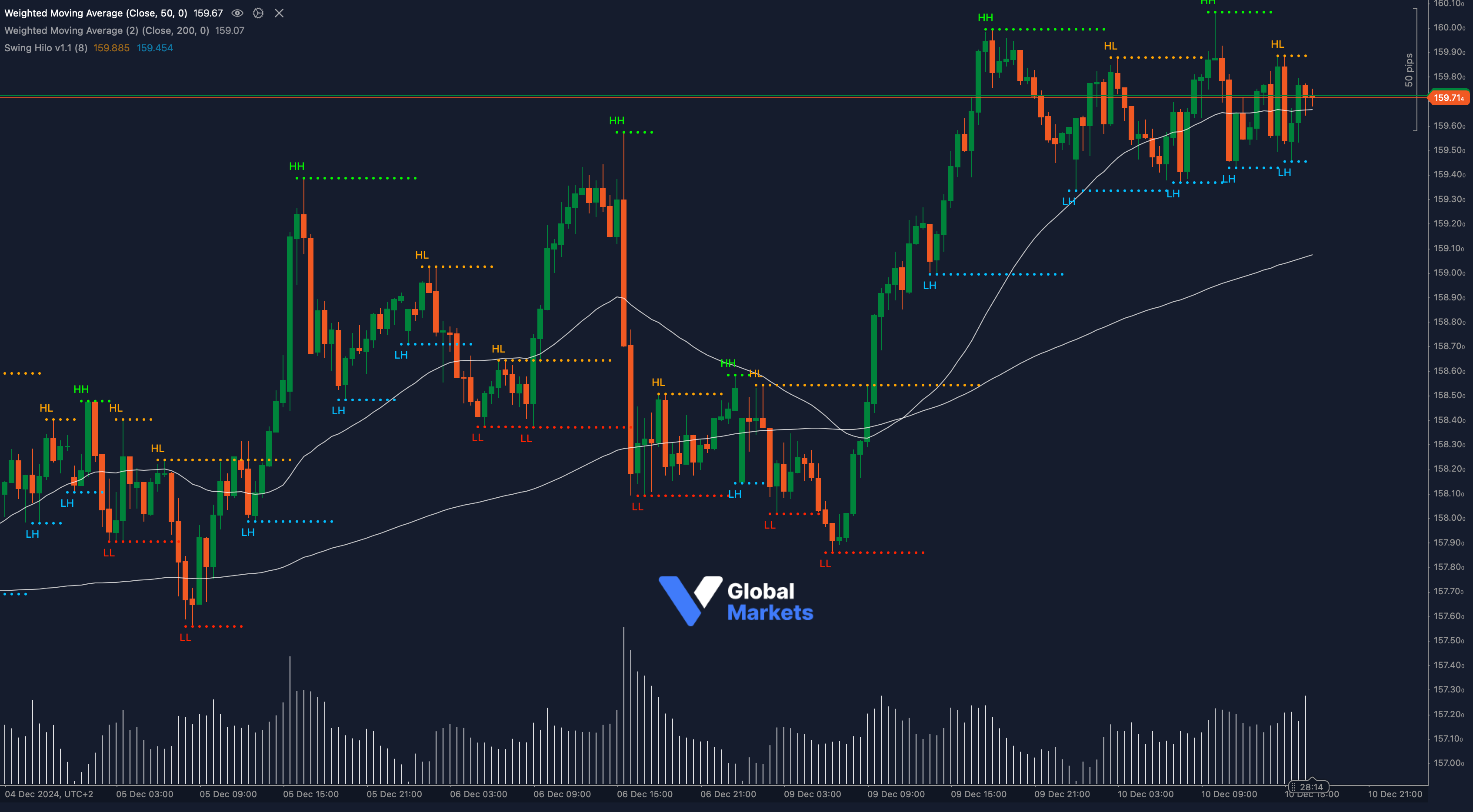

The EURJPY pair is currently consolidating near 159.70, hovering at a critical support level after recent bullish momentum faced resistance at 159.85. The 50-period Weighted Moving Average (WMA) at 159.67 aligns closely with this support, suggesting a short-term pivot point for traders, while the 200-period WMA at 159.07 provides additional structural backing below.

Swing High and Low analysis reflects a mixed trend, with higher highs (HH) and higher lows (HL) signaling bullish tendencies, but recent rejections near the highs suggest the potential for sideways movement in the near term.

Using the Fibonacci retracement tool, drawn from the swing low of 158.60 to the swing high of 159.85, the 38.2% retracement level at 159.50 is emerging as a secondary support, adding weight to the lower boundary of the current range.

The Relative Strength Index (RSI) at 52 indicates a neutral stance, highlighting the possibility of further consolidation unless external catalysts drive volatility. The Volume Profile underscores concentrated trading activity between 159.50–159.85, suggesting that this range is a critical zone for market participants.

Key Indicators Applied:

- Fibonacci Retracement: Highlights immediate support at 159.50 and resistance at 159.85.

- Volume Profile: Shows significant market interest within the current trading range.

- RSI Analysis: Signals indecision, with no extreme conditions observed.

Key Levels to Watch:

- Support: 159.70, 159.50

- Resistance: 159.85, 160.00

Volume and Sentiment:

📊 Market volume has declined as EURJPY consolidates, hinting at reduced conviction among traders. A surge in volume near support or resistance could signal the next directional move.

Outlook:

The EURJPY pair appears poised for a breakout from the consolidation range. A sustained move above 159.85 could pave the way toward 160.00, while a breakdown below 159.50 may expose the pair to a deeper correction toward the 159.00 zone. Traders should monitor key technical levels closely for actionable signals.

Fundamental Analysis:

The euro remains sensitive to central bank rhetoric and macroeconomic data releases. This week’s focus is on upcoming inflation figures and monetary policy announcements that could impact euro crosses. Meanwhile, the yen’s performance continues to hinge on risk sentiment and movements in global bond yields, with a dovish Bank of Japan potentially keeping yen gains capped.

#EURJPY #ForexTrading #MarketOutlook #TechnicalAnalysis #ctrader