Technical Analysis:

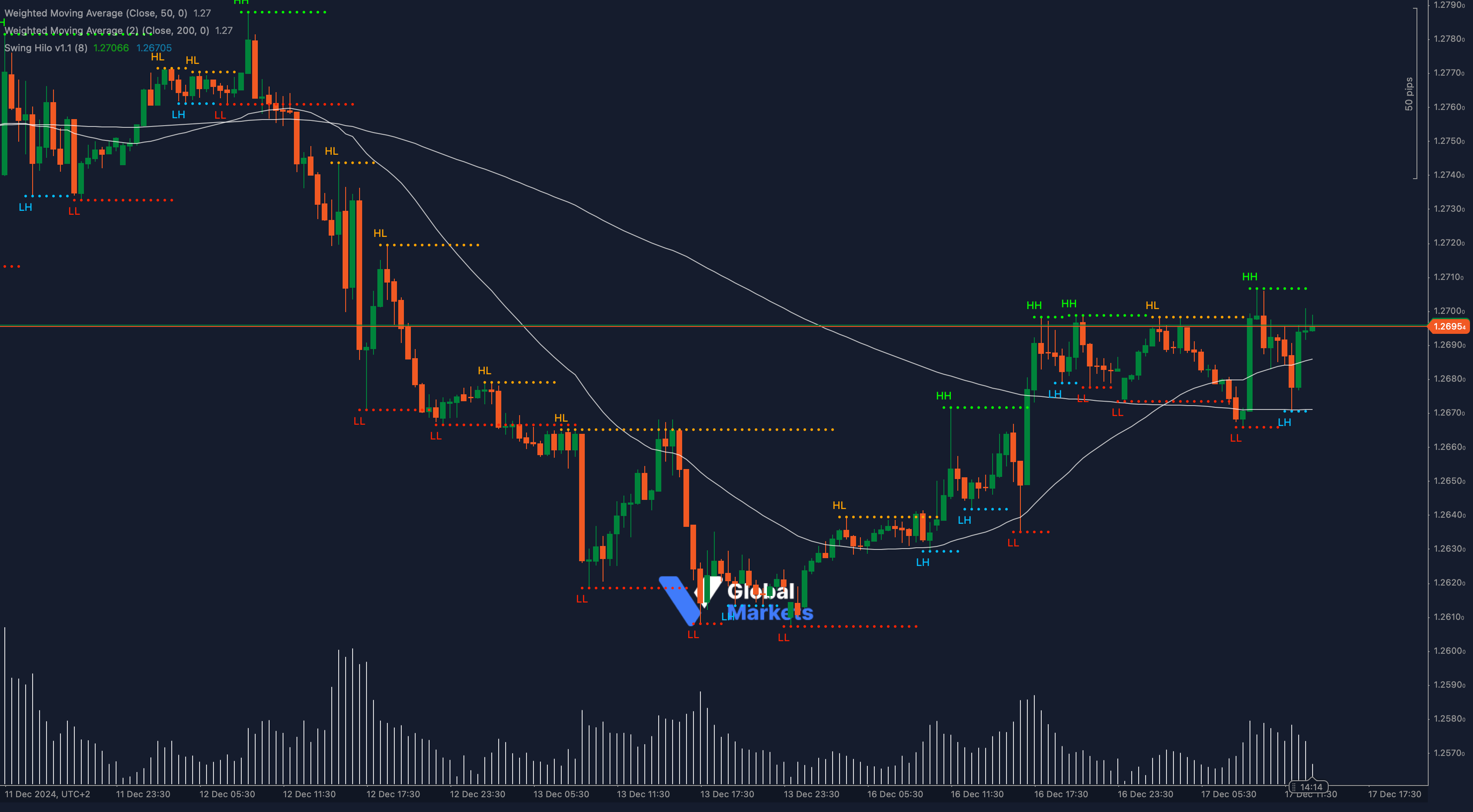

GBPUSD is testing a critical resistance level at $1.2695 as buyers look to push the pair higher. After bouncing from the recent low of $1.2625, the pair is now hovering just above the 50-period Weighted Moving Average (WMA) at $1.2680, while the 200-period WMA at $1.2706 stands as a significant overhead hurdle.

Analyzing Fibonacci retracement levels, the recovery from the swing low at $1.2625 to the high near $1.2707 reveals the 61.8% level at $1.2665, which has already acted as a short-term support during this session. A successful move above $1.2695 could open the door for a fresh push toward the $1.2740 zone.

👉 Fibonacci Retracement: Key support at $1.2665, resistance at $1.2695 and $1.2740

👉 Bollinger Bands: Price near the upper band, indicating upward momentum

👉 RSI: Positive at 54, suggesting mild bullish momentum

The Bollinger Bands are starting to expand, signaling increasing volatility. The price action is flirting with the upper band near $1.2695, suggesting potential continuation if bullish momentum remains intact. The Relative Strength Index (RSI) is currently at 54, showing a slight bullish tilt but leaving room for further upside.

📊 Rising volume during the recent rebound indicates increasing participation from buyers, which could reinforce the bullish case if sustained.

Key Levels to Watch:

🟢 Support: $1.2665, $1.2625

🟠 Resistance: $1.2695, $1.2740

Volume and Sentiment:

The rising volume during the rebound suggests growing confidence among bulls. However, traders must remain cautious near $1.2706, as failure to break above could trigger a near-term pullback.

Outlook:

GBPUSD faces a pivotal moment. If bulls successfully break above $1.2695, the next leg higher could target $1.2740, followed by $1.2775. Conversely, rejection at this level could bring the pair back toward $1.2665 support.

Fundamental Analysis:

The British pound remains supported by improving economic sentiment, coupled with softer-than-expected U.S. economic data, which is pressuring the dollar. Market participants are closely monitoring any new signals regarding the U.S. Federal Reserve’s rate path and key UK economic reports, including inflation and GDP data.