Technical Analysis:

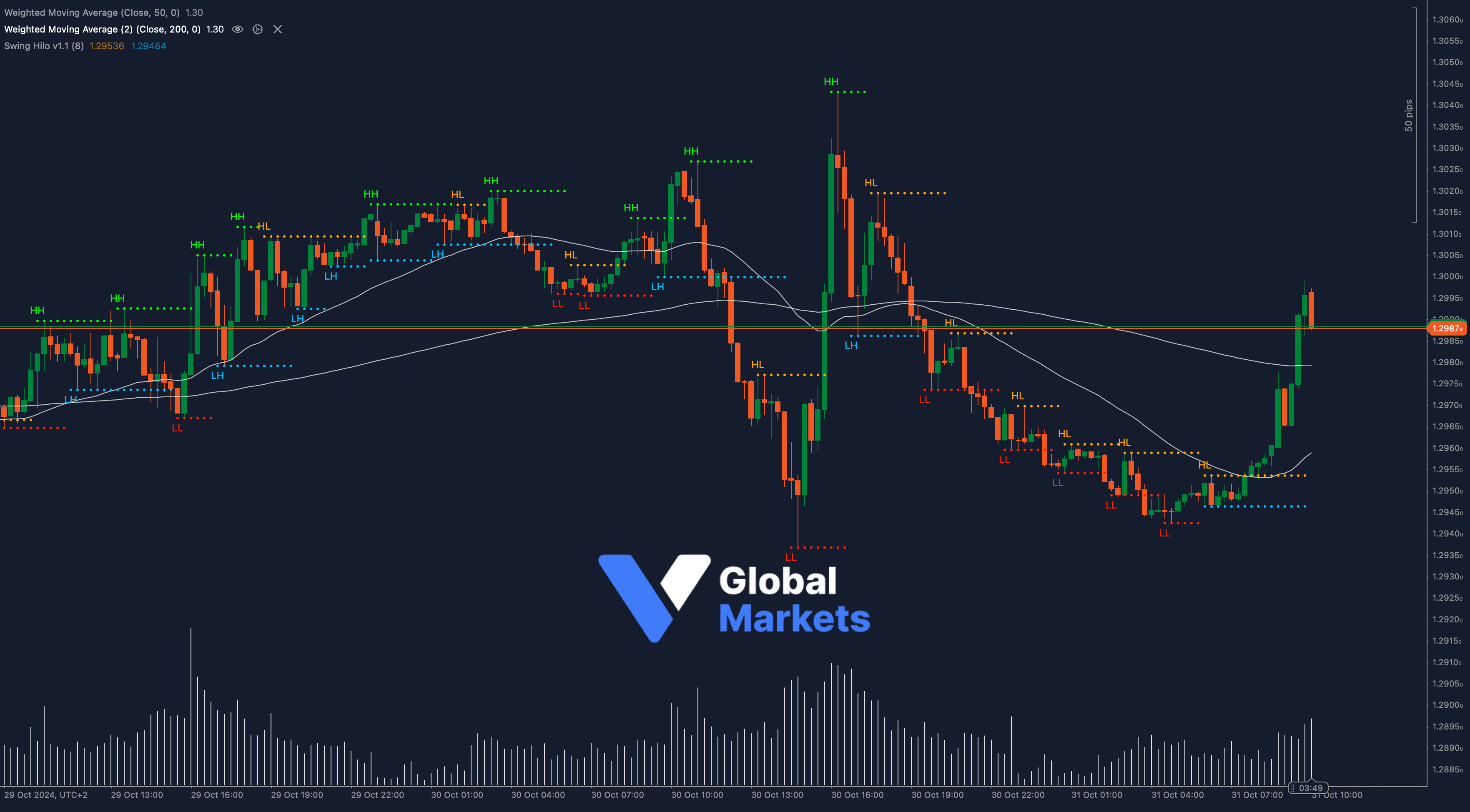

The GBP/USD pair is currently trading around 1.2980, approaching a significant resistance level near 1.3000. After a recent rally, the pair has managed to breach the 50-period and 200-period Weighted Moving Averages (WMAs), which are positioned at 1.29536 and 1.29464, respectively. This upward movement signals a potential shift in momentum, with bulls attempting to reclaim higher ground. However, further upside might be capped at the 1.3000 psychological resistance unless strong buying interest persists.

If GBP/USD breaks above 1.3000, it could open the door to further gains toward the next resistance at 1.3050. Conversely, a rejection here might lead to a pullback toward the WMAs, reinforcing the support around 1.2950.

Support: 🔻 1.2950, 1.2900

Resistance: 🔺 1.3000, 1.3050

Moving Averages:

📉 GBP/USD has moved above both the 50-WMA and 200-WMA, indicating a possible bullish reversal. A close above the 1.3000 resistance could strengthen the upside momentum, but failure to maintain this level might see bears regaining control.

Volume:

📊 Recent volume spikes indicate increased interest as GBP/USD nears the 1.3000 resistance, reflecting strong buying pressure. An increase in volume on a breakout could support further upside.

Key Levels to Watch:

Support: 1.2950, 1.2900

Resistance: 1.3000, 1.3050

Outlook:

🚩 GBP/USD is at a pivotal point, with the 1.3000 level serving as a key resistance. A confirmed breakout above this level may extend the bullish trend, while a failure could lead to a retracement towards the WMAs. Traders should watch for a decisive move as the pair approaches this critical resistance.

Fundamental Analysis:

The GBP/USD pair remains sensitive to developments in the UK’s economic landscape and U.S. Federal Reserve policy. While recent UK data has shown resilience, the USD’s strength from hawkish Fed expectations may limit GBP’s upside. Additionally, global market sentiment and geopolitical factors continue to impact the pair’s direction.

#GBPUSD #ForexTrading #TechnicalAnalysis #PoundSterling #USD #TradingStrategy #VGlobalMarkets #ForexMarket #cTrader