Technical Analysis:

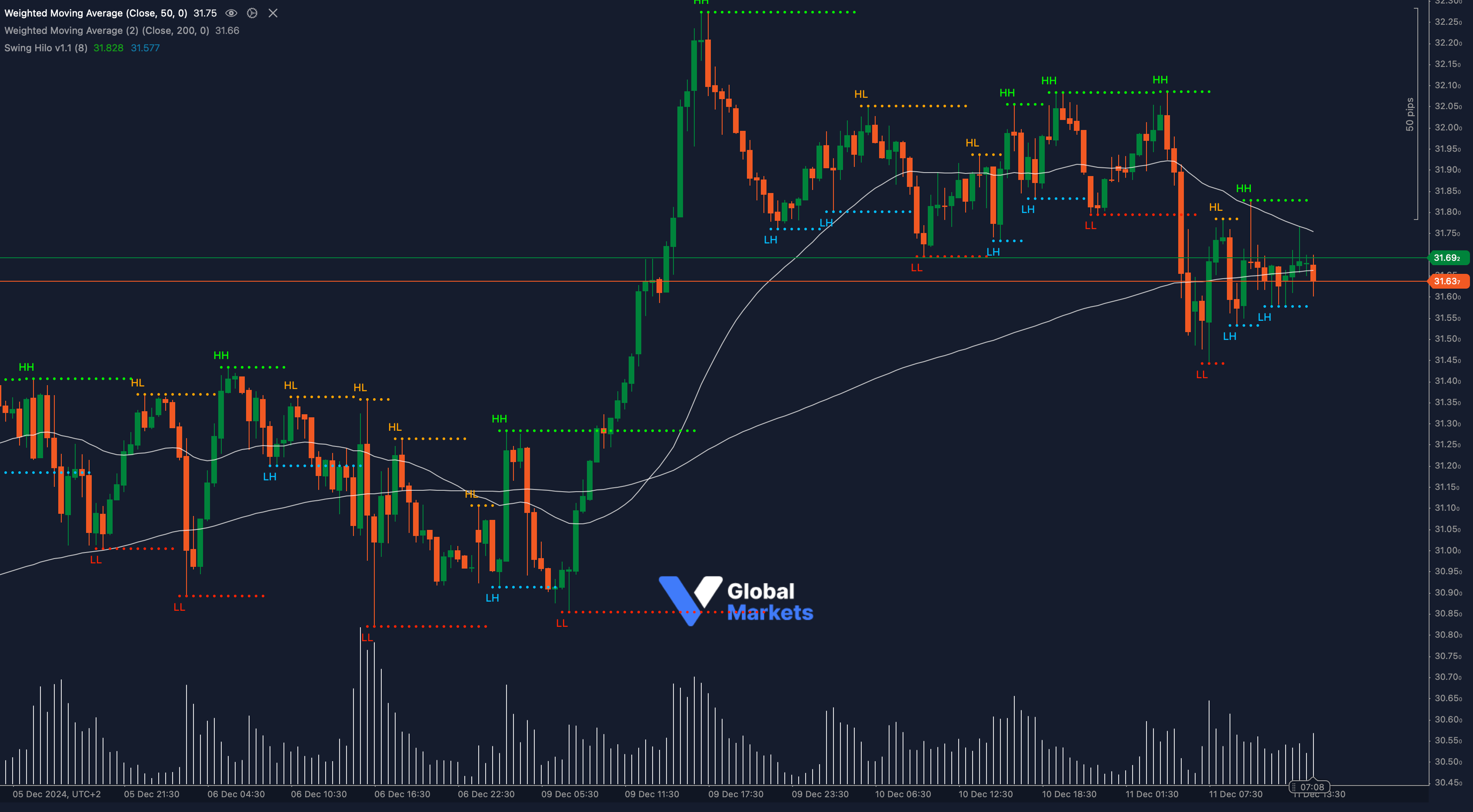

Silver (XAGUSD) is trading at a critical support level of $31.63, following a recent decline from the $32.10 resistance. The pair shows indecisiveness near the 50-period Weighted Moving Average (WMA) at $31.75, while the 200-period WMA at $31.66 acts as a key structural support.

Using Fibonacci retracement, the move from the recent high of $32.25 to the low of $31.45 highlights the 50% retracement level at $31.85, which currently serves as a minor resistance. A breach above this level could pave the way for a retest of the recent highs.

The Bollinger Bands indicate reduced volatility, with prices contracting near the lower band at $31.60, suggesting potential breakout conditions. Additionally, the RSI (Relative Strength Index) is positioned at 48, reflecting neutral momentum, but a move below 45 could confirm bearish sentiment.

Volume analysis reveals declining activity, indicating hesitation among market participants. A surge in volume at key levels could dictate the next directional move.

Key Indicators Applied:

- Fibonacci Retracement: Resistance at $31.85, support at $31.50.

- Bollinger Bands: Suggests narrowing price action with potential volatility ahead.

- RSI: Neutral at 48, watching for directional cues.

Key Levels to Watch:

- Support: $31.63, $31.50

- Resistance: $31.85, $32.10

Volume and Sentiment:

📊 Market volume is subdued, highlighting uncertainty among traders. Any surge in activity could indicate renewed interest and define the trend.

Outlook:

XAGUSD is at a tipping point. A decisive break below $31.63 could expose the metal to a deeper retracement toward $31.45, while a recovery above $31.85 might signal bullish continuation. Traders should monitor price action closely near these levels, as well as fundamental catalysts that could shift sentiment.

Fundamental Analysis:

Silver prices remain sensitive to macroeconomic developments, particularly U.S. inflation data and the Federal Reserve’s policy stance. Any hawkish signals from the Fed could pressure silver, while dovish commentary might support a recovery. Additionally, global economic uncertainties and industrial demand trends remain key drivers for the metal.

#XAGUSD #SilverTrading #ForexMarket #TechnicalAnalysis #ctrader