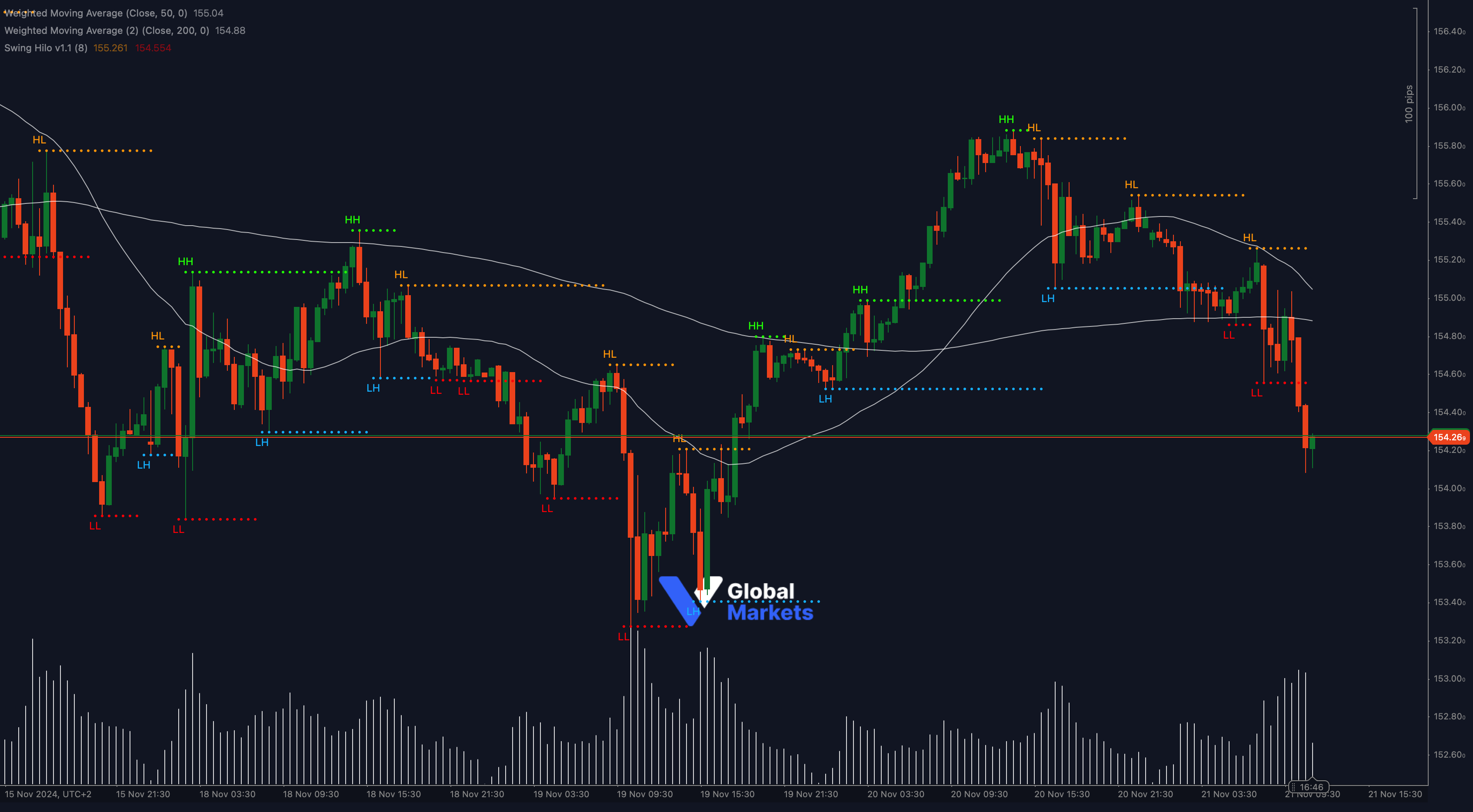

Technical Analysis:

The USD/JPY pair has slipped below a critical support level at 154.26, which aligns with the 61.8% Fibonacci retracement of the recent bullish run from 152.80 to 156.20. This drop suggests growing bearish momentum as sellers take charge.

The Relative Strength Index (RSI) has dipped to 38, signaling bearish conditions but not yet entering oversold territory, leaving room for further downside. The Stochastic Oscillator, however, shows an oversold reading, hinting that a near-term bounce might be on the cards.

Additionally, the price has crossed below the 50-period moving average (155.04) and the 200-period moving average (154.88), reinforcing the bearish outlook. If the bearish momentum persists, the next targets could be 153.80 and 153.20, previous swing lows. On the upside, any recovery may face resistance at 154.50 and 155.00.

Key Levels to Watch:

- Support: 153.80, 153.20

- Resistance: 154.50, 155.00

Volume and Sentiment:

📊 Volume surged during the breakdown below 154.26, confirming strong selling interest. Traders should watch for continued high volume to validate bearish sentiment.

Outlook:

The current structure favors the bears, but oversold indicators like the Stochastic suggest caution for aggressive short positions. A recovery toward resistance levels could provide a better entry for sellers.

Fundamental Analysis:

The USD/JPY is under pressure amid shifting global risk sentiment and renewed concerns over Bank of Japan policy adjustments. Meanwhile, the dollar remains steady, supported by hawkish Fed signals, though risk aversion could intensify market volatility. Upcoming US economic data will be critical in shaping near-term direction.

#USDJPY #ForexAnalysis #TechnicalAnalysis #ForexMarket #TradingStrategy #ctrader #CurrencyPairs #MarketInsights