The EUR/USD pair is at a fascinating inflection point, with technical patterns and fundamental drivers aligning to suggest a breakout may be around the corner. Traders are eyeing critical price zones and emerging signals that could define the pair’s trajectory for the coming sessions.

📊 The Fibonacci retracement is painting a clear roadmap. The price has retraced 61.8% of its recent bearish move, a golden ratio that often signals a reversal or continuation. Right now, EUR/USD sits on the edge of the 1.0530 level, a key confluence zone that traders cannot afford to ignore. A decisive close above this threshold would unleash upside momentum, potentially driving the pair toward 1.0565 and beyond.

🧲 The RSI indicator is showing signs of life. After bouncing from oversold territory, it is now pressing toward the midline of 50. A break above this level would confirm growing bullish momentum, suggesting buyers are ready to take control. If RSI pushes further toward 60, we could see a sustained rally.

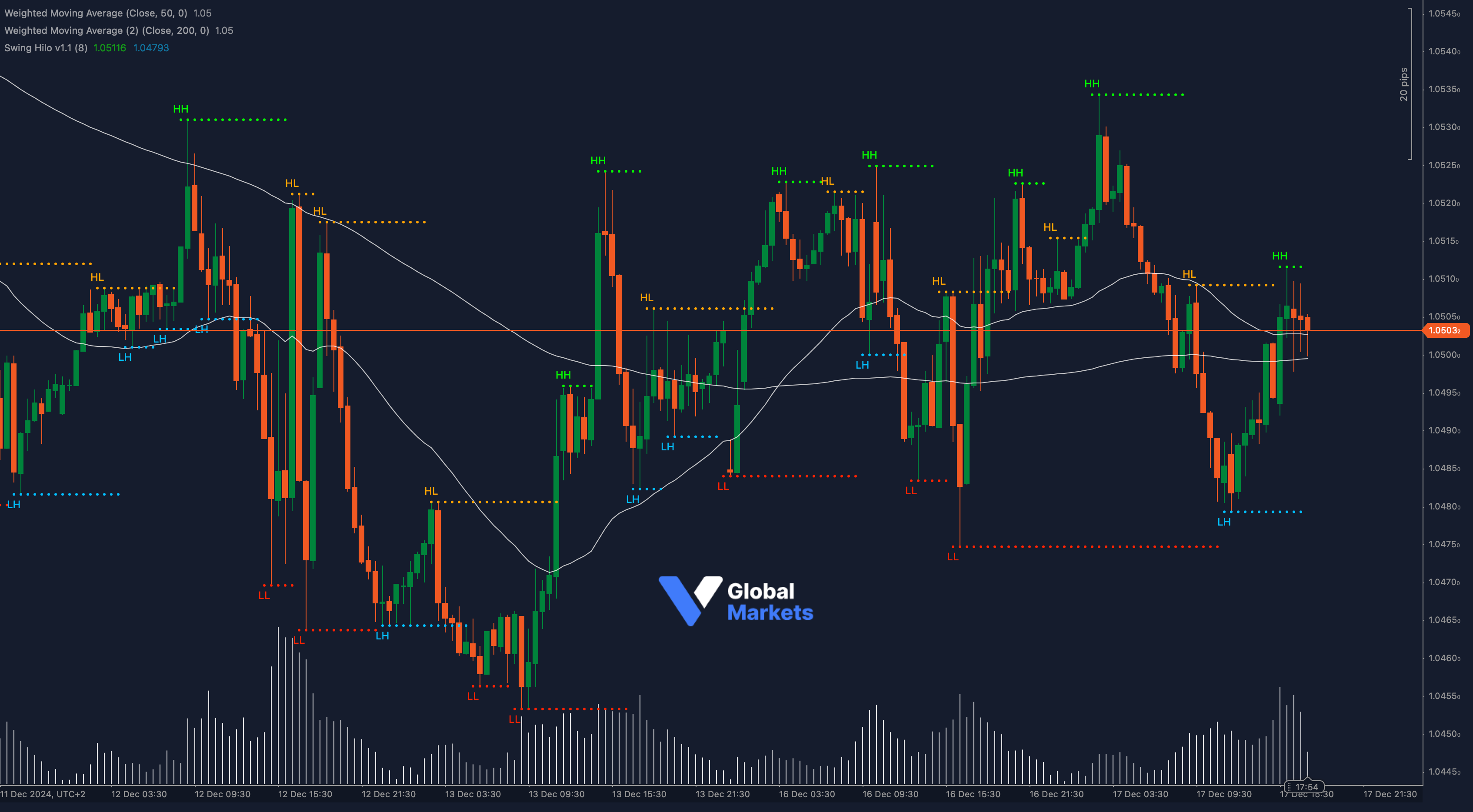

🔄 Price behavior around the pivot points is adding weight to the bullish case. The pair is currently hovering above today’s central pivot near 1.0510. Holding above this level gives buyers the edge to target R1 at 1.0540. If momentum builds, the next target lies at 1.0565, which aligns with the Fibonacci extension. On the downside, slipping below 1.0510 could trigger a retest of 1.0485 support, an area where buyers have historically stepped in.

📈 The Weighted Moving Averages (WMA) are signaling a market on the verge of change. The flattening of both the 50 WMA and the 200 WMA reflects indecision, but a bullish breakout above these levels could create a fresh trend shift. A golden cross could further amplify bullish sentiment. Traders should keep a close eye on any sustained move above the 50 WMA for confirmation.

💥 On the fundamental front, the market’s heartbeat remains tied to USD performance and Eurozone dynamics. Strong U.S. economic data, including labor market resilience and persistent inflation, continues to underpin the Dollar. However, dovish whispers from the Federal Reserve could put USD bulls on edge. Meanwhile, the Eurozone’s upcoming inflation data could inject volatility into the pair. A positive surprise might strengthen the Euro, giving EUR/USD the fuel it needs to breach key resistance levels.

📍 Traders should also monitor global risk sentiment. Renewed optimism across financial markets, particularly if risk-on flows dominate, could push EUR/USD higher as demand for safe-haven Dollars eases.

With all these indicators converging, the EUR/USD pair is entering a critical phase. The 1.0530 resistance is the line in the sand, and a breakout will bring the Fibonacci targets and RSI confirmation into play. Stay sharp and keep an eye on these signals—this is where opportunity meets preparation.