Technical Analysis:

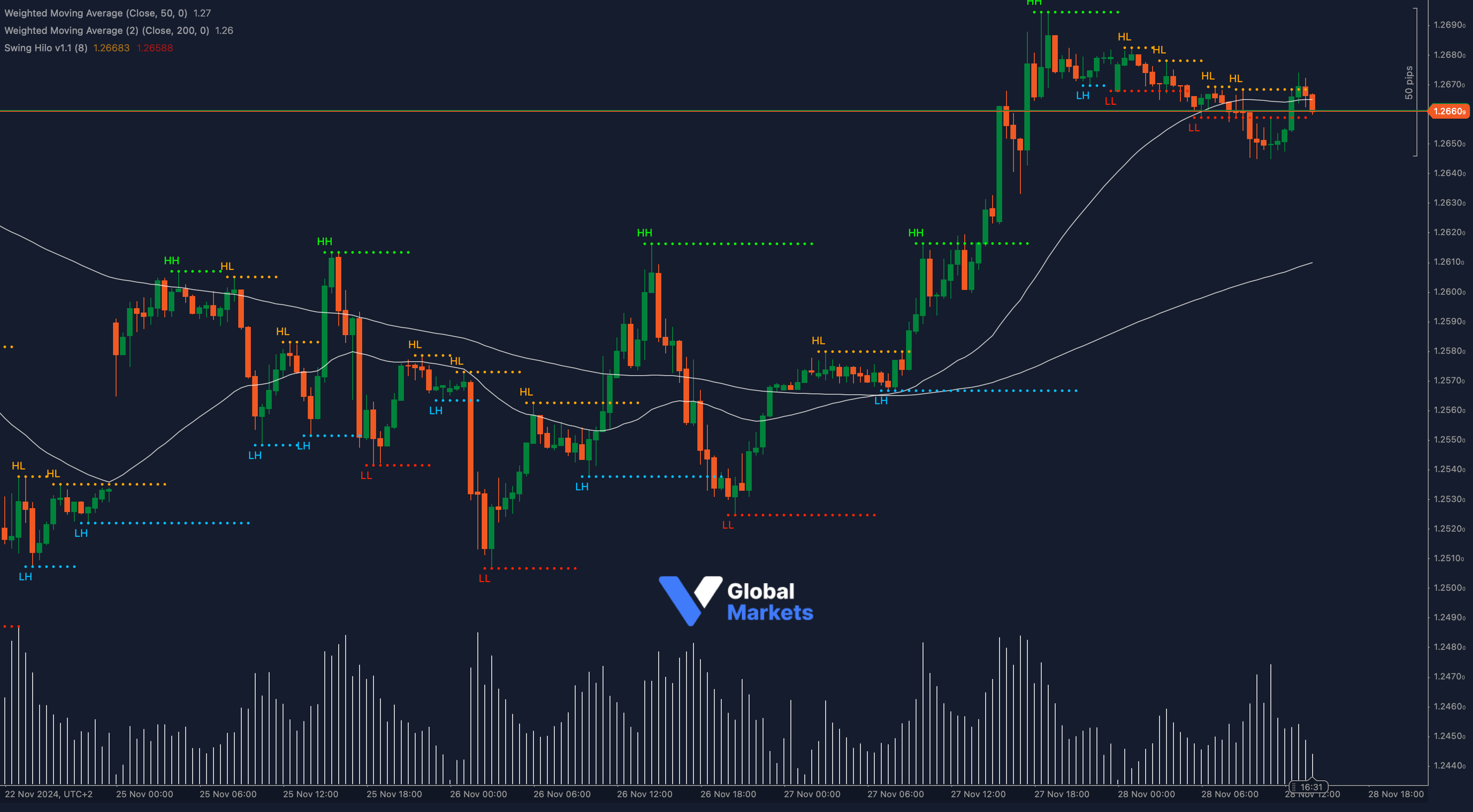

GBP/USD is consolidating around 1.2660, following a strong rally that saw the pair breach key resistance levels. The 200-period moving average (1.2658) is acting as immediate support, while the 50-period moving average (1.2668) hovers closely above, creating a narrow range of indecision.

The price has recently failed to sustain above the 1.2685 resistance, which aligns with the 78.6% Fibonacci retracement level of the broader decline from 1.2700 to 1.2570. The Relative Strength Index (RSI) is trending around 60, indicating bullish momentum, albeit with signs of slowing. Meanwhile, the Average True Range (ATR) shows reduced volatility, hinting at a potential consolidation phase.

If buyers reclaim momentum and break above 1.2685, the pair could target 1.2700, a psychological barrier, followed by 1.2720. On the downside, a drop below 1.2650 may open the path toward 1.2625 and possibly 1.2600, key support levels to watch.

Key Levels to Watch:

- Support: 1.2650, 1.2625, 1.2600

- Resistance: 1.2685, 1.2700, 1.2720

Volume and Sentiment:

📊 Trading volume has declined slightly, reflecting cautious sentiment as traders await further catalysts. A breakout with higher volume could validate the next directional move.

Outlook:

GBP/USD appears to be in a consolidation phase near 1.2660, with a slight bullish bias. A breakout above 1.2685 could resume the recent uptrend, while a breakdown below 1.2650 may indicate renewed selling pressure.

Fundamental Analysis:

The GBP/USD pair remains sensitive to economic data releases from the UK and US, with attention on inflation figures and central bank rate expectations. The pound’s movement will also hinge on Brexit-related headlines and broader market risk sentiment.

#GBPUSD #ForexAnalysis #Cable #ForexMarket #TradingStrategy #ctrader #MarketUpdate