Technical Analysis:

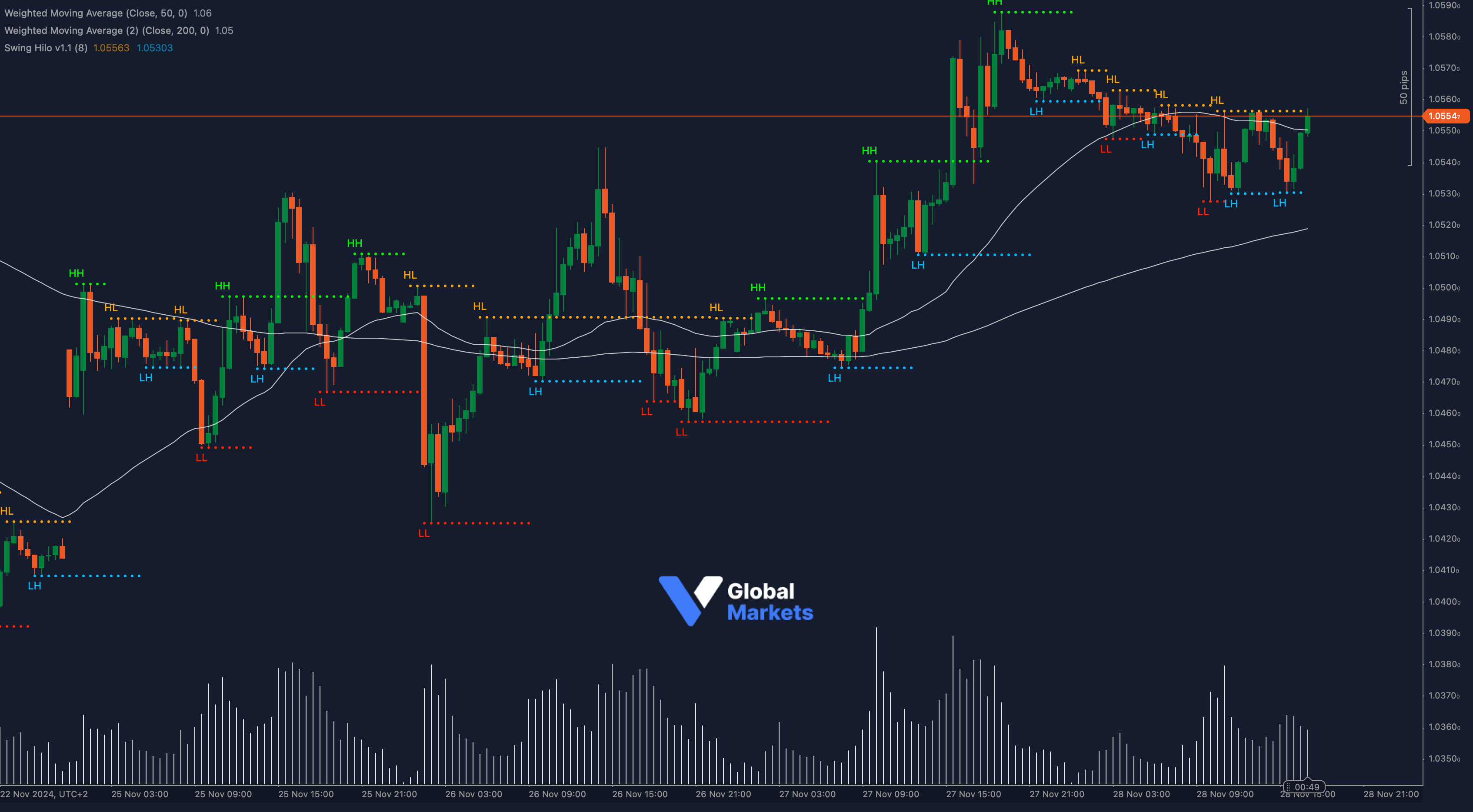

EUR/USD is trading near 1.0556, testing a significant resistance level after rebounding from its recent low of 1.0500. The pair is hovering above the 200-period moving average (1.0540), while the 50-period moving average (1.0530) is catching up, signaling potential bullish momentum.

The MACD histogram is showing rising bullish momentum with its lines diverging upwards, indicating potential for further gains. Moreover, the Fibonacci retracement levels highlight 1.0556 as a critical zone, aligning with the 61.8% retracement of the recent decline from 1.0600 to 1.0500.

If the pair clears 1.0556, the next targets could be 1.0580 and 1.0600, a psychologically significant level. On the flip side, failure to break above this resistance could see EUR/USD retrace toward 1.0530 and potentially test support at 1.0500.

Key Levels to Watch:

- Support: 1.0530, 1.0510, 1.0500

- Resistance: 1.0556, 1.0580, 1.0600

Volume and Sentiment:

📊 Rising volume on the latest bullish push suggests growing interest among buyers. A decisive break above 1.0556 with continued volume increase could confirm the upward trend.

Outlook:

EUR/USD is at a critical juncture, with bullish indicators hinting at a potential breakout above 1.0556. However, failure to breach this resistance could invite selling pressure, keeping the pair range-bound for now.

Fundamental Analysis:

The euro’s movement hinges on European Central Bank (ECB) signals and US economic data. Upcoming inflation reports and Federal Reserve commentary will likely steer the pair’s next move, as traders assess monetary policy divergence between the two regions.

#EURUSD #ForexAnalysis #ForexMarket #TradingStrategy #ctrader #MarketUpdate