Technical Analysis:

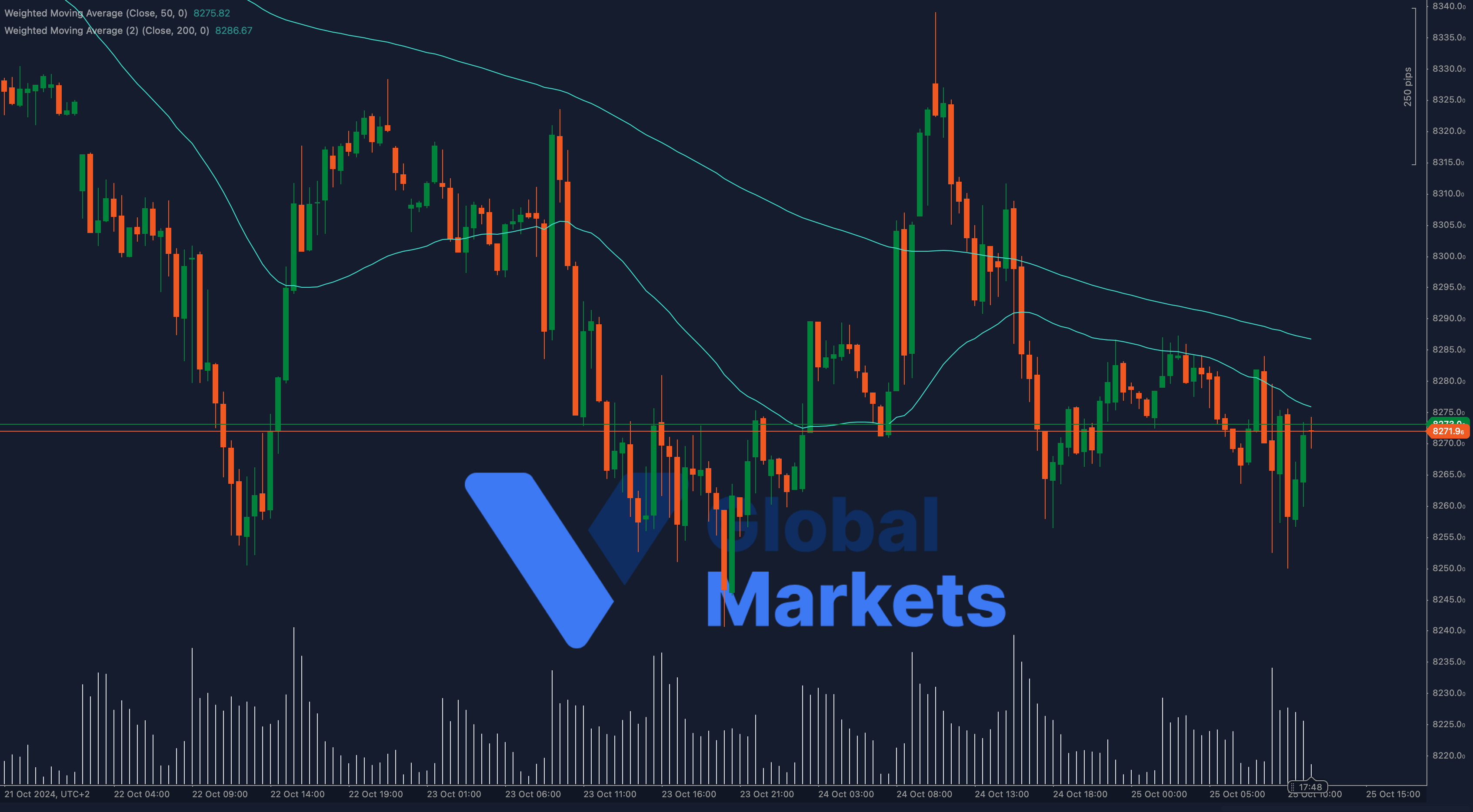

UK100 is currently trading at 8271.9, struggling to break above the 50-period Weighted Moving Average (WMA) at 8275.82. The price remains under pressure as it hovers below the 200-period WMA at 8286.67, indicating a bearish bias in the short term.

A failure to break above the 50-period WMA could lead to further downside movement, with support at 8250. Conversely, a breakout above the 8286.67 resistance (200-WMA) could signal a bullish reversal, targeting the 8300 level and beyond.

- Support: Immediate support lies at 8250, followed by 8230.

- Resistance: The key resistance is at 8286.67, with the next upside target at 8300.

Moving Averages:

The price is currently sandwiched between the 50-period and 200-period WMAs, both acting as pivotal points. A break above these levels would indicate a potential reversal in sentiment, while a failure to clear them could extend the bearish trend.

Volume:

Volume has been consistent, though no significant spikes have been observed. Traders should watch for a volume increase in conjunction with a breakout to confirm any potential directional movement.

Key Levels to Watch:

- Support: 8250 (immediate support), 8230 (next key support)

- Resistance: 8286.67 (200-period WMA), 8300 (next upside target)

Outlook:

UK100 is currently consolidating between key moving averages, with the 50-period WMA acting as resistance. A decisive break above the 8286.67 resistance level (200-WMA) could lead to a bullish move, while failure to break above it may result in further downside. Traders should closely monitor price action and volume around these levels to gauge the next move.

Fundamental Analysis:

The UK stock market is heavily influenced by global economic conditions, Brexit-related developments, and corporate earnings. UK100 is also sensitive to the broader sentiment in European markets and central bank decisions, which could affect the index in the coming sessions.

#FTSE100 #UK100 #TechnicalAnalysis #StockIndex #Trading #VGlobalMarkets #ForexSignals #EquityMarkets