Technical Analysis:

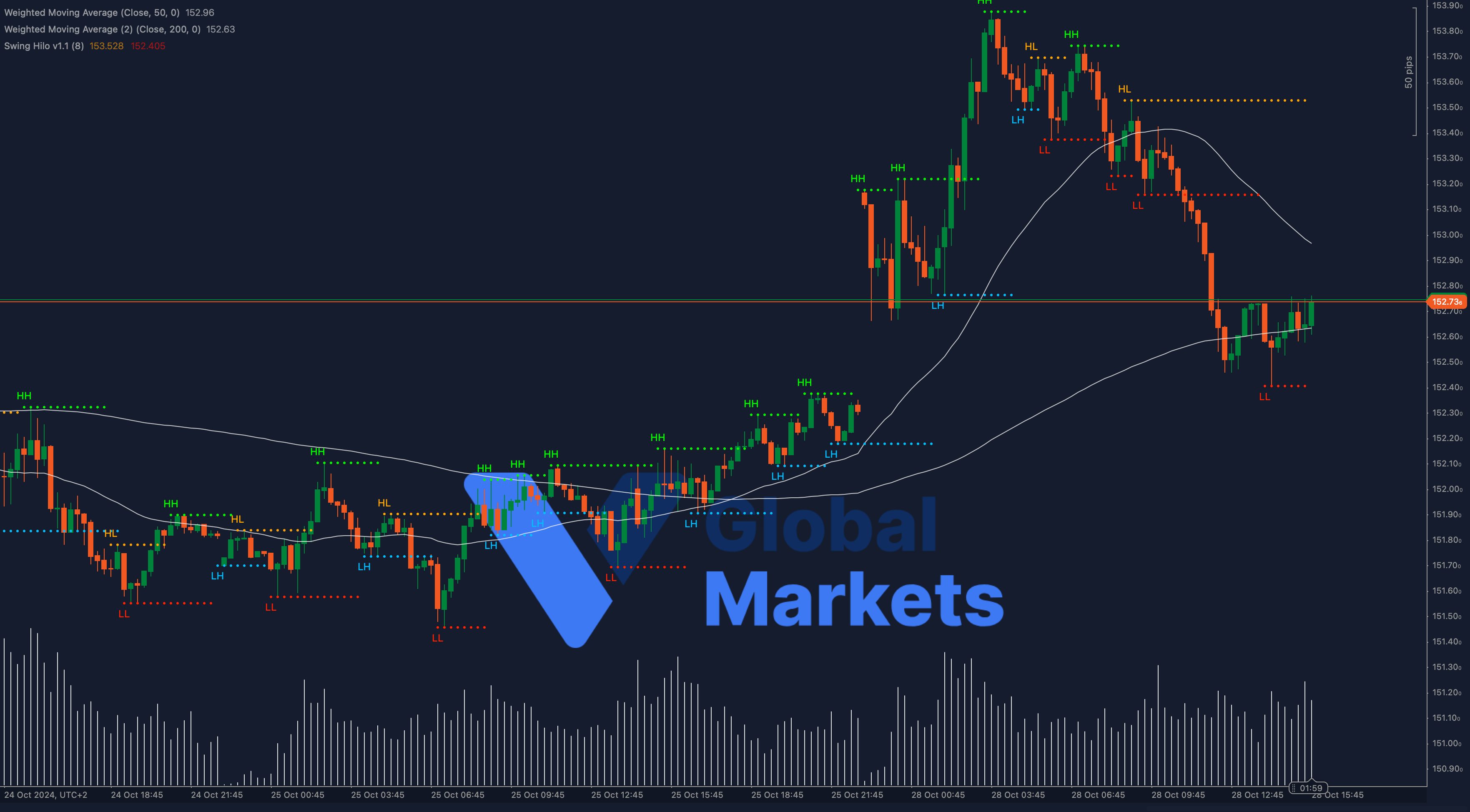

The USD/JPY pair is trading around 152.73, consolidating near the critical 152.80 resistance level. The 50-period Weighted Moving Average (WMA) is currently positioned at 152.96, while the 200-period WMA lies just below at 152.63, forming a significant zone of technical resistance. The price action indicates a possible continuation of the bearish momentum, as the pair struggles to break above these moving averages.

A sustained move above 152.80 could open the door for a test of 153.10, while a failure to maintain these levels might lead to a retracement towards the 152.20 support area.

Support: 152.20, 151.80

Resistance: 152.80, 153.10

Moving Averages:

USD/JPY remains below the 50-period WMA but has recently tested this level, indicating a critical inflection point. A confirmed close above the 50-WMA could trigger buying interest, while rejection at this level may continue the bearish trend.

Volume:

Recent trading volume has been modest, with a slight increase during attempts to break above the 152.80 level. A surge in volume could validate a breakout or reinforce further downside pressure if the resistance holds.

Key Levels to Watch:

Support: 152.20, 151.80

Resistance: 152.80, 153.10

Outlook:

The USD/JPY pair is at a pivotal moment, with the 152.80 level serving as a key resistance. Traders should watch for a potential breakout above this level, which could signal a short-term reversal, while a rejection may lead to further declines. Upcoming economic data from the US could provide the necessary catalyst for the next directional move.

Fundamental Analysis:

The US Dollar remains supported by expectations of continued hawkishness from the Federal Reserve, while the Japanese Yen faces ongoing pressure due to the Bank of Japan’s dovish stance. However, geopolitical tensions and global risk sentiment could shift demand for safe-haven currencies like the Yen, leading to potential short-term volatility in the USD/JPY pair.

#USDJPY #ForexTrading #TechnicalAnalysis #VGlobalMarkets #JapaneseYen #USD #TradingStrategy #ForexMarket #FinancialMarkets