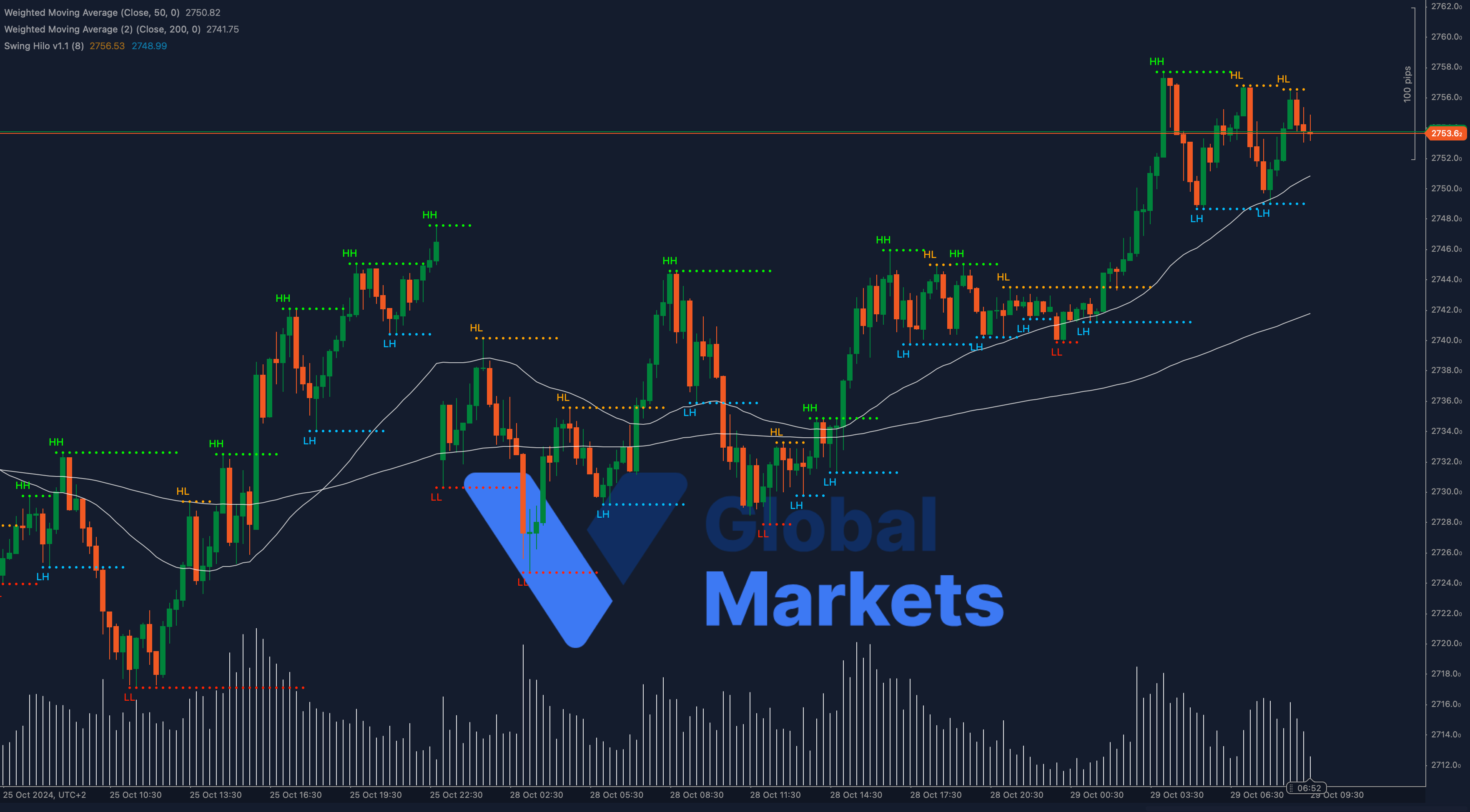

Technical Analysis:

Gold (XAU/USD) is currently trading near $2753.6, facing strong resistance at this level after an upward trend. The 50-period Weighted Moving Average (WMA) is positioned at $2750.82, while the 200-period WMA lies below at $2741.75, providing solid support. The recent price action suggests a consolidation phase, with Gold struggling to break above the resistance near $2753.6.

If the price can break and sustain above this level, the next resistance zone is around $2760. A pullback, however, could see Gold testing support at $2750.82 and possibly the 200-WMA at $2741.75 if selling pressure intensifies.

Support: 2750.82 (50-WMA), 2741.75 (200-WMA)

Resistance: 2753.6, 2760

Moving Averages:

Gold is currently trading slightly above its 50-period WMA, indicating mild bullish momentum. The 200-period WMA serves as a robust support level, which may help sustain the upward trend if it is tested.

Volume:

Volume has remained stable, indicating that market participants are cautious near resistance levels. A significant increase in volume could signal a breakout or further consolidation, depending on price action around the $2753.6 mark.

Key Levels to Watch:

Support: 2750.82 (50-WMA), 2741.75 (200-WMA)

Resistance: 2753.6, 2760

Outlook:

Gold’s current position near a critical resistance level suggests that any sustained move above $2753.6 could lead to a short-term bullish trend continuation. However, caution is warranted as consolidation or a pullback remains possible. Market participants should closely monitor the $2750.82 and $2741.75 support levels, as these will be crucial if a correction ensues.

Fundamental Analysis:

Gold remains supported by macroeconomic uncertainties, including concerns about inflation and geopolitical tensions, which continue to drive demand for safe-haven assets. The US Dollar’s movement will also be a determining factor, with any signs of weakness potentially boosting Gold’s appeal as an alternative asset.

#Gold #XAUUSD #TechnicalAnalysis #ForexTrading #PreciousMetals #VGlobalMarkets #Trading #SafeHaven #GoldPrice