Technical Analysis:

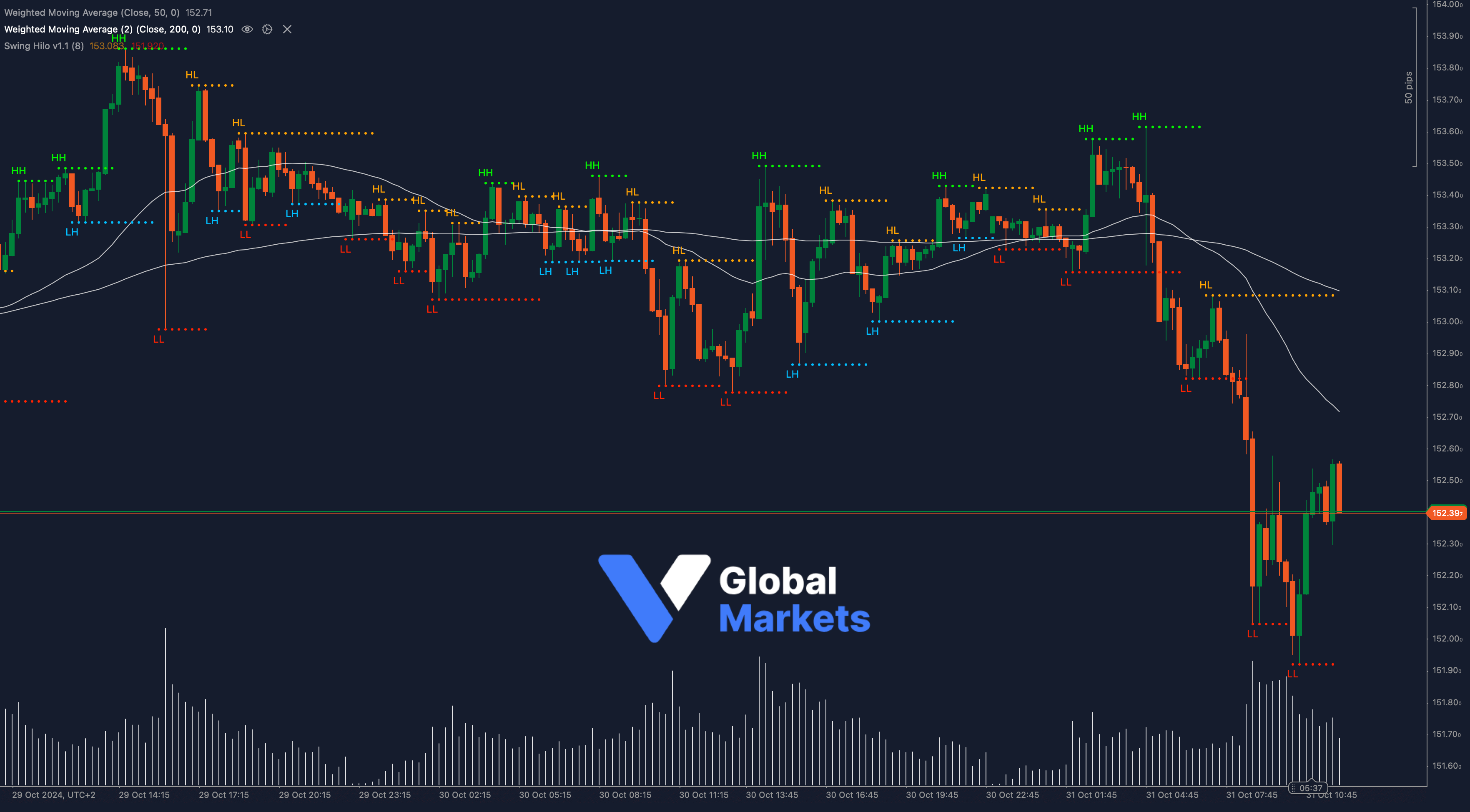

The USD/JPY pair is currently trading around 152.30, hovering just above a crucial support level. Recent price action shows a strong downward momentum, with the pair falling below both the 50-period and 200-period Weighted Moving Averages (WMAs), positioned at 152.71 and 153.10, respectively. This setup indicates a bearish outlook unless the pair manages to reclaim these averages.

A sustained break below 152.30 could expose USD/JPY to further downside, potentially targeting the next support at 151.80. However, a recovery may find immediate resistance at the 153.00 level, where the WMAs converge.

Support: 🔻 152.30, 151.80

Resistance: 🔺 152.71 (50-WMA), 153.10 (200-WMA)

Moving Averages:

📉 USD/JPY is trading below both the 50-WMA and 200-WMA, reinforcing a bearish bias. A close above these moving averages could signal a potential recovery, but for now, the sellers remain in control.

Volume:

📊 Recent trading volume has surged as USD/JPY approaches the 152.30 support, reflecting increased selling pressure. A further increase in volume on a break below this support could confirm the bearish continuation.

Key Levels to Watch:

Support: 152.30, 151.80

Resistance: 152.71 (50-WMA), 153.10 (200-WMA)

Outlook:

🚩 USD/JPY faces considerable bearish pressure near the 152.30 support level. A breakdown here could lead to additional losses, while a hold above might offer a chance for stabilization. Market participants should monitor these levels for a clear directional move.

Fundamental Analysis:

The USD/JPY pair remains impacted by diverging monetary policies between the U.S. and Japan. With ongoing speculation about the Federal Reserve’s stance and the Bank of Japan’s potential for intervention, USD/JPY may see heightened volatility. Additionally, risk sentiment and U.S. Treasury yields play a critical role in influencing this pair’s movements.

#USDJPY #ForexTrading #TechnicalAnalysis #USDollar #JapaneseYen #TradingStrategy #VGlobalMarkets #ForexMarket #cTrader