Technical Analysis:

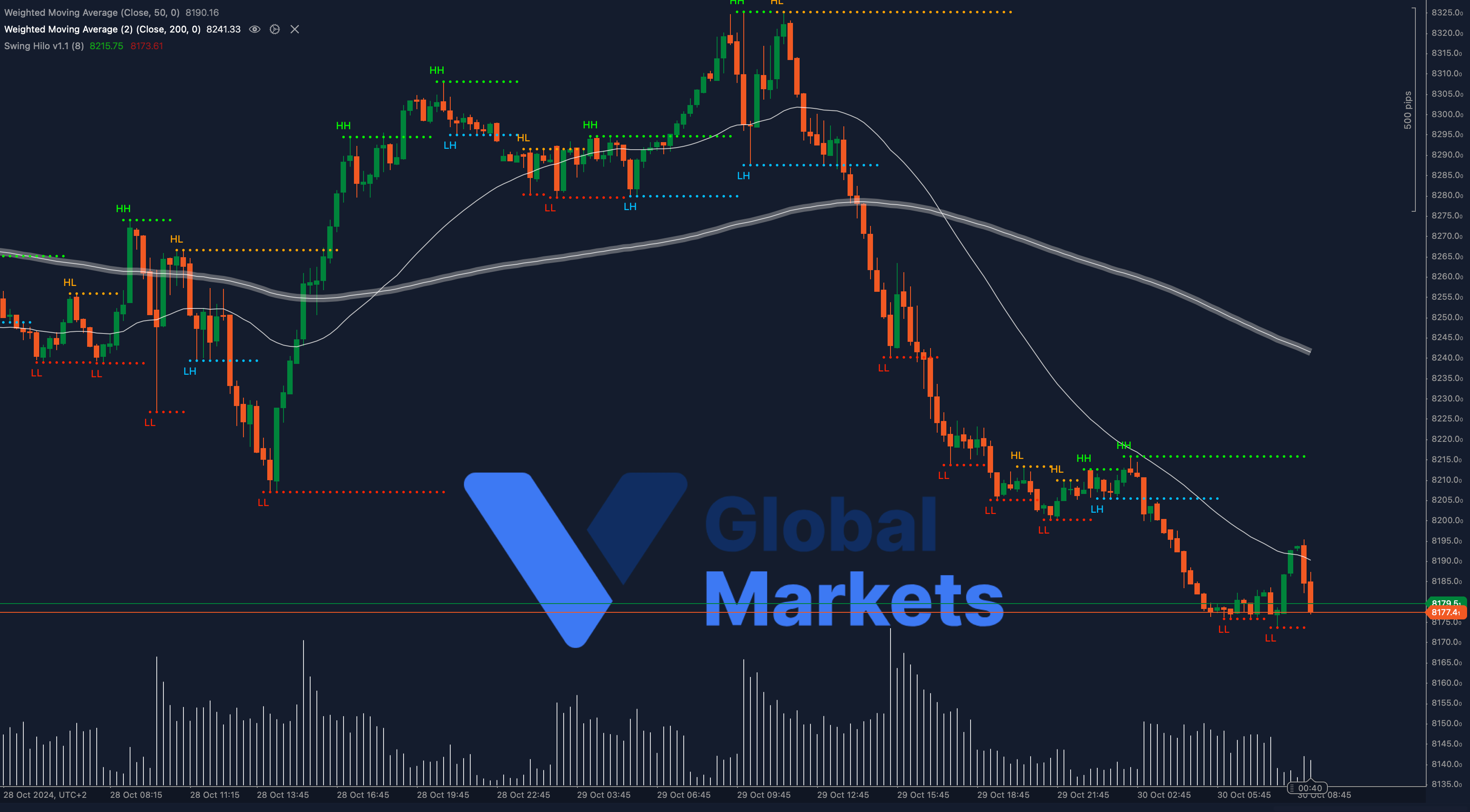

The FTSE 100 is trading around 8174.5, positioned just above a crucial support level at 8175. The index faces downward momentum with both the 50-period and 200-period Weighted Moving Averages (WMAs) acting as overhead resistance, located at 8190.16 and 8241.33, respectively. The continued bearish trend below these levels hints at potential further declines, especially if the index breaches 8175.

A sustained break below 8175 could open the path toward the next support at 8130, while any upward movement may find resistance around 8190 and 8241. The current setup suggests bearish dominance, with sellers testing the market’s resolve at critical levels.

Support: 8175, 8130

Resistance: 8190.16 (50-WMA), 8241.33 (200-WMA)

Moving Averages:

The FTSE 100 remains below its 50-period and 200-period WMAs, indicating continued downward pressure. A move above these moving averages could provide relief for bulls, though the bearish trend remains intact as long as the price stays under these resistance points.

Volume:

Trading volume has increased as the index neared the 8175 support level, suggesting active selling pressure. A further increase in volume on a break below 8175 would likely confirm additional downside.

Key Levels to Watch:

Support: 8175, 8130

Resistance: 8190.16 (50-WMA), 8241.33 (200-WMA)

Outlook:

With the FTSE 100 holding below key resistance levels, the bearish outlook remains. A break below 8175 would likely invite further downside, while a close above 8190 could signal potential bullish momentum. Caution is advised as the index tests critical levels, and a directional breakout could set the stage for the next major move.

Fundamental Analysis:

The FTSE 100 continues to be impacted by global economic uncertainty and concerns over UK economic growth. Market participants are closely watching central bank policies and macroeconomic data, with recent inflation concerns adding pressure on equity markets. A strong US Dollar and geopolitical tensions have also contributed to bearish sentiment, keeping the index under selling pressure.

#FTSE100 #StockMarket #TechnicalAnalysis #BearishTrend #UKEconomy #FTSEIndex #FinancialMarkets #VGlobalMarkets #TradingStrategy #Forex