Technical Analysis:

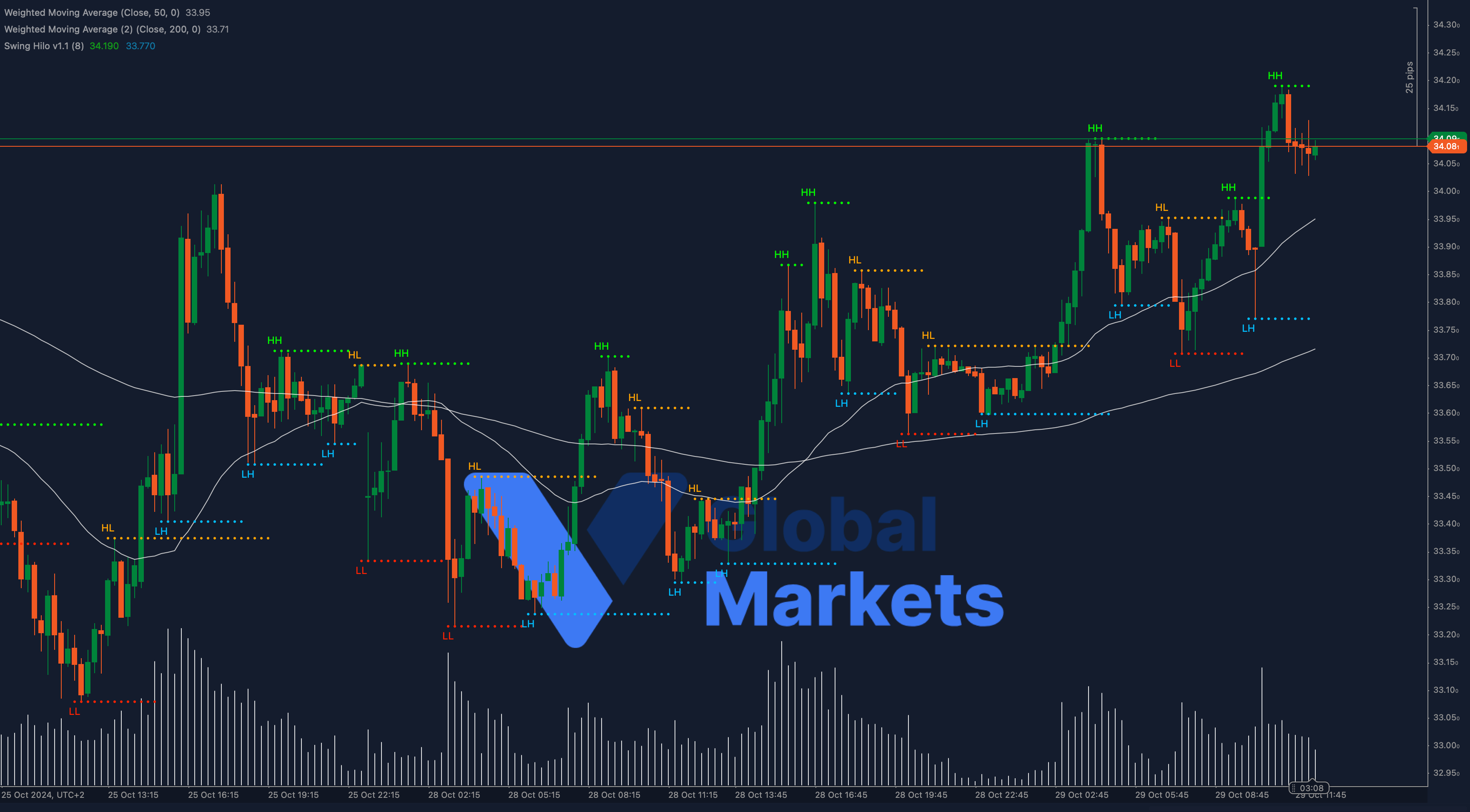

Silver (XAG/USD) is currently trading at $34.08, near the recent high of $34.15. The 50-period Weighted Moving Average (WMA) is positioned at $33.95, while the 200-period WMA lies slightly lower at $33.71, providing substantial support. Recent price action shows bullish momentum, with silver finding support above both moving averages, indicating a potential continuation of the upward trend.

If silver can break and hold above $34.15, the next resistance target would be $34.50. However, a failure to maintain current levels could see a retracement towards the support zones around $33.95 and $33.71.

Support: $33.95 (50-WMA), $33.71 (200-WMA)

Resistance: $34.15, $34.50

Moving Averages:

Silver is trading above both the 50-period and 200-period WMAs, which supports a bullish outlook. A sustained move above $34.15 could confirm the bullish trend, while a failure to hold above the 50-WMA may signal a possible pullback.

Volume:

Volume has increased in recent sessions, suggesting growing buyer interest as silver approaches the resistance at $34.15. A continued rise in volume with a price breakout could confirm further upside, while a volume decrease might signal caution.

Key Levels to Watch:

Support: $33.95 (50-WMA), $33.71 (200-WMA)

Resistance: $34.15, $34.50

Outlook:

Silver appears poised to test the $34.15 resistance level, with moving averages providing solid support. A breakout above this resistance could pave the way for higher levels, while a pullback may find support at the 50-WMA and 200-WMA.

Fundamental Analysis:

Silver’s recent gains are underpinned by a weaker US Dollar and continued demand for safe-haven assets amidst economic uncertainties. Industrial demand for silver, especially in electronics and green technologies, adds to its long-term appeal. Global economic conditions and US Federal Reserve policy announcements will likely influence the next major moves for silver.

#Silver #XAGUSD #Commodities #TechnicalAnalysis #Trading #Forex #VGlobalMarkets #PreciousMetals #SafeHaven #MarketUpdate